Opendoor Technologies Inc (OPEN) Reports Mixed Results Amid Real Estate Challenges

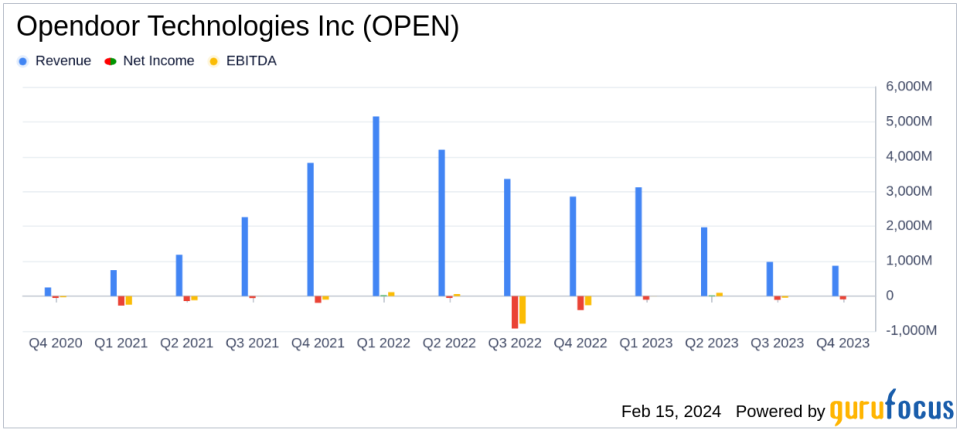

Revenue: $6.9 billion in FY 2023, a 55% decrease from FY 2022.

Net Loss: Reduced to $(275) million in FY 2023 from $(1.4) billion in FY 2022.

Gross Margin: Improved to 7.0% in FY 2023 from 4.3% in FY 2022.

Homes Sold: 18,708 homes in FY 2023, a 52% decrease from FY 2022.

Adjusted EBITDA: $(627) million in FY 2023, compared to $(168) million in FY 2022.

Q4 Performance: Revenue of $870 million, down 70% from Q4 2022.

2024 Outlook: Q1 revenue guidance set between $1.05 billion and $1.1 billion.

Opendoor Technologies Inc (NASDAQ:OPEN) released its 8-K filing on February 15, 2024, detailing its financial results for the fourth quarter and full year ended December 31, 2023. As a leading digital platform for residential real estate transactions, Opendoor enables customers to buy and sell houses online, generating revenue primarily through home sales and ancillary real estate services.

The company's full-year revenue saw a significant decline to $6.9 billion, a 55% decrease compared to the previous year. Despite this, Opendoor managed to improve its gross margin to 7.0% in 2023 from 4.3% in 2022, indicating an enhanced profitability per transaction. The net loss for the year was substantially reduced to $(275) million from $(1.4) billion in 2022, reflecting tighter cost controls and operational efficiencies.

However, the total number of homes sold in 2023 dropped to 18,708, a 52% decrease from 2022, highlighting the challenges faced in the housing market. The company's adjusted EBITDA worsened to $(627) million, compared to $(168) million in the prior year, and the adjusted net loss increased to $(778) million from $(574) million in 2022.

For the fourth quarter, Opendoor reported revenue of $870 million, a 70% decrease from the same quarter in the previous year. The gross profit for the quarter was $72 million with a gross margin of 8.3%, showing an improvement from the 2.5% gross margin in Q4 2022. The net loss for the quarter was $(91) million, an improvement from a net loss of $(399) million in the same period last year.

The company ended the quarter with an inventory balance of $1.8 billion, representing 5,326 homes, a 60% decrease from Q4 2022 but a 35% increase from Q3 2023. Opendoor purchased 3,683 homes in the quarter, up 7% from Q4 2022, and ended with 2,114 homes under contract for purchase, indicating potential for revenue growth in the upcoming quarters.

Opendoor's 2024 financial outlook anticipates a rebound with Q1 revenue guidance set between $1.05 billion and $1.1 billion, and a contribution profit guidance of $40 million to $50 million. However, the company expects an adjusted EBITDA loss between $(80) million and $(70) million for the first quarter.

CEO Carrie Wheeler commented on the results, stating, "Our fourth quarter results exceeded the high end of our prior guidance ranges, demonstrating our ability to deliver, despite ongoing uncertainty in the housing market." She also highlighted the company's focus on structural efficiencies and investment in products to catalyze change in the real estate transaction process.

"The past year was about focus, execution, and progress... We increased our home acquisitions sequentially throughout the year, built a new book of inventory that is performing well, and drove structural efficiencies across our platform that we expect will benefit the Company for years to come," said Wheeler.

Despite the mixed financial results, Opendoor's improved gross margin and reduced net loss year-over-year demonstrate the company's resilience and adaptability in a challenging real estate market. As the company continues to streamline operations and expand its digital platform, investors and stakeholders will be watching closely to see if these strategic moves can translate into sustained growth and profitability.

Explore the complete 8-K earnings release (here) from Opendoor Technologies Inc for further details.

This article first appeared on GuruFocus.