Opaleye Management Inc. Reduces Stake in Harrow Health Inc.

Opaleye Management Inc. (Trades, Portfolio), a Cambridge-based investment firm, recently executed a significant transaction involving Harrow Health Inc. This article provides an in-depth analysis of the transaction, the profiles of both entities, and the potential implications for value investors.

Details of the Transaction

On September 20, 2023, Opaleye Management Inc. (Trades, Portfolio) reduced its holdings in Harrow Health Inc. by 155,000 shares, representing a 4.11% change in its portfolio. The shares were traded at a price of $14.15 each. Following the transaction, the firm holds a total of 3,620,000 shares in Harrow Health Inc., accounting for 12.32% of its portfolio and 10.31% of the traded stock.

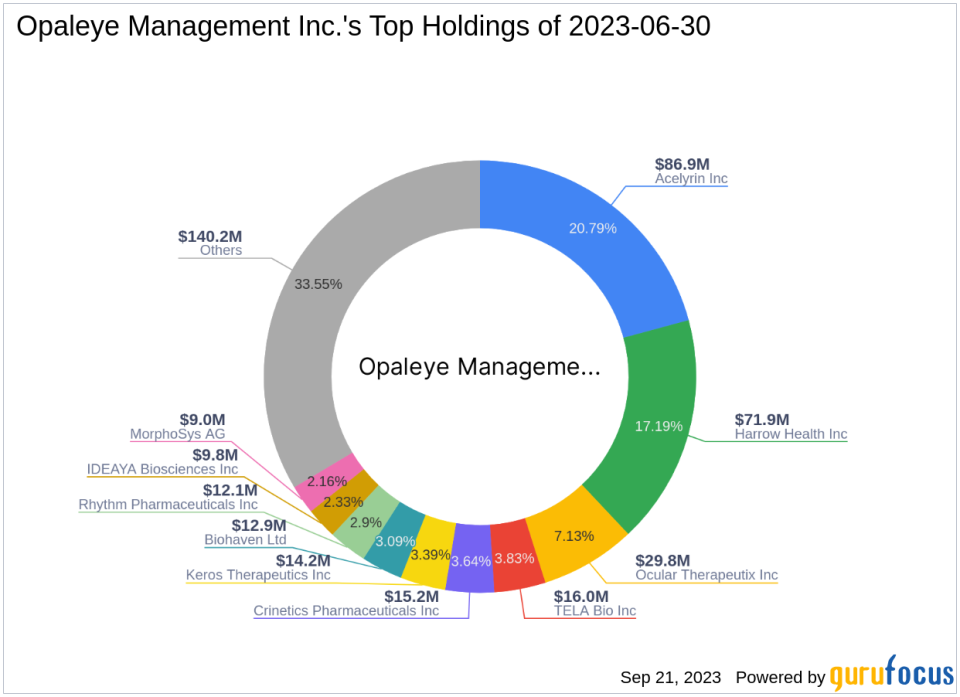

Profile of Opaleye Management Inc. (Trades, Portfolio)

Opaleye Management Inc. (Trades, Portfolio) is an investment firm located at 9B Russell Street, Cambridge, MA. The firm's portfolio consists of 47 stocks, with a total equity of $418 million. Its top holdings include Harrow Health Inc(NASDAQ:HROW), Ocular Therapeutix Inc(NASDAQ:OCUL), Crinetics Pharmaceuticals Inc(NASDAQ:CRNX), TELA Bio Inc(NASDAQ:TELA), and Acelyrin Inc(NASDAQ:SLRN).

Overview of Harrow Health Inc.

Harrow Health Inc., a US-based pharmaceutical company, specializes in the development, production, and sale of ophthalmology-focused medications. The company's products are designed to address patient compliance issues and provide compelling medical and economic benefits. Harrow Health Inc. operates in single segment, other revenues, and net product sales. As of September 21, 2023, the company's market capitalization stands at $498.110 million, with a current stock price of $14.185.

