OmniAb Inc (OABI) Reports Decline in Annual Revenue and Net Loss for Q4 and Full Year 2023

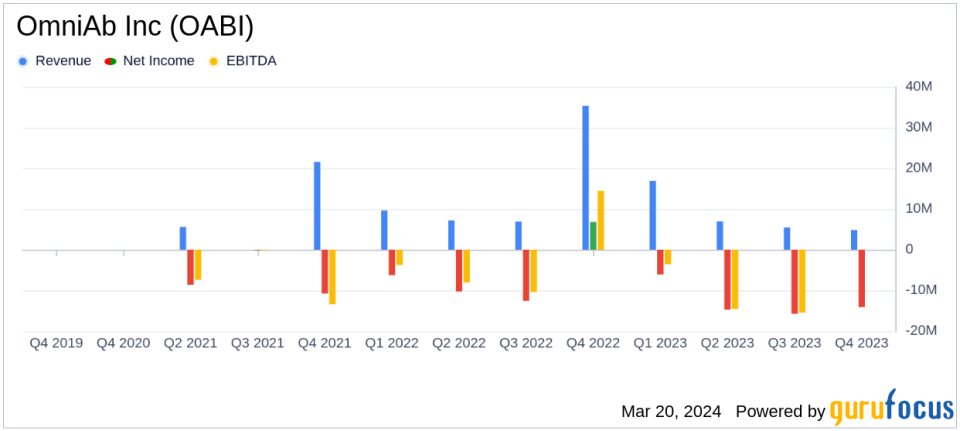

Revenue: Q4 revenue fell to $4.8 million from $35.3 million in the same period last year, largely due to a one-time milestone payment in 2022.

Net Loss: Q4 net loss widened to $14.1 million, or $0.14 per diluted share, compared to a net income of $6.8 million, or $0.07 per share, in Q4 2022.

Full Year Financials: 2023 annual revenue decreased to $34.2 million from $59.1 million in 2022, with a net loss of $50.6 million, or $0.51 per share.

Operating Expenses: R&D expenses increased due to higher personnel costs, while G&A expenses rose due to costs associated with being an independent public company.

Cash Position: As of December 31, 2023, OmniAb had cash, cash equivalents, and short-term investments totaling $87.0 million.

2024 Outlook: Operating expenses for 2024 expected to be similar to 2023, with a focus on leveraging future business growth.

On March 20, 2024, OmniAb Inc (NASDAQ:OABI) released its 8-K filing, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its therapeutic antibody discovery technologies, faced a significant decrease in revenue and reported a widened net loss for the quarter and the year.

Company Overview

OmniAb Inc offers a cutting-edge platform for the discovery of fully-human antibodies, leveraging the Biological Intelligence of its proprietary transgenic animals, including OmniRat, OmniMouse, and OmniChicken. These technologies are crucial for the rapid development of therapeutics across a wide range of diseases.

Financial Performance and Challenges

The fourth quarter saw a sharp decline in revenue to $4.8 million, down from $35.3 million in the same quarter of the previous year. This decrease was primarily due to the absence of a $25.0 million milestone payment received in 2022. The full-year revenue also saw a decrease, from $59.1 million in 2022 to $34.2 million in 2023. The net loss for the fourth quarter was $14.1 million, or $0.14 per diluted share, a significant shift from the net income of $6.8 million, or $0.07 per share, in the prior year's quarter. For the full year, the net loss was $50.6 million, or $0.51 per share, compared to a net loss of $22.3 million, or $0.26 per share, in 2022.

Despite these challenges, the company's financial achievements, such as maintaining a robust cash position with $87.0 million in cash, cash equivalents, and short-term investments, are important for sustaining its operations and investment in research and development. This is particularly significant in the biotechnology industry, where long-term investment is critical for innovation and bringing new therapies to market.

Key Financial Metrics

Research and development expenses increased to $56.5 million for the year, up from $48.4 million in 2022, reflecting the company's commitment to advancing its technology platform. General and administrative expenses also rose to $33.3 million from $24.9 million, attributed to the costs of operating as an independent public entity.

The company's balance sheet remains solid, with total assets amounting to $375.2 million. The stockholders' equity stood at $314.6 million, indicating a strong financial foundation for future growth.

Looking Ahead

OmniAb expects its operating expenses in 2024 to mirror those of 2023, with a strategic focus on leveraging the growth of the business. The company anticipates its cash use in 2024 to be similar to 2023, excluding the one-time milestone payment received last year. With the expected progression of its partnered pipeline, OmniAb foresees a substantial reduction in cash use in 2025.

Throughout 2023, OmniAb expanded its partnership base and launched two new technologies, OmniDeep and OmnidAb, which are expected to enhance the company's antibody discovery and optimization capabilities. The company ended the year with 77 active partners and 325 active programs, including 32 OmniAb-derived programs in clinical development or commercialization.

OmniAb's inclusion in the Nasdaq Biotechnology Index (NBI) as of December 18, 2023, is a testament to its growth potential and industry recognition.

For a detailed discussion of OmniAb's financial results and business highlights, management will host a conference call with accompanying slides, accessible via the company's investor relations website.

For more information on OmniAb's financial performance and strategic initiatives, visit www.omniab.com.

Explore the complete 8-K earnings release (here) from OmniAb Inc for further details.

This article first appeared on GuruFocus.