OneSpan Inc (OSPN) Reports Growth in Q4 and Full Year 2023 Revenue

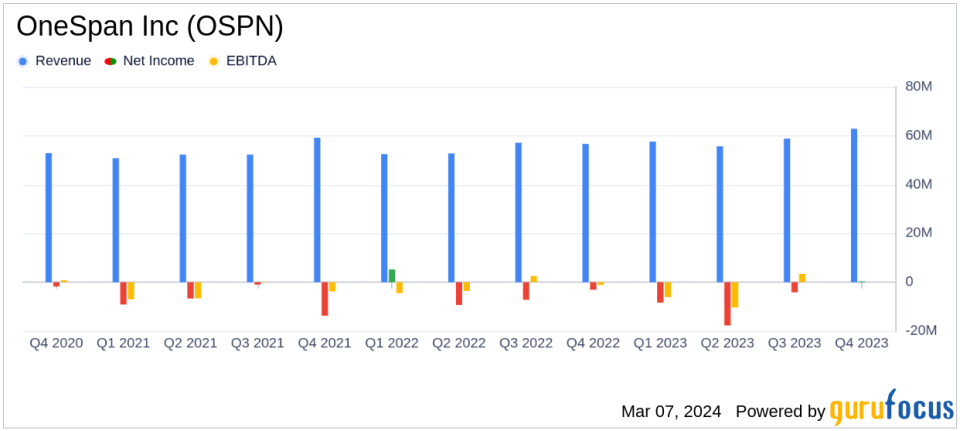

Q4 Revenue Growth: Fourth quarter revenue increased by 11% year-over-year to $62.9 million.

Full Year Revenue Growth: Full year revenue saw a 7% increase year-over-year, reaching $235.1 million.

Subscription and ARR Expansion: Subscription revenue for Q4 grew by 15% and ARR by 11% year-over-year.

Profitability Improvements: Q4 GAAP operating margin improved to 3% and adjusted EBITDA margin to 18%.

Net Income Recovery: Q4 net income was $0.4 million, a positive shift from a net loss of $3.1 million in the same period last year.

2024 Financial Outlook: Revenue is expected to be in the range of $238 million to $246 million with an adjusted EBITDA margin of 20% to 23%.

On March 6, 2024, OneSpan Inc (NASDAQ:OSPN), a leading provider of digital agreement security solutions, released its 8-K filing, detailing the financial results for the fourth quarter and full year ended December 31, 2023. The company, known for securing and managing access to digital assets and protecting online transactions, reported an 11% increase in fourth-quarter revenue to $62.9 million and a 7% increase in full-year revenue to $235.1 million. Subscription revenue for the fourth quarter grew by 15% to $27.3 million, contributing to a full-year subscription revenue increase of 19% to $106.4 million.

OneSpan's Annual Recurring Revenue (ARR) also grew by 11% year-over-year to $154.6 million, with a Net Retention Rate (NRR) of 110%. The company's focus on operational rigor and cost reduction actions led to a significant improvement in profitability, with a 3% GAAP operating margin and an 18% adjusted EBITDA margin in the fourth quarter.

Interim CEO Victor Limongelli commented on the results, stating:

"We ended the year on a high note led by strong operational rigor and accelerated cost reduction actions over the second half of 2023, resulting in 3% GAAP operating margin and 18% adjusted EBITDA margin in the fourth quarter, a dramatic improvement from the prior year. We will continue to focus on driving efficient revenue growth, profitability and cash flow in 2024."

The company's financial achievements are particularly important in the software industry, where recurring revenue streams and high margins are critical indicators of sustainable growth and profitability. OneSpan's ability to expand its subscription base and ARR demonstrates the company's success in capturing market demand for its security solutions.

Key financial details from the Income Statement include a gross profit of $43.5 million, or a 69% gross margin, compared to $38.0 million, or 67% in the same period last year. The Balance Sheet shows cash and cash equivalents of $42.5 million at the end of 2023. The Cash Flow Statement indicates that the company used $29.2 million, net of fees and expenses, to repurchase shares of its common stock during the year.

For the full year 2024, OneSpan expects revenue to be in the range of $238 million to $246 million, with ARR between $160 million to $168 million, and an adjusted EBITDA of $47 million to $52 million.

OneSpan's performance reflects its strategic focus on driving efficient revenue growth, profitability, and cash flow, which is essential for value investors seeking companies with strong financial health and growth prospects.

Investors and analysts interested in further details can access the conference call hosted by OneSpan, where Interim CEO Victor Limongelli and CFO Jorge Martell will discuss the company's results for the fourth quarter and full year 2023.

For more information on OneSpan Inc (NASDAQ:OSPN) and its financial results, visit www.onespan.com.

Explore the complete 8-K earnings release (here) from OneSpan Inc for further details.

This article first appeared on GuruFocus.