Olin Corp (OLN) Reports Mixed Q4 Results Amid Economic Challenges

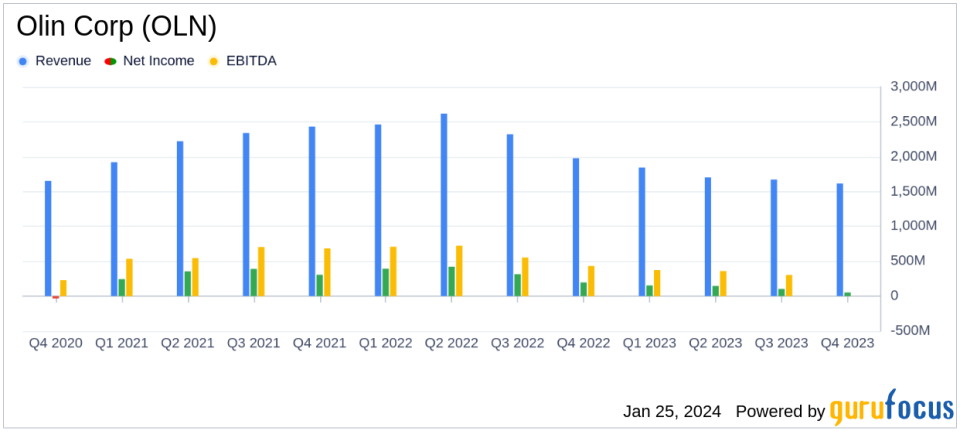

Net Income: Q4 net income fell to $52.9 million from $196.6 million in the prior year.

Adjusted EBITDA: Q4 adjusted EBITDA decreased to $210.1 million from $441.8 million year-over-year.

Sales: Sales dropped to $1,614.6 million in Q4 from $1,977.0 million in the same quarter last year.

Share Repurchases: Olin Corp repurchased $711.3 million worth of shares in 2023.

Debt Management: Net debt stood at approximately $2.5 billion with a net debt to adjusted EBITDA ratio of 1.9 times.

Segment Performance: Winchester segment's earnings increased, while Chlor Alkali Products and Vinyls, and Epoxy segments faced declines.

Olin Corp (NYSE:OLN), a leading manufacturer and distributor of chemical products and ammunition, released its 8-K filing on January 25, 2024, detailing its financial results for the fourth quarter ended December 31, 2023. The company, which operates through three segmentsChlor Alkali Products and Vinyls, Epoxy, and Winchesterreported a decline in net income and adjusted EBITDA compared to the same period in the previous year. The majority of Olin Corp's revenue is generated in the United States, with its products serving a wide range of industries from cosmetics to fire protection.

Financial Performance and Challenges

Olin Corp's fourth quarter net income was $52.9 million, or $0.43 per diluted share, a significant decrease from $196.6 million, or $1.43 per diluted share, in the fourth quarter of 2022. Adjusted EBITDA for the quarter was $210.1 million, down from $441.8 million in the prior year's quarter. The company's sales also saw a reduction, coming in at $1,614.6 million compared to $1,977.0 million in the fourth quarter of 2022. This performance reflects the challenges faced by the company in a tough economic environment, including lower pricing and a less favorable product mix, particularly in the Chlor Alkali Products and Vinyls segment.

Financial Achievements and Industry Significance

Despite the downturn in some financial metrics, Olin Corp achieved significant share repurchases in 2023, buying back approximately 10% of its outstanding shares for $711.3 million. This move demonstrates confidence in the company's future and its commitment to delivering value to shareholders. In the chemicals industry, where market conditions can be volatile, such capital allocation strategies are important indicators of a company's financial health and management's confidence in its business model.

Segment Analysis and Outlook

The Chlor Alkali Products and Vinyls segment's sales decreased primarily due to lower pricing and a less favorable product mix, with segment earnings dropping by $186.4 million year-over-year. The Epoxy segment also faced challenges, with a segment loss of $23.1 million compared to earnings of $30.5 million in the previous year, due to lower pricing and restructuring actions. However, the Winchester segment showed strength, with an increase in sales and segment earnings, attributed to higher commercial ammunition shipments and military sales.

Olin Corp's Chairman, President, and CEO, Scott Sutton, commented on the results and the company's strategy moving forward:

"Through the challenging economic environment of 2023, Olin successfully demonstrated our unique winning model by delivering $1.3 billion of adjusted EBITDA and corresponding cash flows enabling the 2023 repurchase of approximately 10% of our outstanding shares... We anticipate our initiative supports an improved 2024 adjusted EBITDA as compared to 2023."

Liquidity, Debt, and Share Repurchases

As of December 31, 2023, Olin Corp had a cash balance of $170.3 million and a net debt of approximately $2.5 billion, maintaining a net debt to adjusted EBITDA ratio of 1.9 times. The company had about $1.3 billion of available liquidity and continued its share repurchase program, buying back 2.5 million shares in the fourth quarter of 2023 for $116.2 million.

In conclusion, Olin Corp's fourth quarter results reflect the resilience of its business model in a challenging economic climate. While the company faced headwinds in pricing and sales, its strategic initiatives, including share repurchases and a focus on maintaining an investment-grade balance sheet, position it for potential improvement in the coming year. Investors will be watching closely to see if the 'value accelerator initiative' and disciplined approach to capital allocation will lead to a favorable inflection point for Olin Corp in 2024.

Explore the complete 8-K earnings release (here) from Olin Corp for further details.

This article first appeared on GuruFocus.