Oppenheimer Holdings Inc (OPY) Reports Mixed Financial Results Amid Regulatory Settlements

Net Income: Q4 net income decreased to $11.1 million from $22.4 million in Q4 2022.

Adjusted Net Income: Adjusted for regulatory settlements, Q4 adjusted net income was $16.1 million.

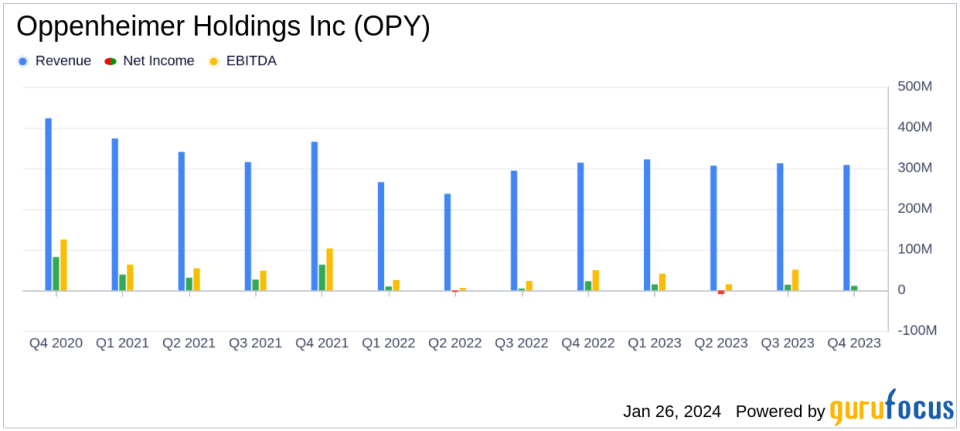

Revenue: Full year revenue increased by 12.4% to $1.2 billion, despite a 1.7% decrease in Q4.

Earnings Per Share: Basic EPS for Q4 dropped to $1.07 from $2.04 year-over-year.

Book Value: Book value per share increased to $76.72 from $72.41 at the end of 2022.

Share Repurchase: OPY repurchased 900,518 shares at an average price of $39.00 per share in 2023.

Dividend: A quarterly dividend of $0.15 per share announced for Q4 2023.

On January 26, 2024, Oppenheimer Holdings Inc (NYSE:OPY) released its 8-K filing, detailing its financial performance for the fourth quarter and full fiscal year of 2023. The company, which operates in the securities industry and offers a range of services including retail securities brokerage, investment banking, and asset management, faced a challenging quarter marked by regulatory settlements but managed to increase its full-year revenue.

Financial Performance Overview

OPY's fourth quarter saw a decline in net income to $11.1 million, or $1.07 basic earnings per share (EPS), compared to $22.4 million, or $2.04 EPS, in the same period of the previous year. This decrease was partly due to a $5.0 million expense related to a regulatory settlement. When adjusted for this expense, the adjusted net income for the quarter was $16.1 million, or $1.56 EPS. The company's revenue for the quarter also saw a slight decrease of 1.7% to $308.3 million.

For the full year, OPY reported a net income of $30.2 million, or $2.81 EPS, compared to $32.4 million, or $2.77 EPS, for the previous year. The adjusted net income for the year, which excludes a $13.0 million regulatory settlement expense, was $43.2 million, or $4.02 EPS. The company's annual revenue saw a significant increase of 12.4%, reaching $1.2 billion.

Segment Performance and Challenges

The Private Client segment reported a revenue increase for both the quarter and the full year, with assets under administration rising to $118.2 billion. The Asset Management segment, however, experienced a decrease in quarterly revenue and pre-tax income, although assets under management increased to $43.9 billion. The Capital Markets segment faced a decrease in revenue and a pre-tax loss for the quarter, reflecting industry-wide challenges in investment banking and capital raising activities.

OPY's Chairman and CEO, Albert G. Lowenthal, commented on the year's performance, highlighting the impact of legal and regulatory costs, which totaled approximately $70 million for the year. He noted that without these costs, the company would have produced a decent return despite a slowdown in investment banking activity. Lowenthal remains optimistic about the future, citing strategic personnel additions and the company's strong balance sheet.

The Company generated profitable results for the full year 2023 despite mixed macroeconomic conditions and significantly higher legal and regulatory costs. The costs of a particular legal matter (which we now believe is behind us from a financial point of view) and, the impact of a non-recurring accrual related to an SEC industry-wide focus on off-channel communications was approximately $70 million for the year. But for these, the Company would have produced a decent return despite the ongoing drought in Investment Banking activity.

Financial Metrics and Importance

Key financial metrics such as the book value per share, which reached record levels at $76.72, reflect the company's underlying asset value and financial health. The share repurchase program, which saw the company buy back shares at an average price of $39.00, demonstrates confidence in the company's value and a commitment to shareholder returns. The effective tax rate of 35.3% was influenced by the non-deductible regulatory settlement, while the adjusted effective tax rate was 27.6%.

OPY's performance in a year marked by regulatory challenges and mixed economic conditions showcases the resilience of its diversified business model. The increase in full-year revenue, despite a challenging fourth quarter, positions the company for potential growth as market conditions improve.

Investors and potential GuruFocus.com members interested in the capital markets industry may find Oppenheimer Holdings Inc's ability to navigate regulatory hurdles and maintain revenue growth an important factor to consider when evaluating the company's stock for their portfolios.

For a detailed breakdown of OPY's financial results and management's commentary, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Oppenheimer Holdings Inc for further details.

This article first appeared on GuruFocus.