Is Opera (OPRA) a Hidden Bargain? A Comprehensive Look at its Valuation

Opera Ltd (NASDAQ:OPRA), a global internet brand, witnessed a daily gain of 2.78% and reported an Earnings Per Share (EPS) (EPS) of 0.62. However, over the past three months, the stock has declined by 16.42%. This raises a critical question: Is Opera modestly undervalued? This article delves into a detailed valuation analysis of Opera to answer this question.

Company Overview

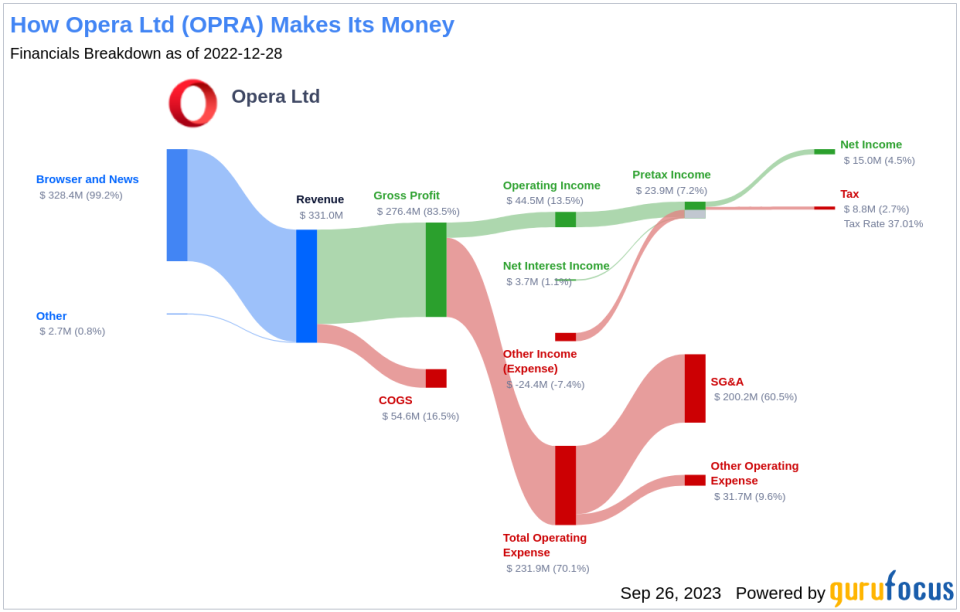

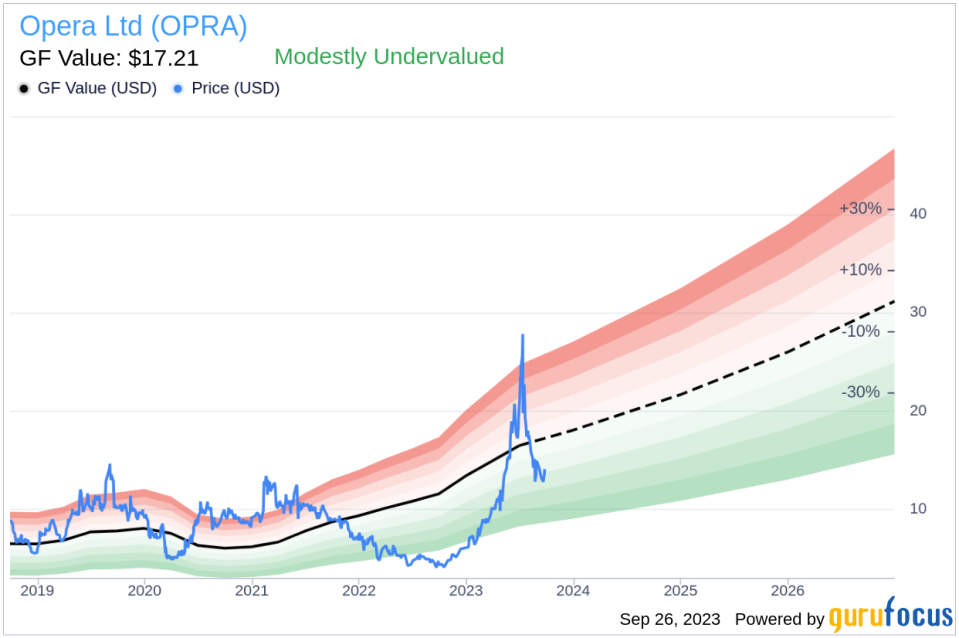

Opera Ltd offers a range of products and services that include PC and mobile browsers, Opera Gaming portals, development tools, Opera News content recommendation products, and various e-commerce products and services. It has a large and growing user base worldwide. Its stock is currently trading at $14.07 per share, while the GF Value suggests a fair value of $17.21 per share. This suggests that Opera might be modestly undervalued.

Understanding the GF Value

The GF Value is a proprietary measure that estimates a stock's intrinsic value. It is calculated based on historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. A stock's price is likely to fluctuate around the GF Value Line. If the price is significantly above the GF Value Line, the stock is overvalued, and its future return is likely to be poor. Conversely, if the price is significantly below the GF Value Line, the stock's future return will likely be higher.

