Opera (OPRA): A Modestly Undervalued Player in the Interactive Media Industry

Opera Ltd (NASDAQ:OPRA) experienced a daily loss of -14.78%, and a 3-month loss of -2.78%. Despite these setbacks, the company reported an Earnings Per Share (EPS) of 0.42. The question arises: is the stock modestly undervalued? This article aims to provide a comprehensive valuation analysis of Opera, offering insights into its financial health, growth prospects, and intrinsic value.

Company Overview

Opera Ltd is a global internet brand with a large, engaged and growing base. The company offers a range of products and services that include PC and mobile browsers, Opera Gaming portals, development tools, Opera News content recommendation products, and various e-commerce products and services. Opera's features focus on privacy, security, and efficiency with tabbed browsing, data savings, PC/mobile sync, ad blocking, and a built-in VPN. The company's browser products include Opera Mini, Opera Browser for Android and iOS, Opera for Computers, Opera GX, and Opera GX Mobile, tailored for gamers. The latest addition to its browser portfolio is a Web3-centric browser for PC and mobile, designed for crypto enthusiasts.

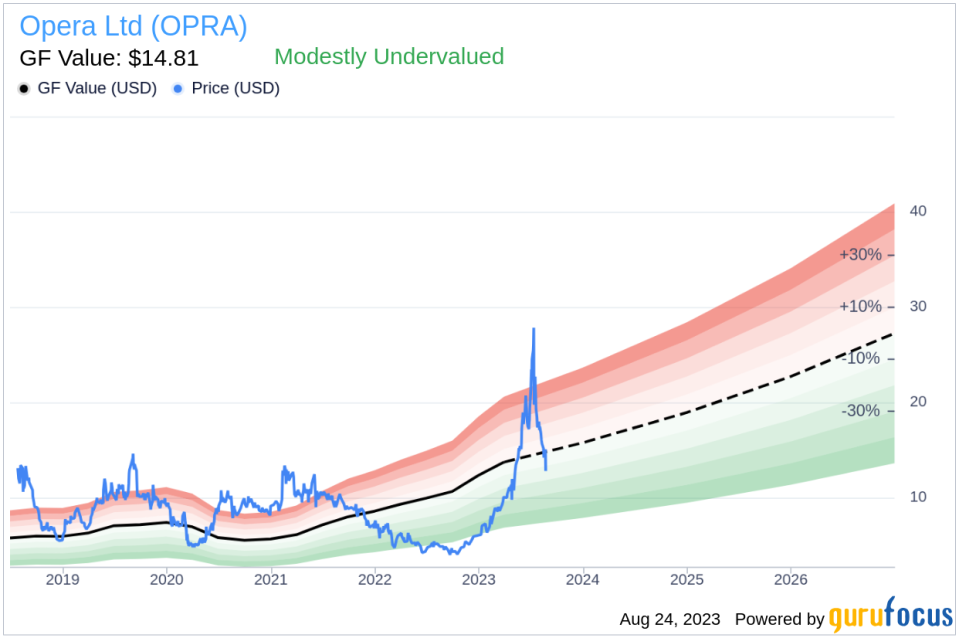

Opera's stock price stands at $12.86, with a market cap of $1.20 billion. The company's GF Value, an estimation of fair value, is $14.81, indicating that the stock may be modestly undervalued. The following analysis delves deeper into Opera's value, merging financial assessment with key company details.

Understanding the GF Value

The GF Value is a unique measure of a stock's intrinsic value, calculated based on historical multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line on our summary page provides an overview of the fair value at which the stock should ideally trade. If the stock price is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. On the other hand, if it is significantly below the GF Value Line, its future return will likely be higher.

Opera (NASDAQ:OPRA) appears to be modestly undervalued based on GuruFocus' valuation method. The stock's fair value is estimated considering historical multiples, an internal adjustment based on the company's past business growth, and analyst estimates of future business performance. At its current price of $12.86 per share, Opera has a market cap of $1.20 billion and appears to be modestly undervalued. Given its relative undervaluation, the long-term return of its stock is likely to be higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength

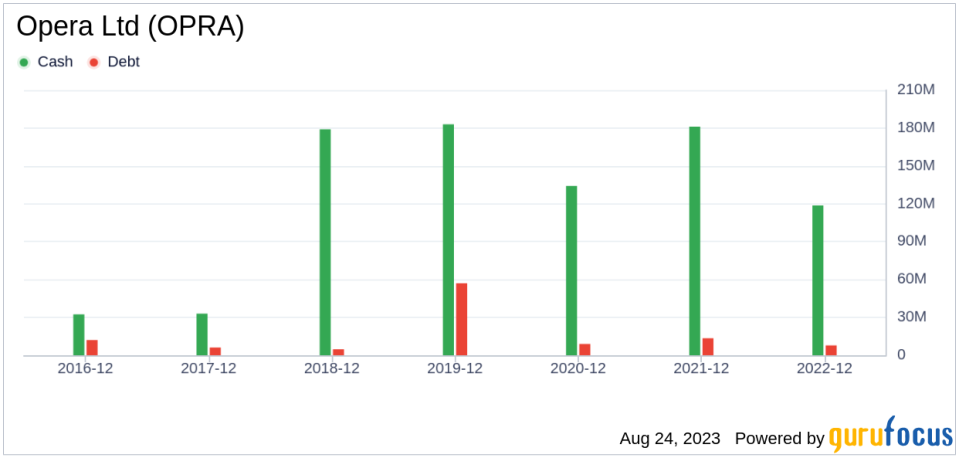

Investing in companies with low financial strength could result in permanent capital loss. Therefore, it's crucial to review a company's financial strength before deciding to buy shares. Looking at the cash-to-debt ratio and interest coverage can provide a good initial perspective on the company's financial strength. Opera has a cash-to-debt ratio of 12.2, which ranks better than 57.64% of 550 companies in the Interactive Media industry. Based on this, GuruFocus ranks Opera's financial strength as 8 out of 10, suggesting a strong balance sheet.

