Optimistic Investors Push Gentrack Group Limited (NZSE:GTK) Shares Up 29% But Growth Is Lacking

Gentrack Group Limited (NZSE:GTK) shares have continued their recent momentum with a 29% gain in the last month alone. The annual gain comes to 155% following the latest surge, making investors sit up and take notice.

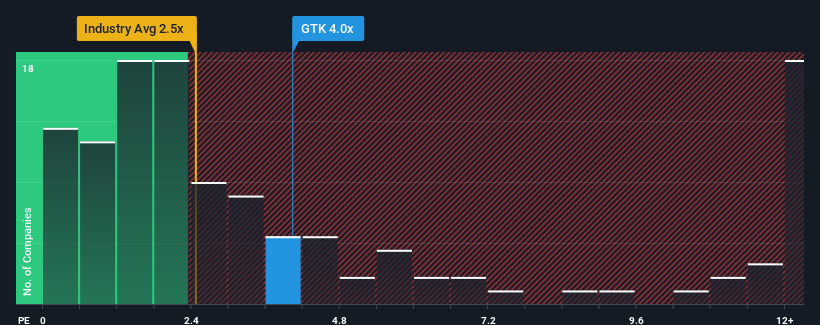

Since its price has surged higher, you could be forgiven for thinking Gentrack Group is a stock not worth researching with a price-to-sales ratios (or "P/S") of 4x, considering almost half the companies in New Zealand's Software industry have P/S ratios below 2.4x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Gentrack Group

How Has Gentrack Group Performed Recently?

Recent times haven't been great for Gentrack Group as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Gentrack Group will help you uncover what's on the horizon.

What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Gentrack Group's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 35%. The strong recent performance means it was also able to grow revenue by 69% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 9.1% per year over the next three years. That's shaping up to be materially lower than the 19% per year growth forecast for the broader industry.

In light of this, it's alarming that Gentrack Group's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Gentrack Group's P/S

The large bounce in Gentrack Group's shares has lifted the company's P/S handsomely. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Gentrack Group, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 1 warning sign for Gentrack Group that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.