OPKO Health (OPK) Ties Up for Oral Peptide Tablet Formulations

OPKO Health, Inc.’s OPK subsidiary, OPKO Biologics, Inc., recently entered into a Research Collaboration Agreement with Entera Bio Ltd. ENTX. Under the terms of the agreement, OPKO Health will supply its proprietary long-acting Glucagon-Like Peptide-2 (GLP-2) peptide and certain Oxyntomodulin (OXM) analogs for the development of oral tablet formulations using Entera’s proprietary oral delivery technology.

Per the agreement terms, both companies will be responsible for specific phases of development of the two oral peptides to the point of demonstrated in vivo feasibility. However, further details of the agreement were not available.

The latest partnership is expected to significantly strengthen OPKO Health’s business on a global scale.

Rationale Behind the Collaboration

Administering peptides orally is challenging due to their rapid degradation in the gastrointestinal tract and negligible permeability. However, treatment with GLP-2 analogs has been shown to improve the absorption of nutrients in patients with short bowel syndrome (SBS) and reduce parenteral support requirements. In SBS patients, oral drug delivery is more challenging because the site of absorption, the intestine, is short and less functional.

OPKO Health has developed several proprietary, modified OXM analogs as potential candidates for treating obesity, including an injectable pegylated peptide. This demonstrated significant reductions in weight loss and decreased plasma triglyceride levels in a 420-patient phase 2B study.

OPKO Health’s management believes that the collaboration will likely fit with its strategy to expand its pipeline to develop orally administered tablet presentations of long-acting peptides. Management also feels that working with Entera and its unique oral delivery platform will complement its previous experience in the development of NGENLA and enhance the diversity and strength of its development portfolio.

Entera’s management feels that the partnership with OPKO Health is significant as it enables the company to expand its oral delivery technology across additional high-value peptides.

Industry Prospects

Per a report by Allied Market Research, the global peptide therapeutics market was valued at $33.3 billion in 2021 and is anticipated to reach $64.3 billion by 2031 at a CAGR of 6.8%. Factors like the increase in number of elderly people, an increase in the prevalence of chronic diseases and growing patient awareness about peptide therapeutics advancements are likely to drive the market.

Given the market potential, the latest association is expected to significantly strengthen OPKO Health’s business.

Notable Developments

Last month, OPKO Health reported its second-quarter 2023 results, wherein it registered robust results from the Pharmaceuticals segment, with solid sales of RAYALDEE. Management also confirmed that NGENLA (somatrogon) had been approved in 44 markets, including the United States, Japan, EU Member States, Canada and Australia. Also, its continued sales by Pfizer in more than 18 countries, with expectations to launch in all priority international markets by the year-end, looks promising.

In June, OPKO Health, along with Pfizer, confirmed that the FDA had approved NGENLA (somatrogon-ghla), a once-weekly human growth hormone analog indicated for the treatment of pediatric patients aged three years and older having growth failure due to inadequate secretion of endogenous growth hormone.

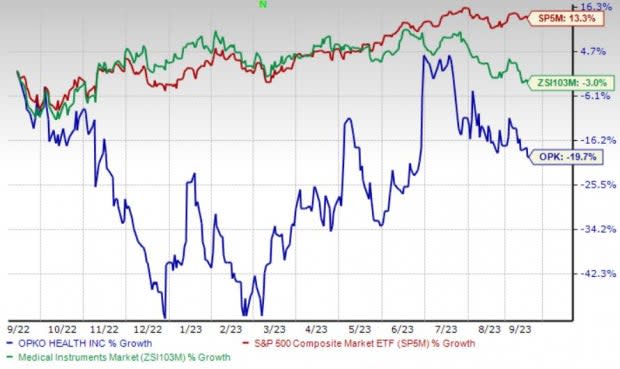

Price Performance

Shares of the company have lost 19.6% in the past year compared with the industry’s 2.9% decline. The S&P 500 has witnessed 13.3% growth in the said time frame.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, OPKO Health carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks in the broader medical space are DaVita Inc. DVA and HealthEquity, Inc. HQY.

DaVita, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 12.7%. DVA’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average surprise of 21.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DaVita has gained 6.9% against the industry’s 8.4% decline over the past year.

HealthEquity, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 23.5%. HQY’s earnings surpassed estimates in all the trailing four quarters, with an average of 13%.

HealthEquity has lost 0.9% compared with the industry’s 11.5% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

OPKO Health, Inc. (OPK) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Entera Bio Ltd. (ENTX) : Free Stock Analysis Report