Ollie's Bargain Outlet Holdings Inc (OLLI) Reports Stellar Fiscal 2023 Results

Net Sales: Q4 net sales increased by 18.0% to $648.9 million; full-year net sales up 15.1% to $2.103 billion.

Comparable Store Sales: Q4 comparable store sales grew by 3.9%.

Gross Margin: Improved by 290 basis points in Q4; full-year gross margin up by 370 basis points.

Operating Income: Q4 operating income rose by 44.3%; full-year operating income surged by 74.0%.

Net Income: Q4 net income increased by 44.1% to $76.5 million; full-year net income grew by 76.5% to $181.4 million.

Earnings Per Share: Q4 EPS increased by 44.7% to $1.23; full-year EPS up by 77.1% to $2.91.

Store Expansion: Raised long-term store target to 1,300 from 1,050.

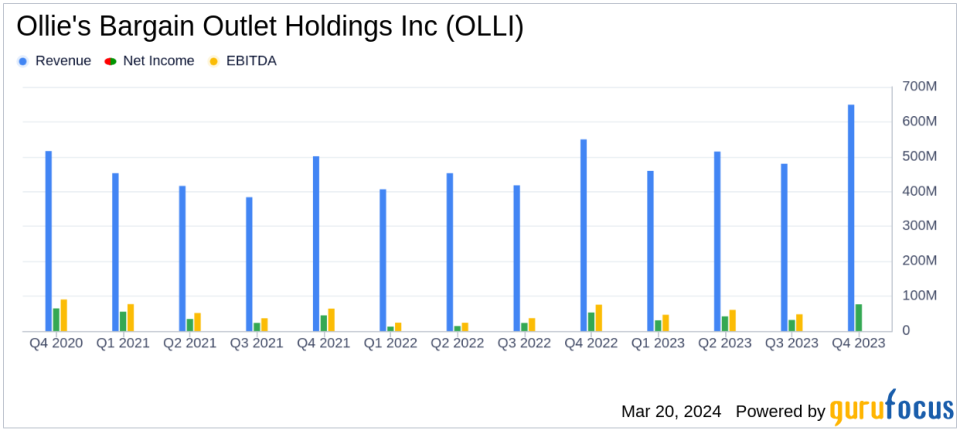

On March 20, 2024, Ollie's Bargain Outlet Holdings Inc (NASDAQ:OLLI) released its 8-K filing, announcing its financial results for the fourth quarter and full-year fiscal 2023. The company, known for its discounted brand-name merchandise across various departments, has reported a robust performance with significant growth in net sales, gross margin, and earnings per share.

Ollie's Bargain Outlet Holdings Inc (NASDAQ:OLLI) operates a chain of retail stores across the Eastern half of the United States, offering a unique shopping experience with a focus on value for money. The company's differentiated strategy and engaging marketing campaigns have contributed to its strong and consistent store performance and rapid growth trajectory.

Financial Performance Highlights

The fourth quarter saw net sales jump to $648.9 million, an 18.0% increase compared to the same period last year. This was driven by new store growth and a 3.9% rise in comparable store sales, with an additional $34.0 million in sales attributed to the 53rd week. Excluding this extra week, sales still showed a healthy increase of 11.9% year over year.

Gross profit for Q4 soared by 27.4% to $263.0 million, with gross margin expanding to 40.5% from 37.6% in the previous year, primarily due to favorable supply chain costs and a reduction in shrink. Selling, general, and administrative expenses rose by 19.1% to $156.1 million, largely due to new store openings and higher incentive compensation.

Operating income for the quarter increased significantly by 44.3% to $97.7 million, with operating margin improving by 270 basis points to 15.0%. Net income followed suit, rising by 44.1% to $76.5 million, resulting in earnings per share of $1.23, a 44.7% increase from the prior year's $0.85.

For the full fiscal year, net sales climbed by 15.1% to $2.103 billion, with a comparable store sales increase of 5.7%. Gross profit for the year was up by 26.9% to $832.4 million, and operating income surged by 74.0% to $227.8 million. Net income for the year increased by a remarkable 76.5% to $181.4 million, translating to earnings per share of $2.92.

The company's balance sheet remains strong, with cash and cash equivalents and short-term investments totaling $353.2 million at the end of fiscal 2023. Capital expenditures were $124.4 million, primarily related to new store development and distribution center expansions.

Ollie's Bargain Outlet Holdings Inc (NASDAQ:OLLI) has raised its long-term store target to 1,300 from 1,050, reflecting confidence in its growth strategy and market opportunities. The company's President and CEO, John Swygert, highlighted the positive migration trend from larger metropolitan markets to rural and suburban areas as beneficial for Ollie's expansion.

Looking ahead to fiscal 2024, Ollie's expects net sales to range between $2.248 and $2.273 billion, with a comparable store sales increase of 1.0% to 2.0%. The company anticipates an operating income of $243 to $251 million and adjusted net income of $192 to $198 million, equating to an adjusted net income per diluted share of $3.10 to $3.20.

Investors and analysts can access a replay of the conference call discussing these results on the Investor Relations section of the company's website at http://investors.ollies.us/.

Ollie's Bargain Outlet Holdings Inc (NASDAQ:OLLI) continues to demonstrate its ability to deliver strong financial results and grow its footprint in the discount retail sector, positioning itself as a compelling investment opportunity for value investors.

Explore the complete 8-K earnings release (here) from Ollie's Bargain Outlet Holdings Inc for further details.

This article first appeared on GuruFocus.