Oppenheimer Says These 2 Beaten-Down Stocks Could Double Your Money — Here’s Why They Could Rebound

Over the summer months the bull market that has defined 2023 so far has been taking a break. The question is, can it regain momentum and push ahead again? Or as Oppenheimer’s Chief Investment Strategist John Stoltzfus puts it, is it just “the pause that refreshes?”

While Stoltzfus notes the potential for “some uptick in volatility” in the weeks and months ahead, his overall view of what’s to come next will be encouraging to investors.

“We remain positive on the US economy and the equity markets,” he said. “The Fed’s 11 rate hikes and a ‘skip’ (since March of 2022) in its efforts to stem untoward levels of inflation show considerable signs of success, even if still at some distance from its goal of 2% inflation.”

“Jobs, consumer spending, employment vs. unemployment, GDP (Q1 and Q2) and corporate results in the S&P 500 Q2 earnings season persist in showing resilience that provides support to the case that the central bank this hike cycle may very well not ‘break something’ that would push the US economy into a recession as its detractors posit,” Stoltzfus further added.

Meanwhile, the Oppenheimer analysts have been seeking out the names poised to use the bull market’s resumption to their advantage. They have been calling investors’ attention to two names that have retreated by significant amounts over the past months, but which they see as ready to jump again – and by jump, we mean get a proper bounce, in the order of triple-digit growth over the coming year.

We ran these beaten-down names through the TipRanks database for a fuller picture of their prospects. Here are the details.

Aeva Technologies (AEVA)

Let’s first take a look at Aeva Technologies, a cutting-edge tech firm that specializes in the development of advanced perception systems for autonomous vehicles and other industries.

Founded by former Apple engineers, Soroush Salehian and Mina Rezk, Aeva has attracted attention for its unique and innovative approach to sensing and perception. At the heart of Aeva’s technology is its “4D LiDAR” system, which combines traditional LiDAR (Light Detection and Ranging) with a novel frequency modulation technique, or more specifically, Frequency-Modulated Continuous Wave (FMCW) lidar technology. This sets Aeva apart from conventional LiDAR systems, as the approach not only allows for highly accurate distance measurements and object detection, but also provides velocity information, enabling objects to be tracked in both space and time.

That said, while it is still early days and there could be a significant opportunity in the autonomous vehicle market, it hasn’t been easy operating in the current environment, as was evident in the recent Q2 print. Revenue fell by 50.3% year-over-year to $0.74 million, just falling shy of consensus expectations. The company also regularly operates at a loss, although adj. EPS of -$0.13 beat the forecast by $0.01.

Shares fell once the Street digested the report, and that has been happening pretty regularly this year. Since peaking in February, the shares have swooned by 49%.

However, after assessing the Q2 print, Oppenheimer’s 5-star analyst, Colin Rusch, is keeping the faith, and he highlights why Aeva is well-positioned for better days ahead.

“AEVA continues to make meaningful progress on commercializing its 4D lidar while managing its cash position well. We are encouraged by commentary on its Tier 1 auto OEM customer moving forward with strategic effort to develop software around the AEVA’s 4D data as well as industrial sales expected in 2024 and the announcement of Railergy as a customer (the first rail win for Avea). We see the company continuing to diversify its target markets while leveraging the unique aspects of its hardware offering,” Rusch opined.

“With numerous innovators in the perception space struggling to meet commercial timelines, we believe AEVA is methodically derisking its platform. As we adjust estimates to reflect a slower revenue ramp as AEVA seeds additional customers, we remain constructive on AEVA shares given technology progress and potential growth,” the top analyst went on to add.

Constructive, indeed. Along with an Outperform (i.e. Buy) rating, Rusch gives AEVA a $6 price target. This projection allows for a substantial 488% upside from the current share price of only $1.02. (To watch Rusch’s track record, click here)

