Is There An Opportunity With Nomad Foods Limited's (NYSE:NOMD) 44% Undervaluation?

Key Insights

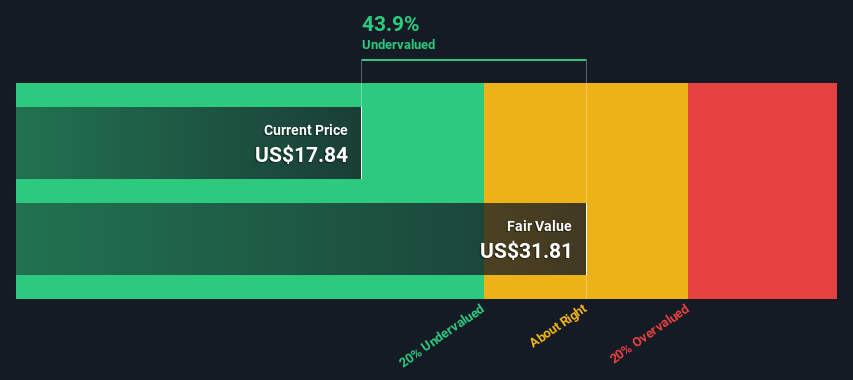

Using the 2 Stage Free Cash Flow to Equity, Nomad Foods fair value estimate is US$31.81

Nomad Foods' US$17.84 share price signals that it might be 44% undervalued

Our fair value estimate is 37% higher than Nomad Foods' analyst price target of €23.25

Today we will run through one way of estimating the intrinsic value of Nomad Foods Limited (NYSE:NOMD) by projecting its future cash flows and then discounting them to today's value. We will use the Discounted Cash Flow (DCF) model on this occasion. There's really not all that much to it, even though it might appear quite complex.

We generally believe that a company's value is the present value of all of the cash it will generate in the future. However, a DCF is just one valuation metric among many, and it is not without flaws. Anyone interested in learning a bit more about intrinsic value should have a read of the Simply Wall St analysis model.

View our latest analysis for Nomad Foods

The Calculation

We're using the 2-stage growth model, which simply means we take in account two stages of company's growth. In the initial period the company may have a higher growth rate and the second stage is usually assumed to have a stable growth rate. In the first stage we need to estimate the cash flows to the business over the next ten years. Where possible we use analyst estimates, but when these aren't available we extrapolate the previous free cash flow (FCF) from the last estimate or reported value. We assume companies with shrinking free cash flow will slow their rate of shrinkage, and that companies with growing free cash flow will see their growth rate slow, over this period. We do this to reflect that growth tends to slow more in the early years than it does in later years.

A DCF is all about the idea that a dollar in the future is less valuable than a dollar today, so we discount the value of these future cash flows to their estimated value in today's dollars:

10-year free cash flow (FCF) estimate

2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | |

Levered FCF (€, Millions) | €268.0m | €316.2m | €299.9m | €291.1m | €287.0m | €286.1m | €287.4m | €290.2m | €294.1m | €298.9m |

Growth Rate Estimate Source | Analyst x1 | Analyst x1 | Est @ -5.16% | Est @ -2.94% | Est @ -1.40% | Est @ -0.31% | Est @ 0.45% | Est @ 0.98% | Est @ 1.35% | Est @ 1.61% |

Present Value (€, Millions) Discounted @ 7.5% | €249 | €274 | €242 | €218 | €200 | €186 | €174 | €163 | €154 | €145 |

("Est" = FCF growth rate estimated by Simply Wall St)

Present Value of 10-year Cash Flow (PVCF) = €2.0b

We now need to calculate the Terminal Value, which accounts for all the future cash flows after this ten year period. The Gordon Growth formula is used to calculate Terminal Value at a future annual growth rate equal to the 5-year average of the 10-year government bond yield of 2.2%. We discount the terminal cash flows to today's value at a cost of equity of 7.5%.

Terminal Value (TV)= FCF2033 × (1 + g) ÷ (r – g) = €299m× (1 + 2.2%) ÷ (7.5%– 2.2%) = €5.8b

Present Value of Terminal Value (PVTV)= TV / (1 + r)10= €5.8b÷ ( 1 + 7.5%)10= €2.8b

The total value, or equity value, is then the sum of the present value of the future cash flows, which in this case is €4.8b. The last step is to then divide the equity value by the number of shares outstanding. Relative to the current share price of US$17.8, the company appears quite good value at a 44% discount to where the stock price trades currently. Remember though, that this is just an approximate valuation, and like any complex formula - garbage in, garbage out.

The Assumptions

Now the most important inputs to a discounted cash flow are the discount rate, and of course, the actual cash flows. If you don't agree with these result, have a go at the calculation yourself and play with the assumptions. The DCF also does not consider the possible cyclicality of an industry, or a company's future capital requirements, so it does not give a full picture of a company's potential performance. Given that we are looking at Nomad Foods as potential shareholders, the cost of equity is used as the discount rate, rather than the cost of capital (or weighted average cost of capital, WACC) which accounts for debt. In this calculation we've used 7.5%, which is based on a levered beta of 0.888. Beta is a measure of a stock's volatility, compared to the market as a whole. We get our beta from the industry average beta of globally comparable companies, with an imposed limit between 0.8 and 2.0, which is a reasonable range for a stable business.

SWOT Analysis for Nomad Foods

Strength

Debt is well covered by earnings and cashflows.

Weakness

Earnings declined over the past year.

Opportunity

Annual earnings are forecast to grow faster than the American market.

Good value based on P/E ratio and estimated fair value.

Threat

Annual revenue is forecast to grow slower than the American market.

Looking Ahead:

Whilst important, the DCF calculation is only one of many factors that you need to assess for a company. It's not possible to obtain a foolproof valuation with a DCF model. Preferably you'd apply different cases and assumptions and see how they would impact the company's valuation. For instance, if the terminal value growth rate is adjusted slightly, it can dramatically alter the overall result. Why is the intrinsic value higher than the current share price? For Nomad Foods, there are three fundamental aspects you should further research:

Risks: You should be aware of the 2 warning signs for Nomad Foods we've uncovered before considering an investment in the company.

Future Earnings: How does NOMD's growth rate compare to its peers and the wider market? Dig deeper into the analyst consensus number for the upcoming years by interacting with our free analyst growth expectation chart.

Other High Quality Alternatives: Do you like a good all-rounder? Explore our interactive list of high quality stocks to get an idea of what else is out there you may be missing!

PS. Simply Wall St updates its DCF calculation for every American stock every day, so if you want to find the intrinsic value of any other stock just search here.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.