Omnicom (OMC) Gains From Diversification Amid Liquidity Woes

Omnicom Group OMC has had an impressive run over the past six months. The stock has gained 11.9%, outperforming the 2.3% rally of the industry it belongs to.

OMC reported impressive fourth-quarter 2023 results, wherein both earnings and revenues beat the Zacks Consensus Estimate. Earnings of $2.16 per share beat the consensus estimate by 1.9% and increased 5.3% year over year. Total revenues of $4.06 billion surpassed the consensus mark by 1.5% and increased 5% year over year.

How is Omnicom Doing?

Omnicom has invested in real estate, back-office services, procurement, IT, data, analytics and precision marketing as part of its internal development initiatives. Driven by these investments, we expect Omnicom to witness higher revenues on the back of organic growth. We expect 2024 revenues to see a year-over-year uptick of 3.6%.

OMC’s presence in various segments of the advertising and marketing industry not only diversifies its revenue streams but also equips it with the flexibility and expertise needed to effectively navigate the ever-evolving and dynamic marketing landscape. Out of 2023 revenues, more than 53% is derived from the Advertising & Media segment.

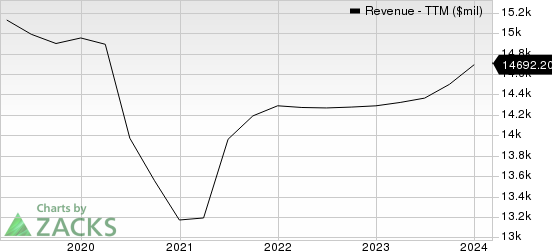

Omnicom Group Inc. Revenue (TTM)

Omnicom Group Inc. revenue-ttm | Omnicom Group Inc. Quote

It has a consistent record of returning value to shareholders in the form of dividends and share repurchases. In 2023, Omnicom paid dividends of $562.7 million and repurchased shares worth $570.8 million. In 2022, the company paid dividends of $581.1 million and repurchased shares worth $611.4 million. In 2021, the company paid dividends of $592.3 million and repurchased shares amounting to $527.3 million. Such moves not only instill investors’ confidence but also positively impact earnings.

In a competitive industry, Omnicom must adapt quickly, offer top-notch services globally and win clients. Periodic competitive reviews by clients can lead to the company losing customers. Failing to stay competitive or retain clients can harm revenues and the business.

Omnicom's current ratio (a measure of liquidity) at the end of the fourth quarter of 2023 was 0.95, lower than the year-ago quarter's 0.97. A current ratio of less than 1 indicates that the company may have problems paying off its short-term obligations.

Zacks Rank and Stocks to Consider

Omnicom currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the broader Zacks Business Services sector are Booz Allen Hamilton BAH and Jamf JAMF

Booz Allen Hamilton sports a Zacks Rank of 1 at present. It has a long-term earnings growth expectation of 12.6%.

BAH delivered a trailing four-quarter earnings surprise of 12.7%, on average.

Jamf has a Zacks Rank of 2 (Buy) at present. It has a long-term earnings growth expectation of 22.5%.

JAMF delivered a trailing four-quarter earnings surprise of 49.4%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Omnicom Group Inc. (OMC) : Free Stock Analysis Report

Booz Allen Hamilton Holding Corporation (BAH) : Free Stock Analysis Report

Jamf Holding Corp. (JAMF) : Free Stock Analysis Report