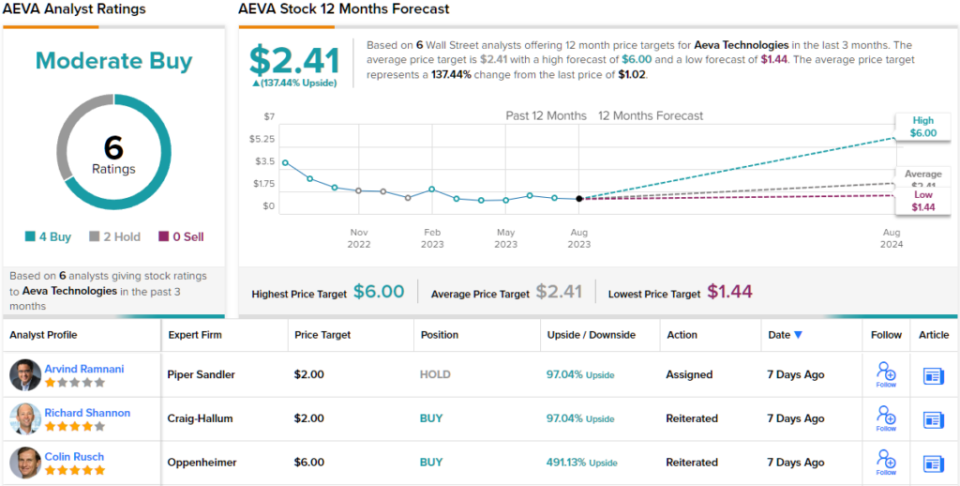

Overall, 3 other analysts join Rusch in the bull camp, and with the addition of 2 Holds, the stock claims a Moderate Buy consensus rating. Shares are anticipated to climb 137% higher over the coming months, considering the average target stands at $2.41. (See AEVA stock forecast)

Arvinas, Inc. (ARVN)

We’ll turn now to the biotech space where Arvinas, a company dedicated to creating novel therapies for a diverse array of illnesses by utilizing inventive protein degradation methods, comes into play. The company employs its proprietary PROTAC (PROteolysis TArgeting Chimera) technology, which leverages the body’s inherent protein elimination mechanism to precisely remove harmful proteins associated with diseases. This approach seeks to offer superior and longer-lasting treatments compared to standard small molecule inhibitors or antibodies.

It’s still early days for Arvinas’ pipeline but a number of drugs are already undergoing clinical studies.

In the ongoing Phase 1/2 dose escalation and expansion trial, ARV-766, Arvinas’ treatment for prostate cancer, demonstrated commendable tolerability and showcased encouraging effectiveness.

Furthermore, in collaboration with Pfizer, the company has recently commenced patient enrollment for the study lead-in of the first-line Phase 3 trial of vepdegestrant (ARV-471) in conjunction with palbociclib as a therapeutic regimen for metastatic breast cancer. The company now has two ongoing Phase 3 trials with vepdegestrant (one with it as a monotherapy) with Arvinas eyeing a first Phase 3 data read-out in 2H24. Beforehand, the company intends on presenting additional data from the Phase 1b combination trial with palbociclib at a medical congress during the second half of the year.

Oppenheimer analyst Matthew Biegler has been keeping an eye on this drug’s progress and while an update from the ARV-471 program earlier in the year failed to impress, Biegler thinks the concerns might be overblown.

“There have certainly been hiccups (recent ARV-471 data didn’t look as strong as they did a year and a half ago + possible concerns with the palbociclib combination), but we think the Street might be irrational in its averseness to this stock,” Biegler opined. “Arvinas is still an industry leader in protein degradation, a field still admittedly finding its footing—but one we would argue has delivered real clinical validation. What’s more, the opportunity for ARV-471 is real—just look at ORSERDU’s recent launch. We are hoping pipeline updates in 2H23 can turn this former darling around.”

A turnaround would be welcome as the stock is down by 35% since this year’s February highs. For Biegler, the current price is way too cheap. His target stands at $95, implying shares will post growth of a big 278% in the months ahead. (To watch Biegler’s track record, click here)

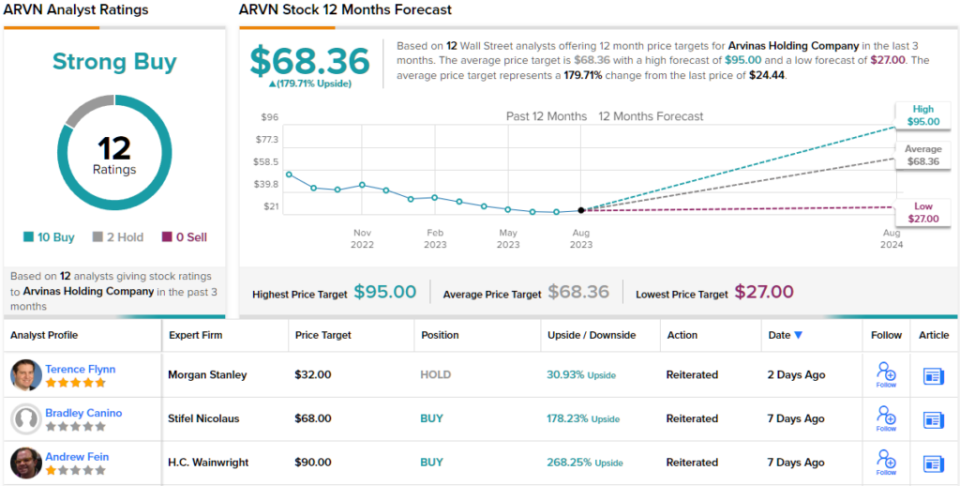

What does the rest of the Street think? Most agree with the Oppenheimer analyst. The stock boasts a Strong Buy consensus rating, based on 10 Buys vs. 2 Holds. Most think the shares are significantly undervalued too. Going by the $68.36 average target, they will post gains of ~180% over the course of the year. (See ARVN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.