ONEOK Inc's Dividend Analysis

An Insightful Look at ONEOK Inc's Upcoming Dividend and Financial Health

ONEOK Inc (NYSE:OKE) recently announced a dividend of $0.99 per share, payable on 2024-02-14, with the ex-dividend date set for 2024-01-29. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into ONEOK Inc's dividend performance and assess its sustainability.

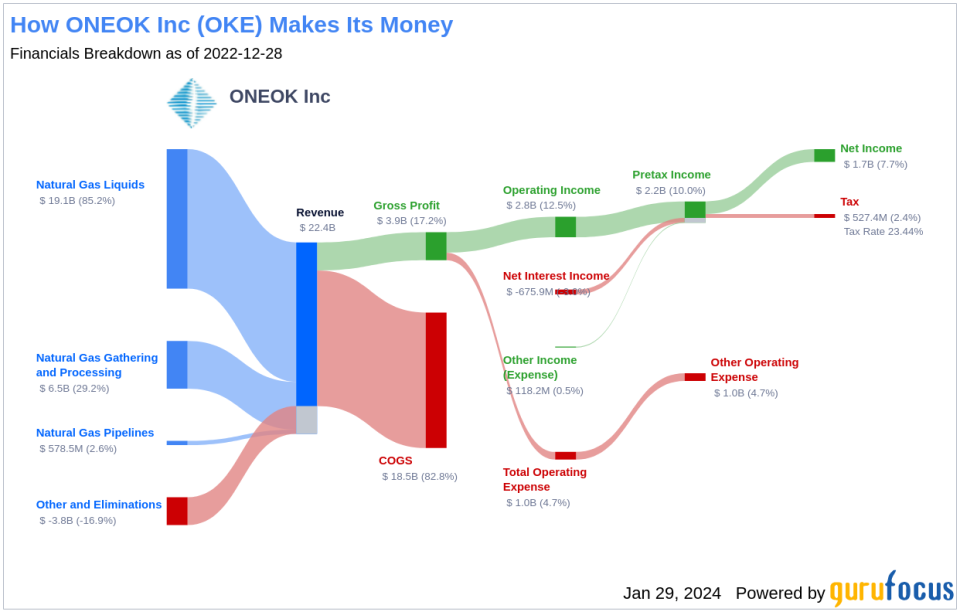

What Does ONEOK Inc Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

ONEOK Inc specializes in natural gas gathering, processing, storage, and transportation, as well as natural gas liquids transportation and fractionation. It boasts significant assets in key regions such as the midcontinent, Permian, and Rocky Mountain areas.

A Glimpse at ONEOK Inc's Dividend History

ONEOK Inc has upheld a steady dividend payment history since 1986, with quarterly distributions to shareholders.