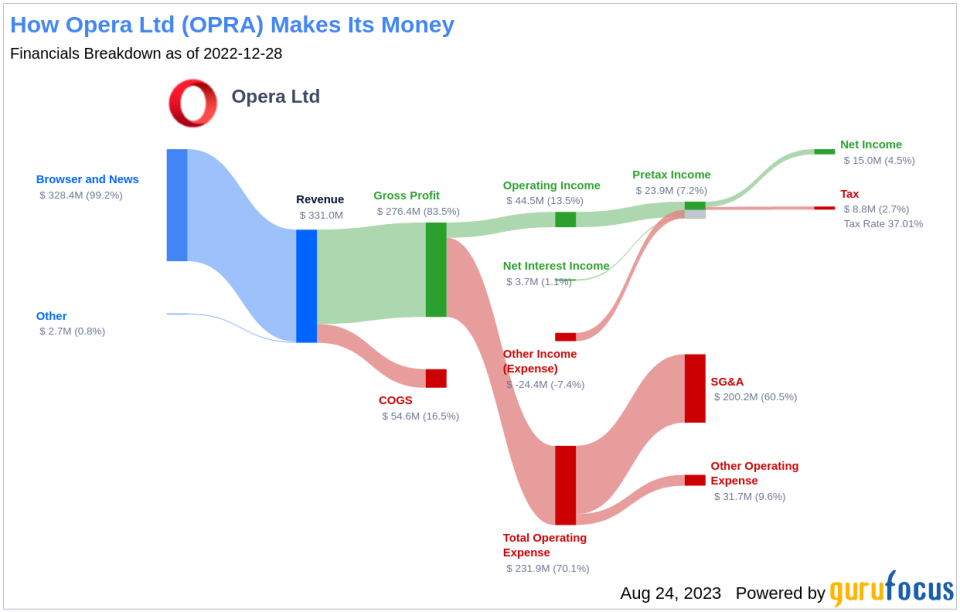

Profitability and Growth

Investing in profitable companies carries less risk, especially in companies that have demonstrated consistent profitability over the long term. Typically, a company with high profit margins offers better performance potential than a company with low profit margins. Opera has been profitable 5 years over the past 10 years. During the past 12 months, the company had revenues of $346.50 million and Earnings Per Share (EPS) of $0.42. Its operating margin of 16.27% is better than 73.04% of 586 companies in the Interactive Media industry. Overall, GuruFocus ranks Opera's profitability as fair.

Growth is probably the most important factor in the valuation of a company. The faster a company is growing, the more likely it is to be creating value for shareholders, especially if the growth is profitable. The 3-year average annual revenue growth rate of Opera is 24.7%, which ranks better than 75.1% of 514 companies in the Interactive Media industry. However, the 3-year average EBITDA growth rate is -14.3%, which ranks worse than 75.64% of 390 companies in the Interactive Media industry.

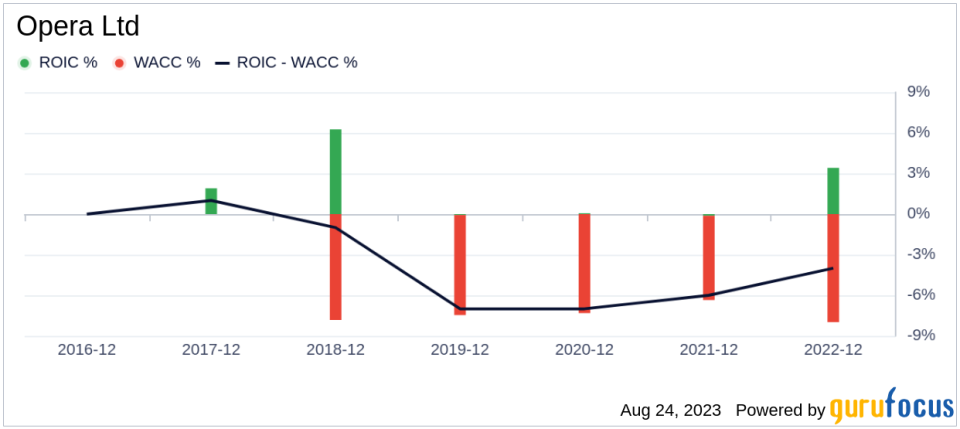

Another method of determining the profitability of a company is to compare its return on invested capital to the weighted average cost of capital. Return on invested capital (ROIC) measures how well a company generates cash flow relative to the capital it has invested in its business. The weighted average cost of capital (WACC) is the rate that a company is expected to pay on average to all its security holders to finance its assets. When the ROIC is higher than the WACC, it implies the company is creating value for shareholders. For the past 12 months, Opera's return on invested capital is 5.39, and its cost of capital is 7.38.

Conclusion

In summary, Opera (NASDAQ:OPRA) appears to be modestly undervalued. The company's financial condition is strong, and its profitability is fair. However, its growth ranks worse than 75.64% of 390 companies in the Interactive Media industry. To learn more about Opera stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.