Opportunity is Brewing for These Highly-Ranked Manufacturing Stocks

It’s been a rather dull month for stocks so far but opportunity continues to brew in the Zacks Manufacturing-Construction and Mining Industry which is in the top 2% of over 250 Zacks industries.

Belonging to the industrial products sector the industry is benefiting from increased construction and infrastructure-related activities.

At the moment there are several highly-ranked stocks in the Manufacturing-Construction and Mining Industry with a few holding spots on the Zacks Rank #1 (Strong Buy) list.

Caterpillar’s Historical Dominance

Starting with some of the top players in the space we will begin with Caterpillar CAT which has a reputation of providing lofty returns similar to that of big tech conglomerates.

To that point, Caterpillar’s stock is up a very respectable +17% this year and has now climbed +231% over the last decade to just trail the Nasdaq’s +263%. Caterpillar’s stock has topped the Manufacturing-Construction and Mining Markets’ +200% performance during this period with the S&P 500’s +167% trailing this industry and CAT shares.

Image Source: Zacks Investment Research

Most intriguing to investors is that Caterpillar is still seeing lucrative expansion as the world’s largest global construction and mining equipment manufacturer. Plus, shares of CAT trade reasonably at 14.1X forward earnings which is near the industry average of 13.8X and a 31% discount to the S&P 500’s 20.6X.

Image Source: Zacks Investment Research

Now may be an opportune time to buy Caterpillar’s stock considering CAT has largely outperformed the benchmark in the last 10 years. Furthermore, Caterpillar’s sales are forecasted to jump 12% in fiscal 2023 and rise another 3% in FY24 to $69.11 billion.

Better still, Caterpillar’s annual earnings are now projected to soar 43% this year at $19.82 per share compared to EPS of $13.84 in 2022. Fiscal 2024 earnings are projected to pop another 7% with EPS estimates soaring for both FY23 and FY24 over the last 60 days which should further propel CAT.

Image Source: Zacks Investment Research

Other Standouts

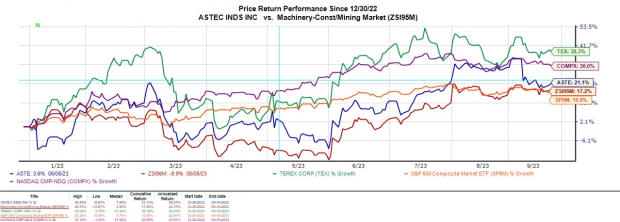

Astec Industries ASTE and Terex TEX also stand out among the top-rated Manufacturing-Construction and Mining Industry. Both are becoming top players in the space with Terex stock soaring +38% YTD and Astec shares up +21%.

Their performances have topped the industry and the benchmark with Terex’s stock outperforming the Nasdaq this year as well.

Image Source: Zacks Investment Research

Briefly, Astec is a leading manufacturer of road equipment used in each phase of road building with Terex providing aerial platforms, cranes, and other machinery used in construction maintenance, manufacturing, and various materials management applications.

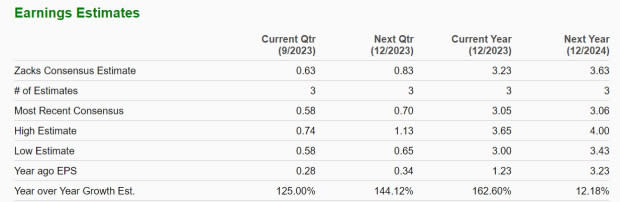

Astec’s sales are projected to rise 9% in FY23 and edge up another 4% in FY24 to $1.45 billion. Taking advantage of its industry's booming business environment, Astec's earnings are expected to skyrocket 162% this year at $3.23 per share versus EPS of $1.23 in 2022. Fiscal 2024 EPS is expected to expand another 12% and estimates have continued to trend higher over the last two months offering further support to Aztec's 15X forward earnings multiple.

Image Source: Zacks Investment Research

Turning to Terex, sales are projected to jump 16% in FY23 to $5.21 billion compared to $4.42 billion last year. Plus, FY24 sales are expected to rise another 3%. Furthermore, earnings are anticipated at $6.95 a share this year which would be a 61% increase from EPS of $4.32 in 2022.

Fiscal 2024 earnings are forecasted to rise another 3% to $7.20 a share making Terex stock look cheap at just 8.5X forward earnings with EPS estimates noticeably higher over the last 60 days as well.

Image Source: Zacks Investment Research

Bottom Line

Simply put, these Zacks Manufacturing-Construction and Mining Industry stocks looked poised to outperform the broader market. Judging from the historical performance in the space this should come as no surprise to investors with Caterpillar, Astec Industries, and Terex stock all coveting a Zacks Rank #1 (Strong Buy) at the moment.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Astec Industries, Inc. (ASTE) : Free Stock Analysis Report

Terex Corporation (TEX) : Free Stock Analysis Report