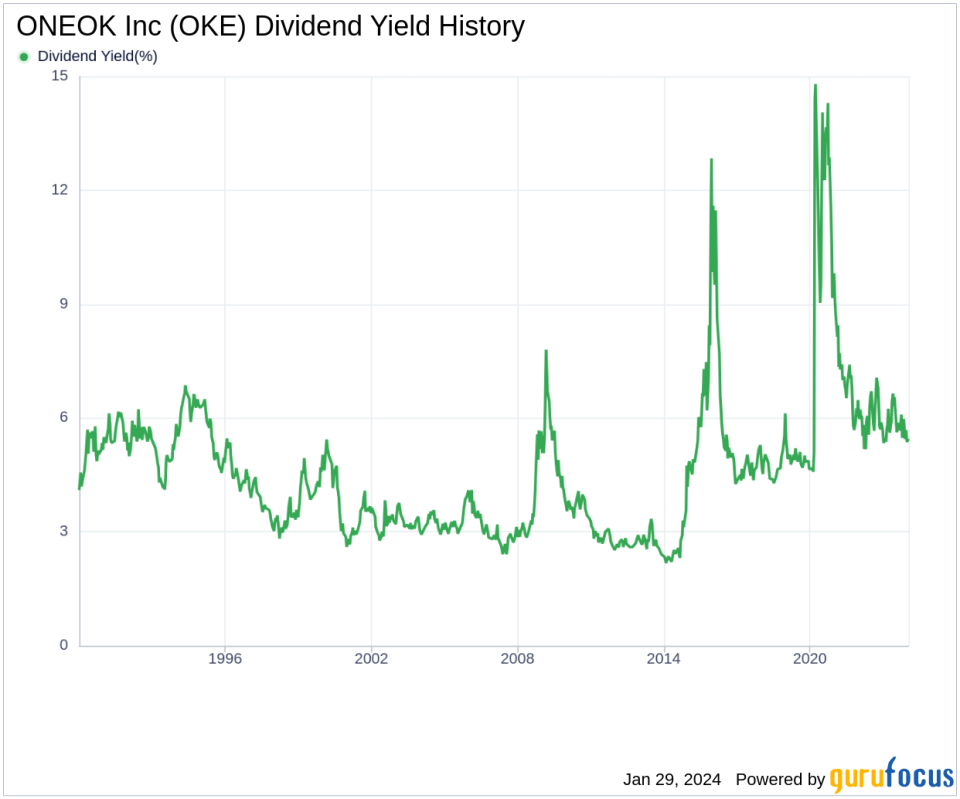

Since 1999, ONEOK Inc has raised its dividend annually, earning it the prestigious title of a dividend aristocrata distinction awarded to companies that have consistently increased their dividends for at least 25 consecutive years. The chart below illustrates the annual Dividends Per Share to observe historical trends.

Breaking Down ONEOK Inc's Dividend Yield and Growth

Currently, ONEOK Inc boasts a 12-month trailing dividend yield of 5.42% and a 12-month forward dividend yield of 5.62%, indicating anticipated dividend increases over the next year.

Over the past three years, ONEOK Inc's annual dividend growth rate was 1.90%. On a five-year scale, this rate climbs to 6.10% annually. Over the past decade, the annual dividends per share growth rate has been an impressive 11.40%.

Considering ONEOK Inc's dividend yield and five-year growth rate, the 5-year yield on cost for the stock is approximately 7.29% as of today.

The Sustainability Question: Payout Ratio and Profitability

The dividend payout ratio is a crucial metric for evaluating dividend sustainability, reflecting the portion of earnings allocated to dividends. A lower ratio indicates a greater retention of earnings for growth and contingencies. As of 2023-09-30, ONEOK Inc's dividend payout ratio stands at 0.70, which may raise concerns about the sustainability of the company's dividends.

ONEOK Inc's profitability rank is an impressive 8 out of 10, suggesting strong profitability prospects. The company has also reported consistent positive net income over the last decade, reinforcing its robust financial health.

Growth Metrics: The Future Outlook

ONEOK Inc's growth rank is a solid 8 out of 10, indicating a promising growth trajectory compared to its competitors.

ONEOK Inc's revenue per share and 3-year revenue growth rate suggest a strong revenue model, with an average annual increase of 26.80%, surpassing 78.87% of global competitors.

The company's 3-year EPS growth rate reflects its ability to grow earnings at an average rate of 9.10% annually, outperforming 36.4% of global competitors.

Moreover, ONEOK Inc's 5-year EBITDA growth rate of 17.80% exceeds that of 63.53% of global competitors, highlighting its strong earning potential.

Next Steps

In conclusion, while ONEOK Inc's dividend history and growth rates are commendable, the current payout ratio may warrant a closer examination for long-term sustainability. However, the company's strong profitability rank and solid growth metrics provide a positive outlook for future dividend stability and potential growth. Investors should consider these factors alongside their individual investment strategies and market conditions. For those seeking high-dividend yield opportunities, GuruFocus Premium offers a High Dividend Yield Screener to discover stocks that meet specific dividend criteria.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.