Oncternal Therapeutics (NASDAQ:ONCT) pulls back 13% this week, but still delivers shareholders respectable 33% return over 1 year

Some Oncternal Therapeutics, Inc. (NASDAQ:ONCT) shareholders are probably rather concerned to see the share price fall 30% over the last three months. But at least the stock is up over the last year. But to be blunt its return of 33% fall short of what you could have got from an index fund (around 36%).

In light of the stock dropping 13% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive one-year return.

View our latest analysis for Oncternal Therapeutics

Oncternal Therapeutics wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

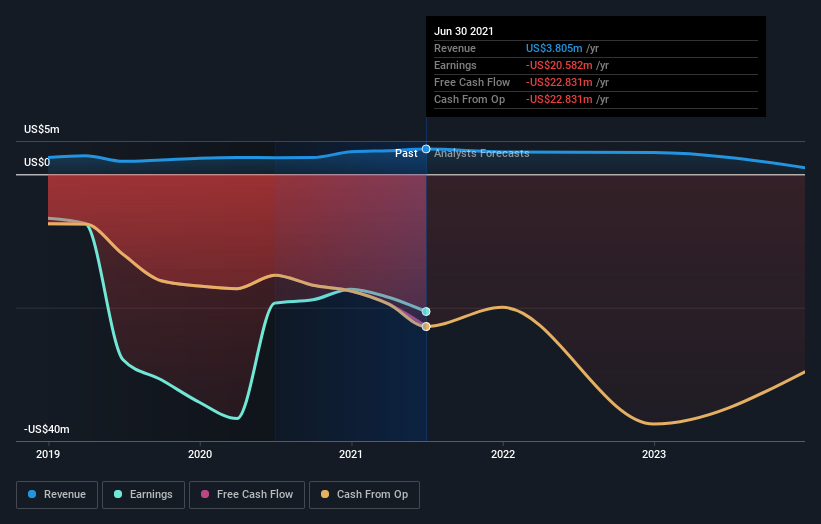

Over the last twelve months, Oncternal Therapeutics' revenue grew by 53%. That's well above most other pre-profit companies. To be blunt the 33% is underwhelming given the strong revenue growth. When revenue spikes but the share price doesn't we can't help wondering if the market is missing something. It could be that the stock was previously over-hyped, or that losses are causing concern for the market, but this could be an opportunity.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Oncternal Therapeutics shareholders have gained 33% over twelve months, which isn't far from the market return of 36%. Unfortunately the share price is down 30% over the last quarter. It may simply be that the share price got ahead of itself, although you might want to check for any weak results. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 4 warning signs for Oncternal Therapeutics (2 are significant) that you should be aware of.

Oncternal Therapeutics is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.