Opendoor (NASDAQ:OPEN) Beats Q4 Sales Targets But

Technology real estate company Opendoor (NASDAQ:OPEN) announced better-than-expected results in Q4 FY2023, with revenue down 69.5% year on year to $870 million. On the other hand, next quarter's revenue guidance of $1.08 million was less impressive, coming in 99.9% below analysts' estimates. It made a GAAP loss of $0.14 per share, improving from its loss of $0.74 per share in the same quarter last year.

Is now the time to buy Opendoor? Find out by accessing our full research report, it's free.

Opendoor (OPEN) Q4 FY2023 Highlights:

Revenue: $870 million vs analyst estimates of $827.6 million (5.1% beat)

EPS: -$0.14 vs analyst estimates of -$0.22 (36.5% beat)

Revenue Guidance for Q1 2024 is $1.08 million at the midpoint, below analyst estimates of $1.17 billion (adjusted EBITDA guidance also missed)

Free Cash Flow was -$551 million compared to -$227 million in the previous quarter

Gross Margin (GAAP): 8.3%, up from 2.5% in the same quarter last year

Homes Sold: 2,364 (2.9% beat vs. expectations of 2,297)

Market Capitalization: $2.30 billion

“The past year was about focus, execution, and progress. Our fourth quarter results exceeded the high end of our prior guidance ranges, demonstrating our ability to deliver, despite ongoing uncertainty in the housing market. We increased our home acquisitions sequentially throughout the year, built a new book of inventory that is performing well, and drove structural efficiencies across our platform that we expect will benefit the Company for years to come. Most importantly, we've remained steadfast in our vision of helping people move with simplicity and certainty,” said Carrie Wheeler, CEO of Opendoor.

Founded by real estate guru Eric Wu, Opendoor (NASDAQ:OPEN) offers a technology-driven, convenient, and streamlined process to buy and sell homes.

Real Estate Services

Technology has therefore been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

Sales Growth

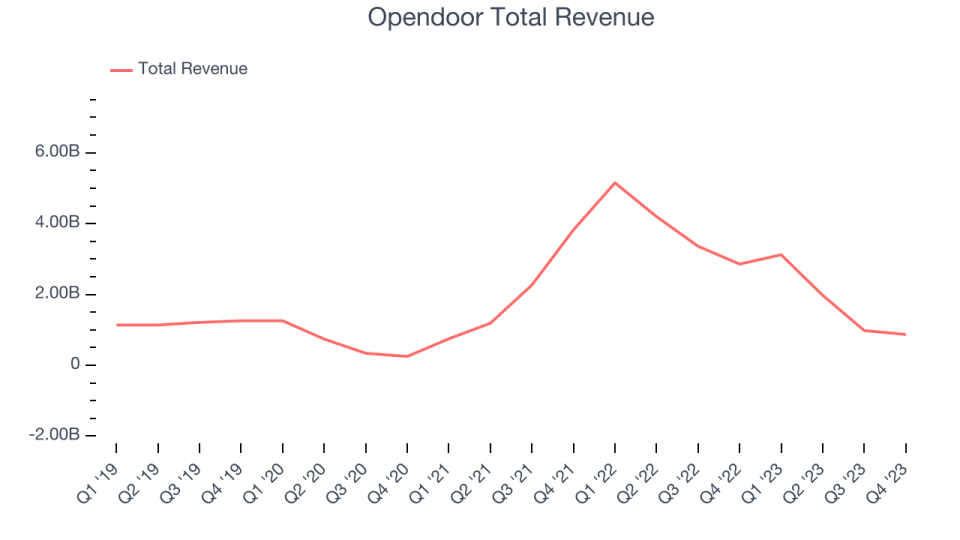

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one may grow for years. Opendoor's annualized revenue growth rate of 30.5% over the last five years was incredible for a consumer discretionary business.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Opendoor's recent history shows a reversal from its five-year trend, as its revenue has shown annualized declines of 6.9% over the last two years.

