Omega (OMGA) Up 95% on Obesity Drug Deal With Novo Nordisk

Shares of Omega Therapeutics OMGA surged 94.7% on Thursday after the company announced that it is entering into a research collaboration agreement with pharma giant Novo Nordisk NVO to develop a novel therapeutic for obesity management.

This agreement with Novo Nordisk is part of an existing framework collaboration between Flagship Pioneering and Novo Nordisk to develop a portfolio of transformational medicines. Flagship is a U.S.-based venture capital company, which focuses on life sciences. One of many Flagship-founded bioplatform companies, Omega Therapeutics utilizes its proprietary technology platform to develop a new class of programmable epigenomic mRNA medicines.

Per the terms of the agreement, Novo Nordisk will reimburse R&D costs and has the right to select one target to advance for clinical development. Both Omega and Pioneering Medicines are eligible to receive up to $532 million in upfront and milestone payments and tiered royalties on annual future net sales of a licensed product.

The deal is likely to benefit Omega, which is currently devoid of a marketed product. The company has only one clinical-stage pipeline candidate, OTX-2002, in phase I/II MICHELANGELO study in patients with hepatocellular carcinoma (HCC) and other solid tumors. With many candidates still in pre-clinical development and a lack of a stable revenue stream, the payments from NVO will help the company fund its pipeline development. This is likely one of the reasons for the share price surge.

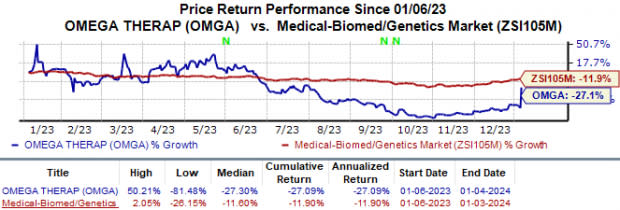

In the past year, shares of Omega Therapeutics have lost 27.1% compared with the industry’s 11.9% decline.

Image Source: Zacks Investment Research

Using Omega’s technology and its expertise in cardiometabolic diseases, Novo Nordisk intends to create an epigenomic controller to enhance thermogenesis, i.e., the naturally occurring production of heat within tissues to raise body temperature. This production is used by the body as a natural metabolic function to regulate overall energy balance.

By enhancing thermogenesis, Omega/Novo intends to raise the body’s metabolism activity to help burn the excess fats. Per the companies, this is a novel approach when compared to the currently available weight-loss drugs, which focus on appetite regulation.

Through these collaborations, Novo Nordisk intends to strengthen its foothold in the obesity drug space. The obesity market is being dominated by Novo Nordisk’s blockbuster obesity drug Wegovy and Eli Lilly’s LLY recently approved obesity drug Zepbound, both of which are vying for market share.

Anticipating an even bigger market for obesity drugs, Lilly has been evaluating multiple other obesity candidates in its pipeline apart from Zepbound. Eli Lilly’s pipeline currently includes retatrutide (GGG tri-agonist) and orforglipron, which are being developed for type II diabetes and obesity. Last August, Lilly acquired private biotech Versanis to strengthen its position further in the obesity market.

The obesity market is also acquiring interest from other large-cap drug makers like AstraZenecaand Roche RHHBY, who are also looking into options to enter the lucrative obesity space.

Last month, Roche announced its foray into the obesity market when it entered into an agreement to acquire privately-owned Carmot Therapeutics for $2.7 billion. The acquisition provides RHHBY access to Carmot’s differentiated portfolio of incretins, including lead assets CT-388, CT-996 and CT-868. Per Roche, the incretin-based portfolio could also be expanded to other indications where incretins play a role, including cardiovascular, retinal and neurodegenerative diseases.

Last November, AstraZeneca announced that it has entered into an exclusive deal with Chinese private biotech Eccogene to develop the latter’s oral drug, ECC5004, for treating obesity, type-II diabetes and other cardiometabolic conditions. With the agreement, AstraZeneca will get exclusive global development and commercialization rights to Eccogene in all territories except China. In China, Eccogene and AstraZeneca have joint rights.

Omega Therapeutics, Inc. Price

Omega Therapeutics, Inc. price | Omega Therapeutics, Inc. Quote

Zacks Rank

Omega currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Omega Therapeutics, Inc. (OMGA) : Free Stock Analysis Report