Omnicell Inc (OMCL) Faces Fiscal Challenges Despite Strong Innovation Pipeline

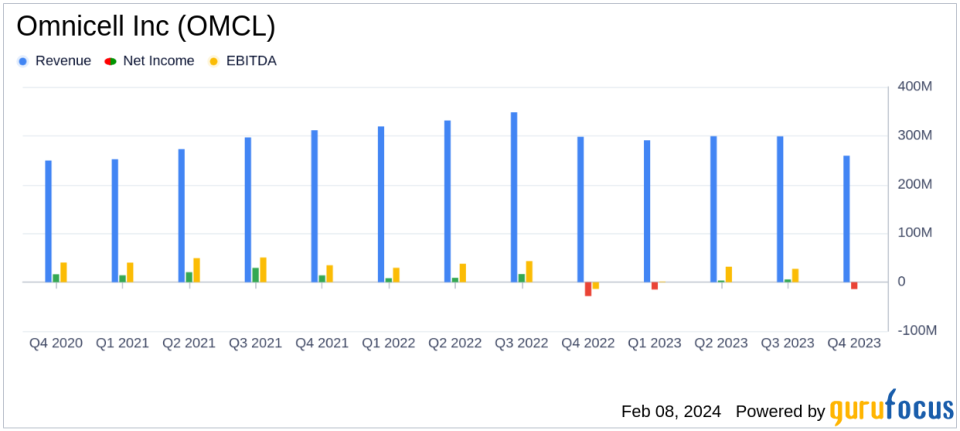

Revenue: Full year 2023 GAAP revenues decreased by 11% to $1.147 billion compared to the previous year.

Net Loss: GAAP net loss for the full year 2023 was $20 million, a decline from a net income of $6 million in 2022.

Earnings Per Share: GAAP net loss per diluted share was $0.45 for 2023, compared to net income per diluted share of $0.12 in 2022.

Non-GAAP EBITDA: Full year 2023 Non-GAAP EBITDA decreased to $138 million from $193 million in the previous year.

Free Cash Flow: Non-GAAP Free Cash Flow for 2023 was $126 million.

Bookings and Backlog: Total bookings for 2023 were $854 million, a 19% decrease year-over-year, with a total backlog of $1.142 billion.

On February 8, 2024, Omnicell Inc (NASDAQ:OMCL) released its 8-K filing, detailing its fiscal year and fourth quarter results for the period ended December 31, 2023. Omnicell, a leader in pharmacy automation and business analytics for healthcare providers, reported a decrease in total GAAP revenues for the year, reflecting ongoing challenges in the healthcare sector.

Company Overview

Omnicell Inc provides critical automation and business analytics software to healthcare providers. The company's offerings include medication dispensing systems, pharmacy inventory management systems, and software, as well as consumable medication blister cards and packaging equipment for medication administration outside of hospital settings. The majority of Omnicell's revenue is generated within the United States.

Financial Performance and Challenges

The company's financial results for 2023 were broadly in line with initial expectations, despite a notable decline in revenue and net income compared to the previous year. The decrease in GAAP revenues was primarily due to lower Point of Care revenues, as healthcare systems faced capital budget and labor constraints. The net loss for the year was a significant shift from the net income reported in 2022, highlighting the financial challenges Omnicell is facing.

Chairman, President, and CEO Randall Lipps commented on the results, stating, "Our team delivered 2023 financial results that were generally in line with what we originally anticipated for the year... However, we recognize we have work to do to strengthen our performance and accelerate profitability." Lipps emphasized the company's commitment to a strategic review aimed at optimizing investments and delivering returns for stockholders.

We remain confident in Omnicells long-term opportunities as we work to transform the pharmacy care delivery model and ultimately help enable healthcare providers to deliver better outcomes around patient safety and overall efficiencies, said Lipps.

Financial Achievements and Importance

Despite the challenges, Omnicell's financial achievements include maintaining a strong innovation pipeline, particularly around its XT fleet of connected devices. The company's position in the market is crucial as it anticipates an improvement in the macroeconomic environment and hospital cost pressures. These factors are vital for a company in the Healthcare Providers & Services industry, where innovation and efficiency are key drivers of success.

Key Financial Metrics

Important metrics from Omnicell's financial statements include a Non-GAAP net income per diluted share of $1.91 for the full year 2023, down from $3.00 in the previous year. The company's balance sheet as of December 31, 2023, showed $468 million in cash and cash equivalents, with total assets amounting to $2.23 billion. Operating activities provided $181 million in net cash, highlighting the company's ability to generate cash flow despite the net loss.

Analysis of Performance

Omnicell's performance in 2023 reflects the broader challenges faced by healthcare providers, including budget constraints and labor shortages. The company's strategic review and focus on innovation suggest a proactive approach to navigating these challenges. The decrease in bookings and backlog indicates a need for the company to adapt to changing market demands and customer needs.

For the full year 2024, Omnicell expects bookings to be between $750 million and $875 million, with total revenues projected to be between $1.045 billion and $1.120 billion. The guidance reflects the company's cautious optimism about its ability to rebound from a tough fiscal year.

Investors and stakeholders will be watching closely as Omnicell continues to navigate a complex healthcare landscape, with the goal of returning to growth and profitability in the coming years.

Explore the complete 8-K earnings release (here) from Omnicell Inc for further details.

This article first appeared on GuruFocus.