Oportun Financial Corp (OPRT) Posts Mixed 2023 Results with Revenue Growth Amidst Net Losses

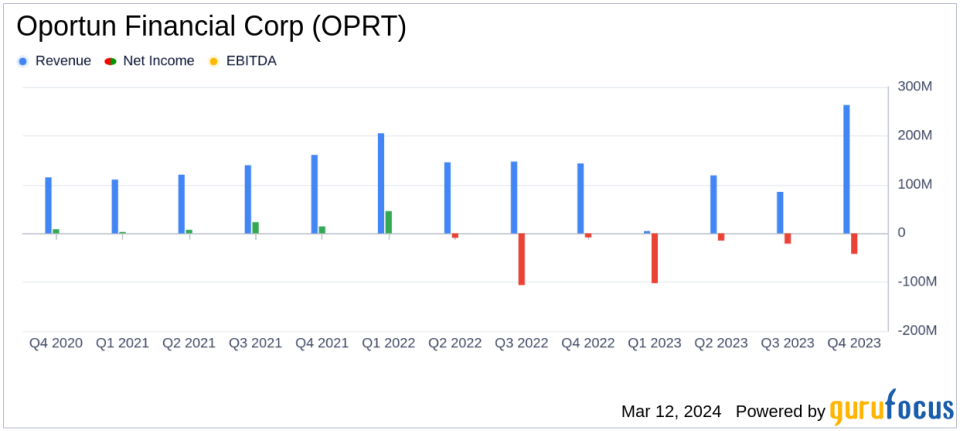

Revenue: OPRT reported a total revenue of $1.1 billion for FY23, marking an 11% increase from the previous year.

Net Income (Loss): The company experienced a net loss of $180 million for FY23, compared to a net loss of $78 million in FY22.

Adjusted EBITDA: Adjusted EBITDA for FY23 was $1.7 million, showing an improvement from a negative $10 million in FY22.

Operating Expenses: Quarterly operating expenses were reduced by 15% year-over-year, with an additional $30 million in operating expense reductions announced for FY24.

Debt Metrics: OPRT's debt-to-equity ratio increased to 7.2x as of December 31, 2023, up from 5.3x the previous year.

Portfolio Performance: The company's portfolio yield increased, while the annualized net charge-off rate and 30+ day delinquency rate showed mixed results.

Guidance: OPRT's guidance for FY24 reflects expectations for significantly improved profitability on an adjusted basis.

On March 12, 2024, Oportun Financial Corp (NASDAQ:OPRT) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full year ended December 31, 2023. The company, which specializes in providing financial services to underserved consumers, reported a total revenue of $1.1 billion for the full year, an 11% increase from the previous year. Despite this growth, OPRT faced a net loss of $180 million for the year, a significant decline from a net loss of $78 million in the prior year.

Company Overview

Oportun Financial Corp is a mission-driven fintech company that offers a range of financial products, including personal and auto loans, aimed at consumers who may lack a substantial credit history. With a focus on responsible lending, OPRT has provided over $17.8 billion in credit since its inception, helping members save on interest and fees.

Financial Performance and Challenges

While OPRT's revenue growth is a positive indicator, the company's net loss highlights ongoing challenges. The net loss widened significantly in 2023, primarily due to non-cash fair value mark-to-market adjustments, increased charge-offs, and higher interest expenses. These challenges underscore the importance of OPRT's credit quality and cost management strategies, which are crucial for its long-term financial stability.

Financial Achievements and Industry Significance

The company's ability to grow its revenue amidst a challenging economic environment is noteworthy, especially within the credit services industry where competition is intense. OPRT's focus on operating efficiencies, as evidenced by the reduction in quarterly operating expenses and the completion of a $200 million asset-backed securitization deal at favorable pricing, demonstrates its commitment to improving its financial position and market competitiveness.

Key Financial Metrics

OPRT's income statement and balance sheet reflect a company in transition, with efforts to optimize its cost structure and improve its lending practices. Important metrics such as the portfolio yield, which increased to 32.7% for the fourth quarter, and the managed principal balance, which decreased by 7% year-over-year to $3.2 billion, are indicative of the company's strategic focus on quality over quantity in its loan originations. Additionally, the adjusted operating efficiency improved, reflecting the company's revenue growth outpacing operating expenses.

Management Commentary

"We executed well during the fourth quarter and met each of our guidance metrics," said Raul Vazquez, CEO of Oportun. "Our top-line remained resilient and we completed full year 2023 with a record $1.1 billion of total revenue, for 11% growth year-over-year, while continuing to focus on the quality rather than the quantity of our originations under a tightened credit posture."

Analysis of OPRT's Performance

The mixed financial results of OPRT reflect a company that is successfully growing its revenue but still grappling with the costs associated with its lending operations and market conditions. The company's strategic decisions to tighten credit and reduce operating expenses are steps towards addressing these challenges and improving profitability. The guidance for 2024, which anticipates markedly improved profitability, suggests that management is confident in the effectiveness of these strategies.

For a more detailed analysis of Oportun Financial Corp's financial results and future outlook, investors and interested parties are encouraged to review the full earnings presentation and non-GAAP financial measure reconciliations available on the Investor Relations page of Oportun's website.

Explore the complete 8-K earnings release (here) from Oportun Financial Corp for further details.

This article first appeared on GuruFocus.