The one-year returns have been for Vision Marine Technologies (NASDAQ:VMAR) shareholders despite underlying losses increasing

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But investors can boost returns by picking market-beating companies to own shares in. To wit, the Vision Marine Technologies Inc. (NASDAQ:VMAR) share price is 21% higher than it was a year ago, much better than the market return of around 5.0% (not including dividends) in the same period. So that should have shareholders smiling. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

The past week has proven to be lucrative for Vision Marine Technologies investors, so let's see if fundamentals drove the company's one-year performance.

Check out our latest analysis for Vision Marine Technologies

Vision Marine Technologies isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last twelve months, Vision Marine Technologies' revenue grew by 52%. That's stonking growth even when compared to other loss-making stocks. While the share price gain of 21% over twelve months is pretty tasty, you might argue it doesn't fully reflect the strong revenue growth. So quite frankly it could be a good time to investigate Vision Marine Technologies in some detail. Human beings have trouble conceptualizing (and valuing) exponential growth. Is that what we're seeing here?

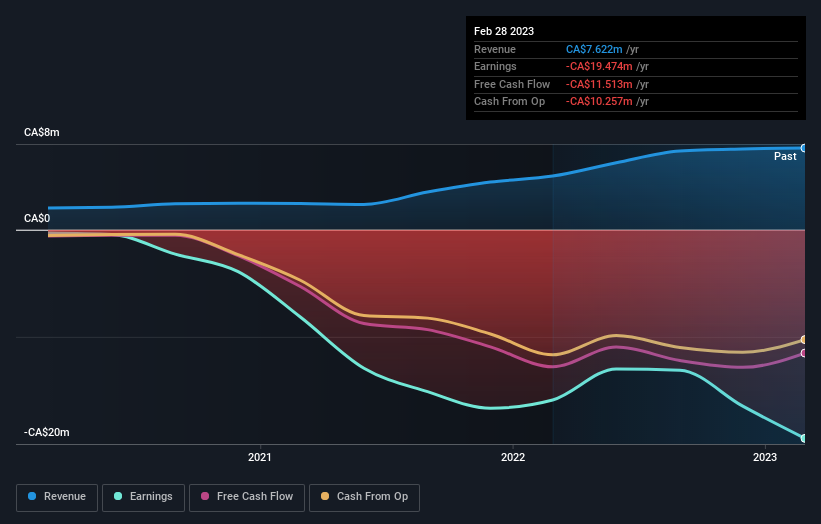

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Dive deeper into the earnings by checking this interactive graph of Vision Marine Technologies' earnings, revenue and cash flow.

A Different Perspective

Vision Marine Technologies shareholders should be happy with the total gain of 21% over the last twelve months. And the share price momentum remains respectable, with a gain of 27% in the last three months. This suggests the company is continuing to win over new investors. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Vision Marine Technologies (of which 2 shouldn't be ignored!) you should know about.

Vision Marine Technologies is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here