Analysis of Harrow Health Inc.'s Financial Performance

Despite a PE Percentage of 0.00, indicating a loss, Harrow Health Inc. is considered fairly valued according to the GF Valuation. The GF Value of the stock is $14.51, with a Price to GF Value ratio of 0.98. Since its IPO in 2007, the stock has gained 63.99%, although it has experienced a year-to-date decline of 4.03%.

Evaluation of Harrow Health Inc.'s Stock Performance

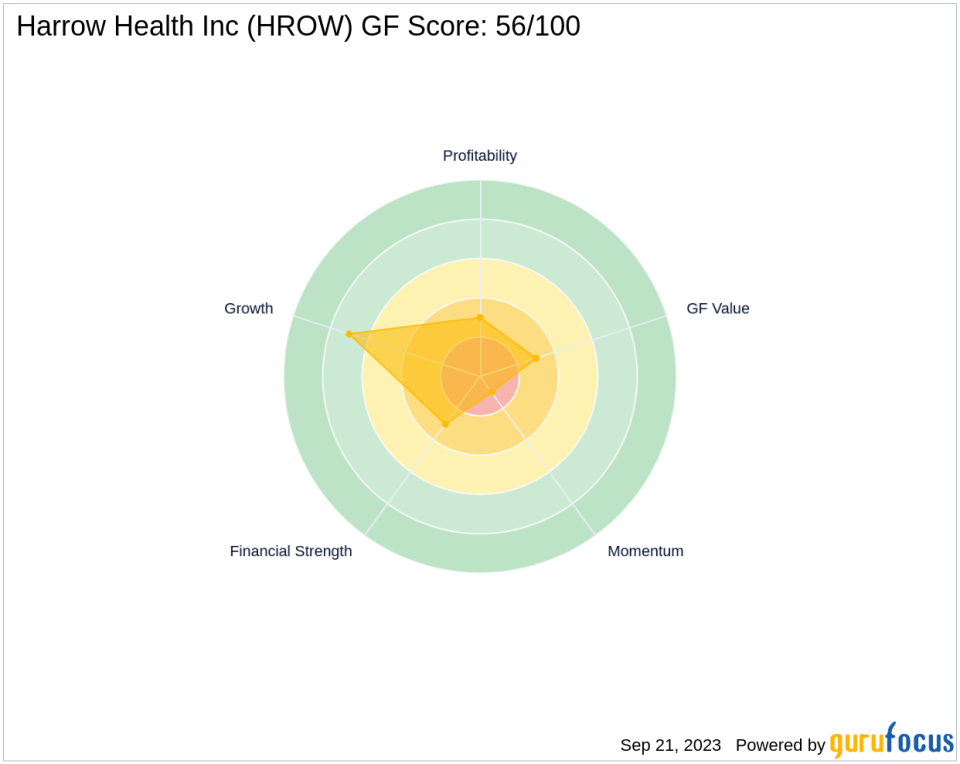

Harrow Health Inc. has a GF Score of 56/100, indicating poor future performance potential. The company's Financial Strength is ranked 3/10, with a Profitability Rank of 3/10 and a Growth Rank of 7/10. The GF Value Rank and Momentum Rank are 3/10 and 1/10, respectively. The company's Piotroski F-Score is 3, and its Altman Z score is 1.40, indicating financial distress.

Comparison with the Largest Guru Holder of Harrow Health Inc.

Private Capital (Trades, Portfolio) Management is currently the largest guru holder of Harrow Health Inc. However, the exact share percentage held by the firm is not available for comparison with Opaleye Management Inc. (Trades, Portfolio)'s holdings.

Conclusion

In conclusion, Opaleye Management Inc. (Trades, Portfolio)'s recent transaction has slightly reduced its exposure to Harrow Health Inc. Despite the company's financial distress and poor future performance potential, it remains a significant part of the firm's portfolio. This transaction provides valuable insights for value investors, particularly those interested in the pharmaceutical industry.

This article first appeared on GuruFocus.