Online Marketplace Stocks Q3 Recap: Benchmarking CarGurus (NASDAQ:CARG)

Earnings results often give us a good indication of what direction a company will take in the months ahead. With Q3 now behind us, let’s have a look at CarGurus (NASDAQ:CARG) and its peers.

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

The 10 online marketplace stocks we track reported a slower Q3; on average, revenues beat analyst consensus estimates by 3.2% while next quarter's revenue guidance was 1.7% below consensus. Investors abandoned cash-burning companies to buy stocks with higher margins of safety, but online marketplace stocks held their ground better than others, with the share prices up 17.3% on average since the previous earnings results.

CarGurus (NASDAQ:CARG)

Bringing transparency to a sometimes opaque process, CarGurus (NASDAQ:CARG) is a digital marketplace where auto dealers can connect with potential customers and where car buyers can browse, purchase, and obtain financing.

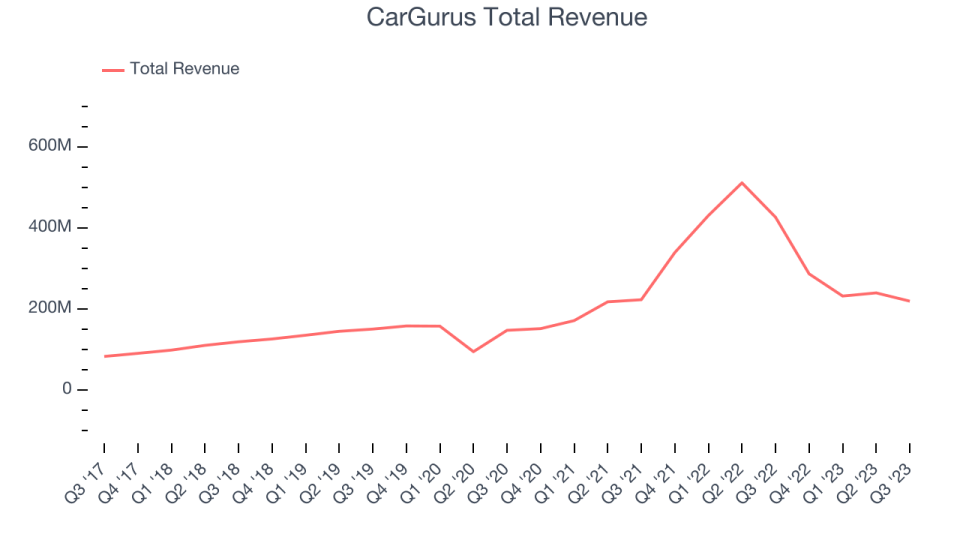

CarGurus reported revenues of $219.4 million, down 48.5% year on year, topping analyst expectations by 1.6%. It was a mixed quarter for the company, with revenue exceeding expectations. Adjusted EBITDA and EPS beat by a more meaningful amount. On the other hand, its revenue growth regrettably slowed and its revenue guidance for next quarter and the full year missed Wall Street's estimates. However, adjusted EBITDA guidance for next quarter and the full year were ahead of expectations.

"We are pleased to have exceeded our forecasted consolidated adjusted EBITDA guidance range for the quarter," said Jason Trevisan, Chief Executive Officer at CarGurus.

CarGurus delivered the slowest revenue growth of the whole group. The company reported 31,191 users, down 0.3% year on year. The stock is up 25.1% since the results and currently trades at $23.

Is now the time to buy CarGurus? Access our full analysis of the earnings results here, it's free.

Best Q3: MercadoLibre (NASDAQ:MELI)

Originally started as an online auction platform, MercadoLibre (NASDAQ:MELI) is a one-stop e-commerce marketplace and fintech platform in Latin America.

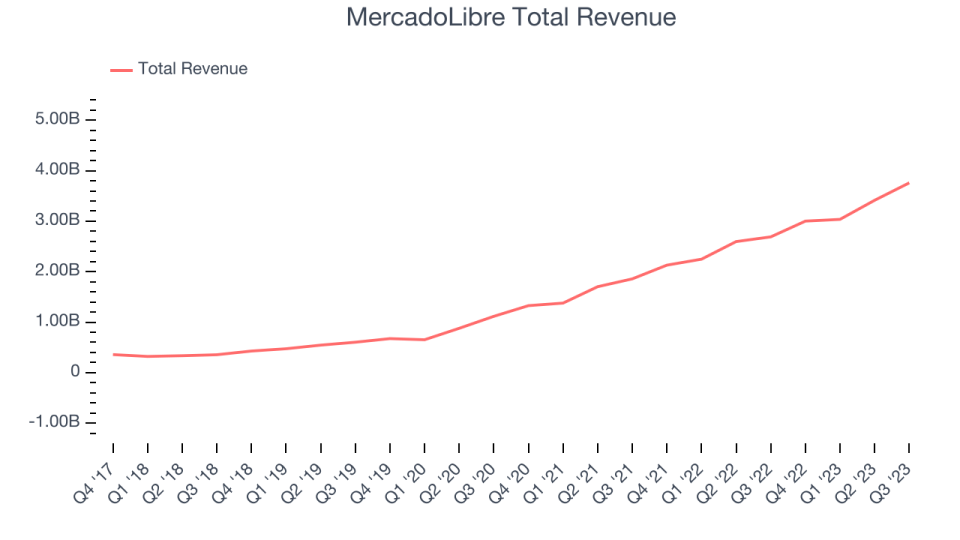

MercadoLibre reported revenues of $3.76 billion, up 39.8% year on year, outperforming analyst expectations by 5.9%. It was a very quarter for the company, with impressive growth in its user base and exceptional revenue growth.

MercadoLibre achieved the fastest revenue growth among its peers. The company reported 120 million daily active users, up 36.4% year on year. The stock is up 33.2% since the results and currently trades at $1,729.

Is now the time to buy MercadoLibre? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Teladoc (NYSE:TDOC)

Founded to help people in rural areas get online medical consultations, Teladoc Health (NYSE:TDOC) is a telemedicine platform that facilitates remote doctor’s visits.

Teladoc reported revenues of $660.2 million, up 8% year on year, falling short of analyst expectations by 0.4%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and full-year revenue guidance missing analysts' expectations.

Teladoc had the weakest performance against analyst estimates and weakest full-year guidance update in the group. The company reported 90.2 million users, up 9.9% year on year. The stock is up 11.8% since the results and currently trades at $20.25.

Read our full analysis of Teladoc's results here.

Etsy (NASDAQ:ETSY)

Founded by a struggling amateur furniture maker Robert Kalin and his two friends, Etsy (NASDAQ:ETSY) is one of the world’s largest online marketplaces, focusing on handmade or vintage items.

Etsy reported revenues of $636.3 million, up 7% year on year, in line with analyst expectations. It was a mixed quarter for the company, with slow revenue growth.

The company reported 97.34 million active buyers, up 3.4% year on year. The stock is up 13.9% since the results and currently trades at $69.26.

Read our full, actionable report on Etsy here, it's free.

Sea (NYSE:SE)

Founded in 2009 and a publicly traded company since 2017, Sea (NYSE:SE) started as a gaming platform and has since expanded to offer a variety of services such as e-commerce, digital payments, and financial services across Southeast Asia.

Sea reported revenues of $3.31 billion, up 4.9% year on year, surpassing analyst expectations by 3.1%. It was a weak quarter for the company, with a decline in its user base and slow revenue growth.

The company reported 40.5 million users, down 21.4% year on year. The stock is down 14.8% since the results and currently trades at $39.25.

Read our full, actionable report on Sea here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned