Open Lending Corp (LPRO) Faces Headwinds: Q4 and Full Year 2023 Earnings Analysis

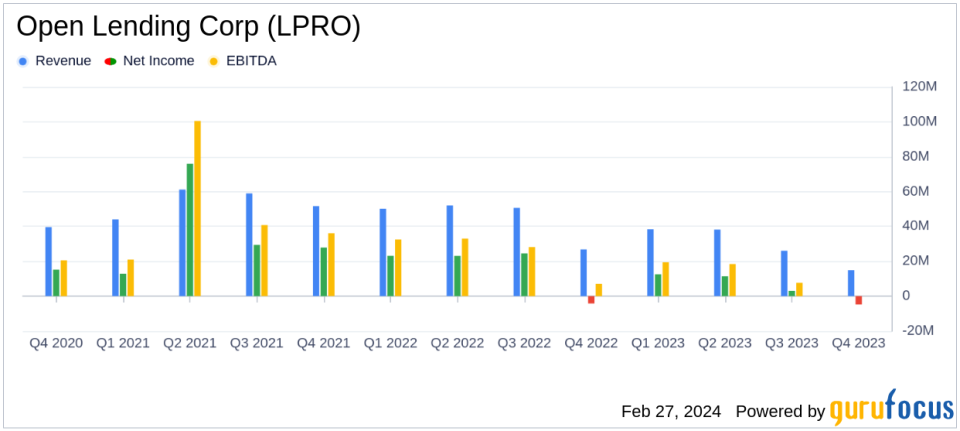

Total Revenue: Q4 revenue declined to $14.9 million from $26.8 million YOY; full-year revenue fell to $117.5 million from $179.6 million.

Net Income: Q4 net loss widened to $4.8 million from $4.2 million YOY; full-year net income decreased to $22.1 million from $66.6 million.

Adjusted EBITDA: Q4 Adjusted EBITDA turned negative at $(2.1) million from $8.5 million YOY; full-year Adjusted EBITDA dropped to $50.2 million from $105.7 million.

Certified Loans: Q4 certified loans decreased to 26,263 from 34,550 YOY; full-year certified loans declined to 122,984 from 165,211.

Cash Position: Year-end cash and cash equivalents stood at $240.2 million, up from $204.4 million at the end of the previous year.

On February 27, 2024, Open Lending Corp (NASDAQ:LPRO) released its 8-K filing, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a provider of automated lending services to financial institutions, faced a challenging year with a significant reduction in certified loans and profit share revenues. Despite these challenges, CEO Keith Jezek remains optimistic about the company's positioning for future growth, particularly in the bank segment.

Company Overview

Open Lending Corp specializes in loan analytics, risk-based pricing, risk modeling, and automated decision technology. Its flagship Lenders Protection Program ("LPP") allows automotive lenders to issue loans with a degree of insurance against defaults, contributing to the financial ecosystem by making transportation more affordable.

Financial Performance and Challenges

The company's performance in 2023 was marked by a decrease in certified loans and total revenue, attributed to a reduction in estimated future profit share revenues. This decline reflects the broader economic challenges and the impact on consumer behavior, particularly in the automotive loan sector. The reduction in profit share estimates indicates potential issues with loan performance from previous periods, which could signal a need for strategic adjustments.

Financial Achievements and Industry Importance

Despite the downturn, Open Lending Corp managed to maintain a strong cash position, ending the year with an increase in cash and cash equivalents. This liquidity is crucial for the company's operations and potential investments in product development and market expansion. In the credit services industry, where cash flow is king, Open Lending's ability to preserve capital amidst adversity is a testament to its financial resilience.

Key Financial Metrics

Open Lending Corp's financial health can be further assessed through key metrics:

"We exceeded the high-end of our guidance range for certified loans and revenues in the fourth quarter, excluding a negative change in estimate associated with our profit share," said Keith Jezek, CEO of Open Lending.

While the company's net income and Adjusted EBITDA have decreased, the focus on optimizing core business and expanding into new segments could pave the way for recovery. The importance of metrics such as Adjusted EBITDA lies in their ability to provide insights into the company's operational efficiency and profitability, excluding non-cash and one-time expenses.

Analysis of Company's Performance

The year-over-year decline in key financial metrics suggests that Open Lending Corp is navigating a difficult period. However, the company's strategic focus on product improvement and market strategy refinement, coupled with a solid cash reserve, positions it to potentially rebound as market conditions improve. The company's guidance for the first quarter of 2024 indicates a cautious but potentially improving outlook.

For a more detailed understanding of Open Lending Corp's financials, interested parties are encouraged to review the full 8-K filing. Additionally, the company will be hosting a conference call to discuss these results and provide further insights into its operations and strategy.

Value investors and those interested in the credit services industry may find Open Lending Corp's journey through these challenging times to be a case study in resilience and strategic adaptation. As the company continues to navigate the evolving financial landscape, its progress will be closely monitored by stakeholders and industry observers alike.

Explore the complete 8-K earnings release (here) from Open Lending Corp for further details.

This article first appeared on GuruFocus.