According to GuruFocus Value calculation, Opera appears to be modestly undervalued. At its current price of $14.07 per share and the market cap of $1.30 billion, Opera stock seems to offer a higher long-term return than its business growth.

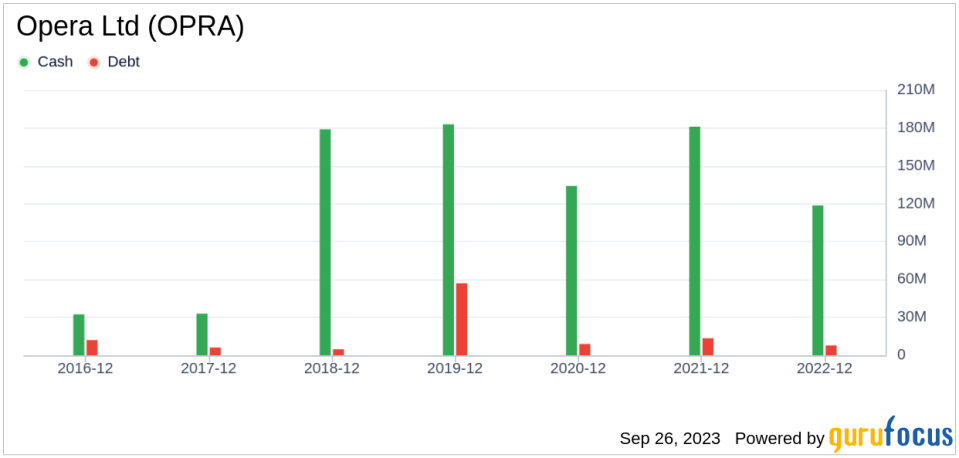

Opera's Financial Strength

Investing in companies with poor financial strength carries a higher risk of permanent loss. Opera's cash-to-debt ratio of 12.18 is better than 56.51% of 568 companies in the Interactive Media industry. This indicates strong financial strength.

Profitability and Growth

Opera has been profitable for 5 out of the past 10 years. Its operating margin of 15.77% ranks better than 75.68% of 584 companies in the Interactive Media industry, indicating fair profitability.

Growth is a crucial factor in a company's valuation. Opera's 3-year average revenue growth rate is better than 74.9% of 514 companies in the Interactive Media industry. However, its 3-year average EBITDA growth rate is -14.3%, which ranks worse than 73.32% of 386 companies in the same industry.

ROIC vs WACC

Opera's ROIC of 6.28 is less than its WACC of 8.43, suggesting that the company may not be effectively creating value for shareholders.

Conclusion

Despite some challenges, Opera's stock appears to be modestly undervalued. The company shows strong financial condition and fair profitability. However, its growth ranks below the industry average. To learn more about Opera stock, check out its 30-Year Financials here.

For high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.