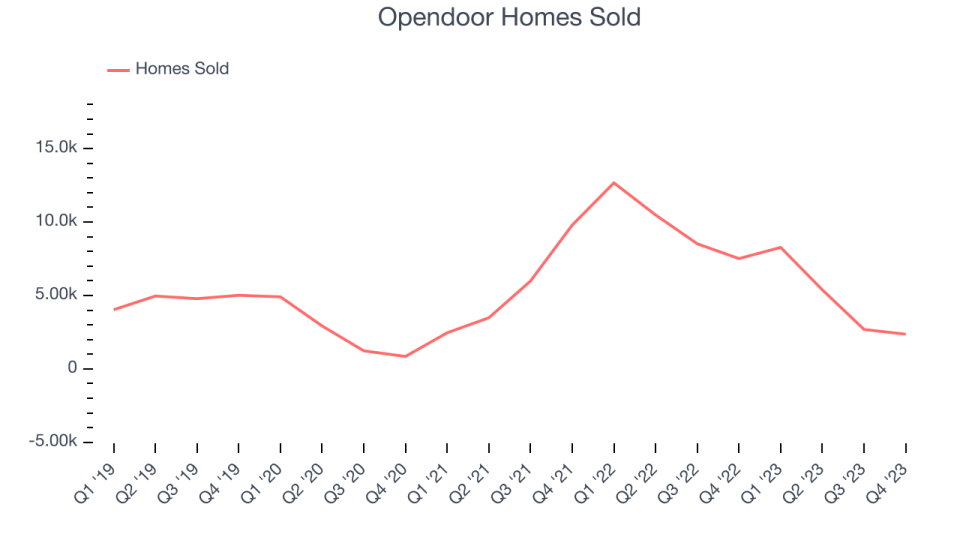

We can dig even further into the company's revenue dynamics by analyzing its number of homes sold, which reached 2,364 in the latest quarter. Over the last two years, Opendoor's homes sold averaged 51.8% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company's average selling price has fallen.

This quarter, Opendoor's revenue fell 69.5% year on year to $870 million but beat Wall Street's estimates by 5.1%. The company is guiding for a 100% year-on-year revenue decline next quarter to $1.08 million, a deceleration from the 39.4% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects revenue to decline 15.1% over the next 12 months.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

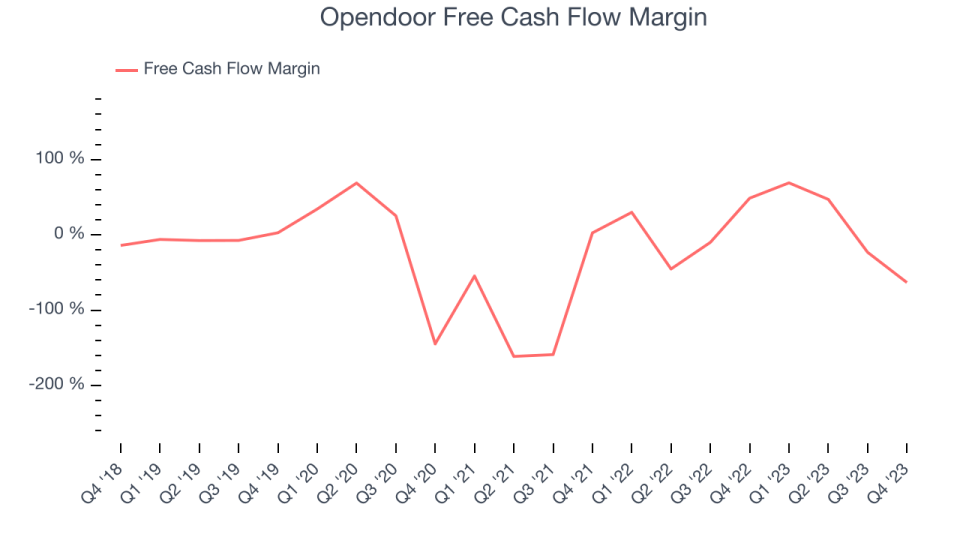

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Opendoor has shown decent cash profitability, giving it some reinvestment opportunities. The company's free cash flow margin has averaged 13.3%, slightly better than the broader consumer discretionary sector.

Opendoor burned through $551 million of cash in Q4, equivalent to a negative 63.3% margin. This caught our eye as the company shifted from cash flow positive in the same quarter last year to cash flow negative this quarter.

Key Takeaways from Opendoor's Q4 Results

We liked how Homes Sold, a key volume metric, outperformed analysts' expectations and led to beats on the revenue and EPS lines. However, Q1 2024 guidance was bad. Both revenue and adjusted EBITDA were guided below expectations, and this outlook is weighing on shares. The stock is down 3% after reporting, trading at $3.25 per share.

So should you invest in Opendoor right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.