The ONE Group (NASDAQ:STKS) Misses Q4 Revenue Estimates, Stock Drops

Upscale restaurant company The One Group Hospitality (NASDAQ:STKS) fell short of analysts' expectations in Q4 FY2023, with revenue up 1.8% year on year to $89.94 million. The company's full-year revenue guidance of $370 million at the midpoint also came in 11.4% below analysts' estimates. It made a non-GAAP profit of $0.17 per share, down from its profit of $0.19 per share in the same quarter last year.

Is now the time to buy The ONE Group? Find out by accessing our full research report, it's free.

The ONE Group (STKS) Q4 FY2023 Highlights:

Revenue: $89.94 million vs analyst estimates of $98.04 million (8.3% miss)

EPS (non-GAAP): $0.17 vs analyst estimates of $0.15 (13.3% beat)

Management's revenue guidance for the upcoming financial year 2024 is $370 million at the midpoint, missing analyst estimates by 11.4% and implying 11.2% growth (vs 5.3% in FY2023)

Gross Margin (GAAP): 23.6%, up from 23% in the same quarter last year

Same-Store Sales were down 4.3% year on year

Market Capitalization: $115.4 million

Doubling as a hospitality services provider for hotels and resorts, The One Group Hospitality (NASDAQ:STKS) is an upscale restaurant company that operates STK Steakhouse and Kona Grill.

Sit-Down Dining

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

Sales Growth

The ONE Group is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale. On the other hand, one advantage is that its growth rates can be higher because it's growing off a small base.

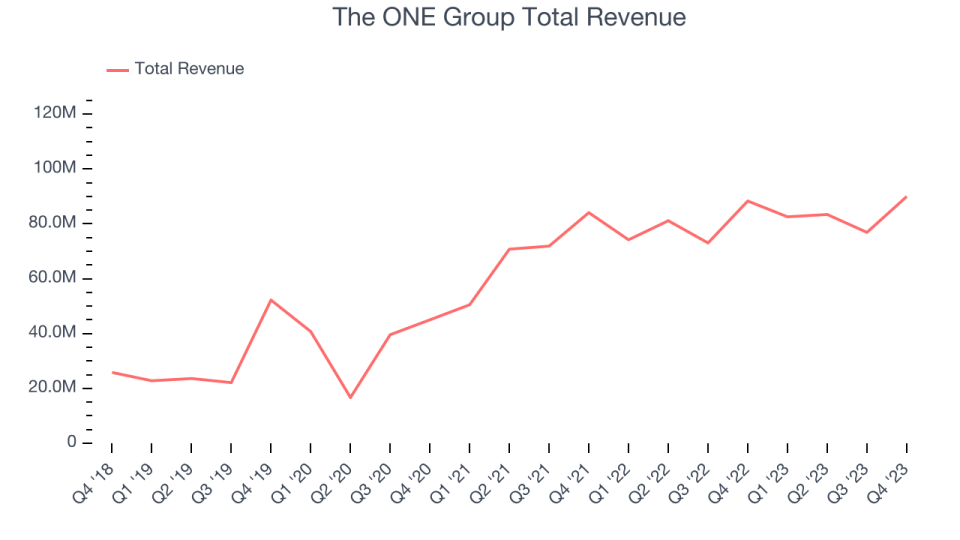

As you can see below, the company's annualized revenue growth rate of 28.9% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was incredible as it added more dining locations and increased sales at existing, established restaurants.

This quarter, The ONE Group's revenue grew 1.8% year on year to $89.94 million, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 25.5% over the next 12 months, an acceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Same-Store Sales

Same-store sales growth is an important metric that tracks organic growth and demand for a restaurant's established locations.

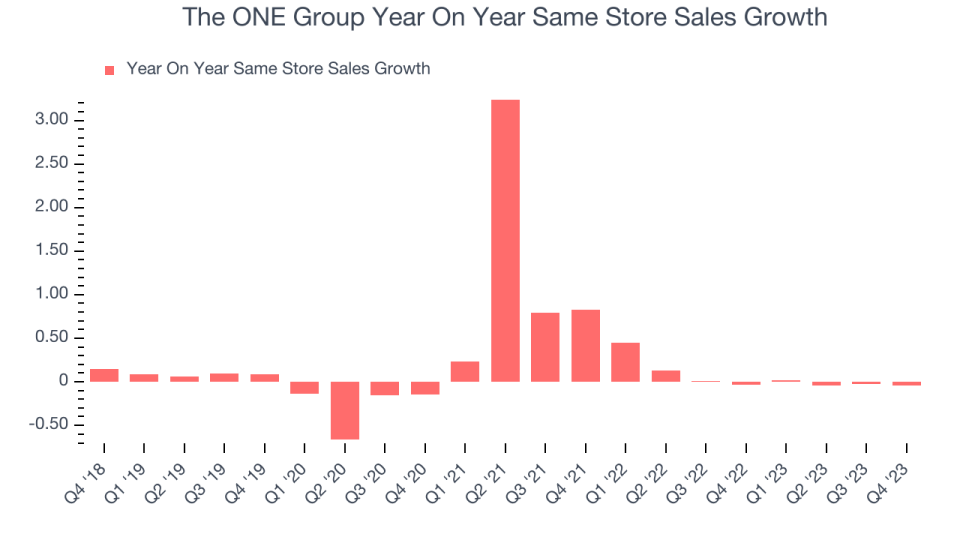

The ONE Group's demand within its existing restaurants has generally risen over the last two years but lagged behind the broader sector. On average, the company's same-store sales have grown by 5.6% year on year. With positive same-store sales growth amid an increasing number of restaurants, The ONE Group is reaching more diners and growing sales.

In the latest quarter, The ONE Group's same-store sales fell 4.3% year on year. This decrease was a further deceleration from the 3.1% year-on-year decline it posted 12 months ago. We hope the business can get back on track.

Key Takeaways from The ONE Group's Q4 Results

We were impressed by The ONE Group's EPS this quarter, which topped analysts' expectations. On the other hand, its revenue missed as its same-store sales declined 4.3%, and due to the weaker demand, the company shared full-year revenue guidance that missed analysts' expectations. Overall, this was a mediocre quarter for The ONE Group. The company is down 7.6% on the results and currently trades at $3.3 per share.

The ONE Group may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.