OneMain Holdings Inc (OMF) Reports Dip in Annual Net Income Despite Quarterly Growth in Managed ...

Net Income: Q4 net income of $165 million, down from $176 million in the prior year quarter.

Diluted EPS: Q4 diluted EPS of $1.38, compared to $1.44 in the prior year quarter.

Managed Receivables: Increased to $22.2 billion, up 7% year-over-year.

Quarterly Dividend: Declared at $1.00 per share, payable on February 23, 2024.

Share Repurchase: Repurchased approximately 531 thousand shares for $20 million in Q4.

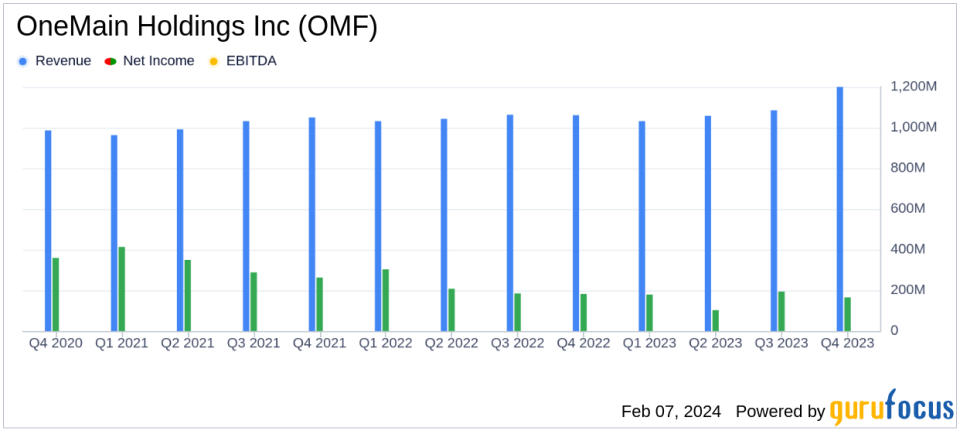

Full Year Net Income: $641 million for 2023, down from $872 million for the full year of 2022.

Full Year Diluted EPS: $5.32 for 2023, compared to $7.01 in the prior year.

On February 7, 2024, OneMain Holdings Inc (NYSE:OMF) released its 8-K filing, detailing the financial results for the fourth quarter of 2023. The company, a leader in nonprime consumer finance in the United States, reported a decrease in net income and diluted earnings per share (EPS) compared to the same quarter in the previous year, despite an increase in managed receivables.

OneMain Holdings operates primarily through its Consumer and Insurance segment, offering personal loan products and credit insurance, with a significant online presence complementing its hundreds of branches. The company's financial performance is crucial as it reflects the health of the consumer credit market, particularly for nonprime borrowers.

Financial Performance and Challenges

The company's pretax income for Q4 2023 stood at $220 million, with net income at $165 million, a decrease from $233 million and $176 million, respectively, in the prior year quarter. The diluted EPS was $1.38, down from $1.44 in the prior year quarter. For the full year of 2023, net income was $641 million, a significant decrease from $872 million in 2022, with full-year diluted EPS dropping to $5.32 from $7.01.

OneMain's managed receivables grew to $22.2 billion, a 7% increase from the previous year, indicating an expansion in its lending activities. However, personal loan originations decreased by 13% year-over-year to $3.0 billion in Q4 2023. The company also faced higher net charge-offs and interest expenses, which were partially offset by an increase in interest income.

The provision for finance receivable losses rose to $446 million in Q4 2023, up $42 million compared to the prior year period, reflecting the company's cautious approach to potential credit losses in an uncertain economic environment.

Financial Achievements and Importance

Despite the challenges, OneMain declared a quarterly dividend of $1.00 per share, demonstrating confidence in its ability to generate cash and return value to shareholders. The company also continued its share repurchase program, buying back 531 thousand shares for $20 million in the fourth quarter, signaling a belief in the intrinsic value of its stock.

OneMain's financial achievements, such as the growth in managed receivables and the maintenance of a robust dividend, are important indicators of the company's market position and operational efficiency. These factors are particularly relevant to value investors who look for companies with the potential for sustainable returns.

Key Financial Metrics and Their Importance

The company's operating expenses for Q4 2023 were $382 million, a 4% increase from the prior year quarter, reflecting continued investment in the business. The balance sheet shows a healthy liquidity position, with $1.0 billion of cash and cash equivalents and significant undrawn committed capacity under various credit facilities.

OneMain's return on assets (ROA) for the full year of 2023 was 2.7%, down from 3.9% in the previous year, indicating a lower efficiency in generating income from its assets. The company's book value per basic share increased to $26.60 at the end of 2023, from $24.91 at the end of 2022, suggesting an increase in the intrinsic value of the company.

"OneMain finished the year very well positioned for the future," said Doug Shulman, Chairman and CEO of OneMain. "As we enter 2024, we feel very good about the competitive position of the business, management of our credit box, and development of new products that will drive profitable growth in future years."

Analysis of Company's Performance

OneMain Holdings Inc's performance in the fourth quarter of 2023 reflects a mixed picture. While the company has managed to grow its receivables and maintain a strong liquidity position, the decrease in net income and diluted EPS year-over-year raises concerns about profitability in a challenging economic climate. The company's strategic focus on credit management and product development is aimed at driving future growth, but it remains to be seen how these initiatives will translate into financial performance.

For value investors, OneMain's commitment to dividends and share repurchases, along with its cautious approach to credit risk, may present a compelling case. However, the decline in annual net income and the challenges posed by the current macroeconomic environment will require careful monitoring.

For more detailed financial analysis and up-to-date information on OneMain Holdings Inc (NYSE:OMF) and other investment opportunities, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from OneMain Holdings Inc for further details.

This article first appeared on GuruFocus.