OneMain (OMF) Seeks Auto Expansion, Signs Deal to Buy Foursight

As part of its efforts to expand into the automobile lending business, OneMain Holdings, Inc. OMF has entered an agreement to acquire Foursight Capital LLC from Jefferies Financial Group Inc. JEF for $115 million in cash. The completion of the deal, subject to customary closing conditions and applicable regulatory approvals, is expected in the first quarter of 2024.

Being an automobile finance company, Foursight purchases and services automobile retail installment contracts primarily made to near-prime borrowers across 38 states. The contracts are sourced through an extensive network of dealers.

OneMain, which is the leader in offering non-prime customers responsible access to credit, is expected to acquire Foursight’s $900 million of loan portfolio. Moreover, nearly 200 Foursight employees will join OMF.

Doug Shulman, the chairman and CEO of OneMain, stated, “Foursight is an attractive tuck-in acquisition giving us a seasoned team, scalable technology, tested credit models, a franchise dealer network and a high-quality loan portfolio to support our disciplined expansion into the auto lending business. I look forward to welcoming Mark Miller and the Foursight team to OneMain and working together to continue to diversify and grow our suite of lending products for hardworking Americans.”

Nick Daraviras, the co-president of Jefferies’ Leucadia Asset Management platform, said, “We thank Mark Miller and the Foursight team for their partnership in building this powerful business. We wish them the best as they continue their development as part of OneMain.”

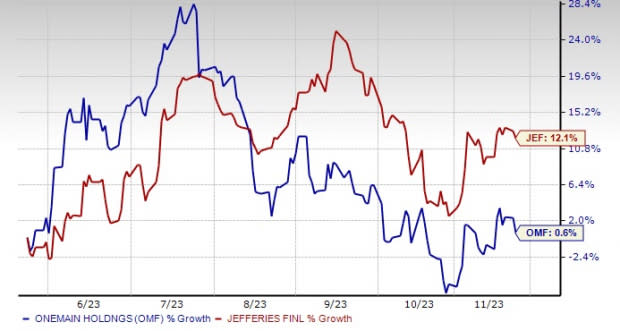

Over the past six months, shares of OMF have gained 0.6%, whereas the JEF stock has rallied 12.1%.

Image Source: Zacks Investment Research

Currently, OMF and JEF carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Inorganic Growth Efforts by Other Firms

First Financial Corporation THFF signed an agreement to acquire Dayton, TN-based SimplyBank for $73.4 million. The completion of the deal, expected in the second quarter of 2024, is subject to customary closing conditions, as well as the receipt of regulatory and SimplyBank stockholder approvals.

Following the deal closure, SimplyBank will be merged with and into First Financial Bank, a wholly-owned subsidiary of THFF. Under the terms of the deal, First Financial will pay $718.38 per share in cash for each share of SimplyBank’s common stock outstanding.

Norman L. Lowery, president and CEO of THFF, stated, “SimplyBank provides us with an opportunity to deepen our commitment to the Tennessee market while expanding into attractive new MSAs.”

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Jefferies Financial Group Inc. (JEF) : Free Stock Analysis Report

First Financial Corporation Indiana (THFF) : Free Stock Analysis Report

OneMain Holdings, Inc. (OMF) : Free Stock Analysis Report