Omega Healthcare Investors Inc (OHI) Reports Q4 and Full Year 2023 Results with Solid AFFO ...

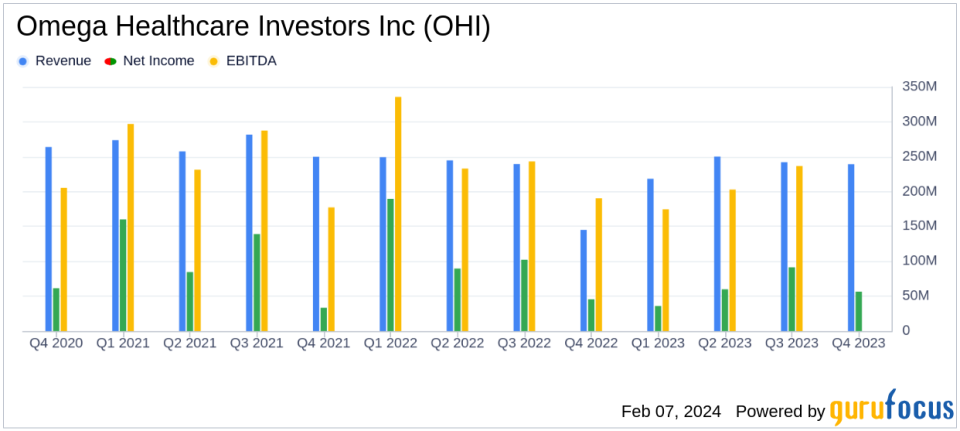

Revenue Growth: Q4 revenues increased by $94.5 million year-over-year, totaling $239.3 million.

Net Income: Q4 net income rose to $56.5 million, marking a $9.8 million increase from the same period in 2022.

Investment Activity: Completed $249 million in new investments in Q4, with a solid acquisition pipeline for future growth.

Operator Performance: Improved operating metrics with occupancy above 80% and EBITDAR coverage at a post-pandemic high of 1.28x.

2024 AFFO Guidance: Provided annual AFFO guidance for the first time since the pandemic, expecting $2.70 to $2.80 per share.

Dividend: Declared a quarterly cash dividend of $0.67 per share, payable on February 15, 2024.

On February 7, 2024, Omega Healthcare Investors Inc (NYSE:OHI) released its 8-K filing, announcing the financial results for the fourth quarter and full year ended December 31, 2023. Omega, a leading healthcare facility real estate investment trust (REIT), focuses on long-term healthcare facilities in the United States, aiming to provide value to investors while maintaining high care standards.

Financial Performance and Challenges

Omega's Q4 performance reflected a significant increase in revenue, primarily due to the timing of operator restructurings, transitions, and revenue from new investments. Despite the challenges faced by operators in the restructuring process, the company's portfolio operating performance has shown improvement, with occupancy rates now above 80% and EBITDAR coverage at a post-pandemic high. However, CEO Taylor Pickett noted that financial performance was impacted by these restructuring efforts, which are expected to continue affecting earnings in the first half of 2024.

"The underlying operating performance of our portfolio has continued to improve... As expected, our financial performance was impacted by operators in the process of being restructured... our ultimate goal is to maximize long-term sustainable cash flow," said Taylor Pickett, Omegas CEO.

Financial Achievements and Industry Position

The company's financial achievements, including the completion of $249 million in new investments during the fourth quarter, are crucial for maintaining growth and stability in the competitive REIT industry. These investments, along with the improved operating metrics, position Omega favorably for future earnings growth. The company's ability to provide AFFO guidance for 2024 also demonstrates confidence in its financial performance and visibility.

Key Financial Metrics

Omega's balance sheet as of December 31, 2023, shows $5.1 billion of outstanding indebtedness with a weighted-average annual interest rate of 4.4%. The company's total assets amounted to $9.1 billion, with total investments at $7.7 billion. The company's liquidity position remains strong, with $442.8 million in cash and cash equivalents and $1.43 billion of undrawn capacity under its unsecured revolving credit facility.

Analysis of Company's Performance

Omega's performance in the fourth quarter and full year of 2023 reflects a resilient business model capable of navigating industry challenges. The company's strategic investment activity and restructuring efforts have contributed to its solid financial position. With the anticipated resolution of operator issues and a solid acquisition pipeline, Omega is poised for further growth in 2024. However, the company remains cautious about the potential impact of CMS's pending final rule on minimum staffing, which could pose challenges for facility operations.

For more detailed information, investors and analysts are invited to review Omega's Fourth Quarter 2023 Financial Supplemental and to join the conference call scheduled for February 8, 2024, to discuss the results and current developments.

Value investors and potential GuruFocus.com members interested in the healthcare REIT sector may find Omega Healthcare Investors Inc's latest earnings report and future guidance a compelling reason to consider the company as part of their investment portfolio.

Explore the complete 8-K earnings release (here) from Omega Healthcare Investors Inc for further details.

This article first appeared on GuruFocus.