One Liberty Properties Inc Reports Mixed Results for Q4 and Full Year 2023

Occupancy Rate: Maintained a high occupancy rate of 98.8%.

Debt Reduction: Paid off $21.8 million of credit facility debt.

Dividends: Declared the 125th consecutive quarterly dividend.

Share Repurchase: Repurchased $9.6 million of shares in 2023.

Rental Income: Full-year rental income decreased slightly to $90.6 million from $92.2 million in 2022.

Net Income: Reported a net income of $29.6 million for 2023, down from $42.2 million in 2022.

FFO and AFFO: FFO per diluted share was $1.82 and AFFO per diluted share was $1.99 for the full year 2023.

On March 5, 2024, One Liberty Properties Inc (NYSE:OLP), a self-administered and self-managed real estate investment trust, released its 8-K filing, reporting its financial results for the fourth quarter and full year ended December 31, 2023. The company, which focuses primarily on net leased industrial properties, has shown resilience with a high occupancy rate and strategic financial moves, despite facing some challenges in its financial metrics.

One Liberty Properties Inc is known for its diversified portfolio of industrial, retail, restaurant, health and fitness, and theater properties, generating the majority of its revenue from rental income. The company's occupancy rate stood strong at 98.8%, reflecting the demand for its properties and the effectiveness of its management strategies.

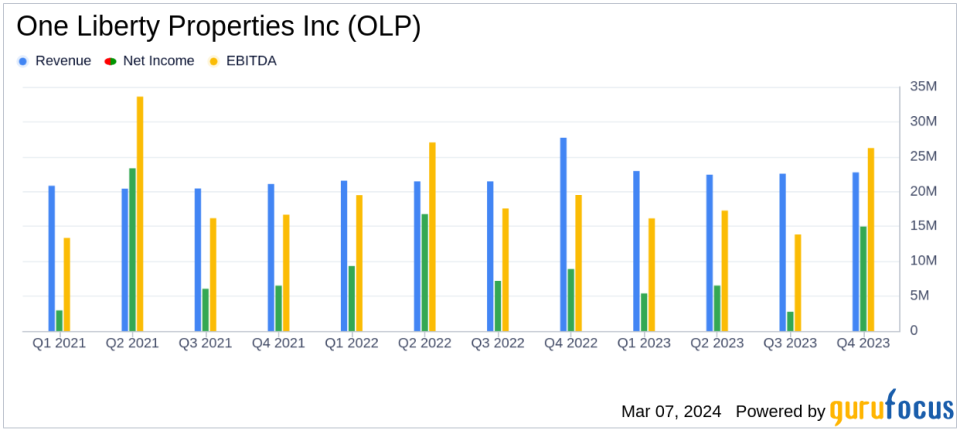

Fourth Quarter and Full Year 2023 Performance

For the fourth quarter, One Liberty Properties reported rental income of $22.7 million, a decrease from $27.7 million in the same period of the prior year. This decline was primarily due to a $4.6 million settlement in the previous year's quarter. Total operating expenses for the quarter were relatively flat year-over-year at $14.3 million.

The company experienced a net income of $15.0 million, or $0.71 per diluted share, in the fourth quarter, compared to $8.9 million, or $0.42 per diluted share, in the same period of the prior year. This increase was largely due to a $12 million gain from the sale of real estate. However, Funds from Operations (FFO) decreased to $9.6 million, or $0.45 per diluted share, from $15.1 million, or $0.71 per diluted share, in the corresponding quarter of 2022. Adjusted Funds from Operations (AFFO) also saw a slight decrease to $10.6 million, or $0.50 per diluted share, from $11.0 million, or $0.52 per diluted share.

For the full year, rental income decreased slightly to $90.6 million from $92.2 million in 2022. Net income for 2023 was reported at $29.6 million, or $1.38 per diluted share, a decrease from $42.2 million, or $1.99 per diluted share, in the previous year. The company's FFO for 2023 was $39.0 million, or $1.82 per diluted share, compared to $49.7 million, or $2.34 per diluted share, in 2022. AFFO for 2023 was $42.6 million, or $1.99 per diluted share, showing a slight increase from $42.1 million, or $1.98 per diluted share, in the prior year.

Strategic Financial Moves and Future Outlook

One Liberty Properties made significant strides in strengthening its financial position by paying off $21.8 million of credit facility debt, which was funded by the net proceeds of $46.6 million from property sales. This strategic move not only reduces future interest expenses but also provides additional financial capacity and flexibility for the company.

The company's balance sheet as of December 31, 2023, showed $26.4 million in cash and cash equivalents, total assets of $761.6 million, total debt of $418.3 million, and total stockholders equity of $306.7 million. The company's liquidity position was further bolstered by its available liquidity of $123.9 million as of March 1, 2024.

One Liberty Properties also continued its shareholder-friendly actions by repurchasing approximately 499,000 shares of common stock for approximately $9.6 million and declaring its 125th consecutive quarterly dividend of $0.45 per share.

Looking ahead, the company remains focused on pursuing industrial properties and selective asset sales to further strengthen its portfolio and cash flow. One Liberty's management believes that the company's FFO and AFFO are important measures of operating performance and are useful in evaluating potential property acquisitions.

Value investors may find One Liberty Properties Inc's commitment to maintaining a high occupancy rate, reducing debt, and returning capital to shareholders through dividends and share repurchases to be compelling reasons to consider the company as a potential investment.

For a detailed view of One Liberty Properties Inc's financials, readers are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from One Liberty Properties Inc for further details.

This article first appeared on GuruFocus.