Olympic Steel Inc (ZEUS) Reports Mixed Year-End Results Amid Market Challenges

Net Income: Q4 net income rose to $7.4 million from $4.0 million in the prior year.

Earnings Per Share: Full-year EPS decreased to $3.85 from $7.87 in 2022.

Sales: 2023 sales declined to $2.2 billion from $2.6 billion in 2022.

Adjusted EBITDA: Adjusted EBITDA for 2023 was $97.6 million, down from $152.0 million in 2022.

Dividend: Quarterly dividend increased by 20% to $0.15 per share.

Debt Position: Total debt increased modestly by $25 million to $190 million at year-end.

Acquisitions: Successful integration of Metal-Fab and Central Tube and Bar acquisitions.

Olympic Steel Inc (NASDAQ:ZEUS), a leading national metals service center, announced its fourth-quarter and full-year results for 2023 on February 22, 2024, revealing a resilient performance despite a challenging market environment. The company's 8-K filing details the financial outcomes and strategic initiatives that have positioned Olympic Steel for future growth.

Olympic Steel Inc provides metals processing and distribution services in the United States, operating in three segments: specialty metals flat products, carbon flat products, and tubular and pipe products. The company specializes in processing and distributing a wide range of metal products and serves a diverse set of industries.

Financial Performance and Challenges

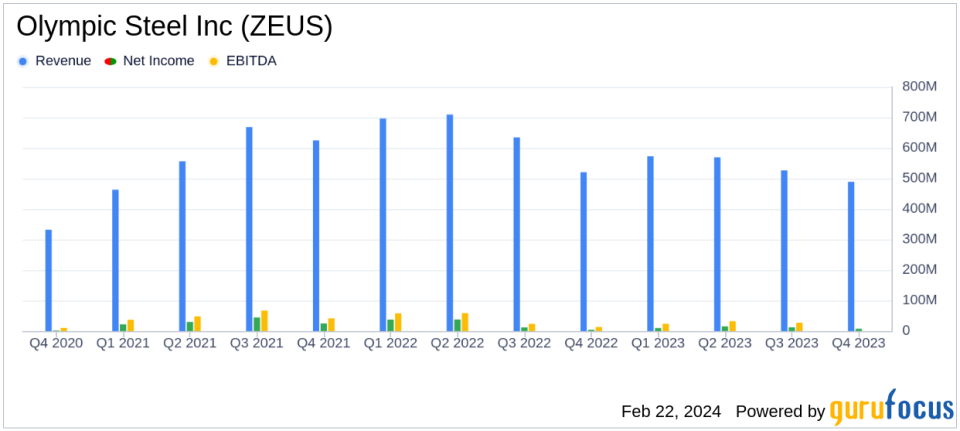

The fourth quarter saw an increase in net income to $7.4 million, or $0.64 per diluted share, up from $4.0 million, or $0.34 per diluted share, in the same period of the previous year. This improvement was partly due to a $5.3 million LIFO pre-tax income in Q4 2023, compared to $0.9 million in Q4 2022. However, sales in the fourth quarter of 2023 decreased to $489 million from $520 million in the prior year.

For the full year, net income totaled $44.5 million, or $3.85 per diluted share, a decrease from $90.9 million, or $7.87 per diluted share, in 2022. The company's sales also saw a decline from $2.6 billion in 2022 to $2.2 billion in 2023. Adjusted EBITDA for the year was $97.6 million, compared to $152.0 million in the previous year.

Strategic Achievements and Importance

Olympic Steel's CEO, Richard T. Marabito, highlighted the company's diversified strategy and operational discipline as key factors in delivering shareholder value and navigating the pricing pressures of 2023. The Pipe and Tube segment delivered its second most profitable year ever, demonstrating the company's ability to achieve consistent, profitable results despite market volatility.

The company's balance sheet was strengthened through prudent inventory management and strong cash flow, allowing for strategic investments like the Metal-Fab and Central Tube and Bar acquisitions, which produced immediate EBITDA returns. Despite these investments, the company's total debt only increased by $25 million to $190 million at year-end, showcasing a disciplined approach to growth.

Olympic Steel's financial achievements are particularly important in the steel industry, where market conditions can be unpredictable. The company's ability to maintain profitability and a strong balance sheet in such an environment is a testament to its strategic planning and operational efficiency.

Key Financial Metrics and Commentary

Important metrics from the income statement and balance sheet include:

"Olympic Steels strong performance in the fourth quarter and for the full year reflects the success of our strategy to build a more diversified company that delivers results and creates shareholder value even under challenging market conditions," said Richard T. Marabito, Chief Executive Officer.

Marabito also emphasized the company's commitment to shareholder returns, as evidenced by the increase in the quarterly dividend to $0.15 per share, marking the third increase since 2022.

Analysis of Company Performance

While Olympic Steel faced a decrease in net income and sales for the full year of 2023, the company's strategic acquisitions and increased dividend reflect a strong financial position and a commitment to shareholder value. The company's diversified portfolio and operational discipline have allowed it to navigate a year marked by significant pricing fluctuations and broader market challenges.

Olympic Steel's performance in 2023, despite a decline in some financial metrics, demonstrates resilience and strategic foresight in a volatile industry. The company's focus on diversification, operational efficiency, and shareholder returns positions it well for future growth and stability.

For additional details and insights into Olympic Steel Inc (NASDAQ:ZEUS)'s financial performance, visit the company's website or access the full 8-K filing.

Explore the complete 8-K earnings release (here) from Olympic Steel Inc for further details.

This article first appeared on GuruFocus.