Optimistic Investors Push Virco Mfg. Corporation (NASDAQ:VIRC) Shares Up 66% But Growth Is Lacking

Virco Mfg. Corporation (NASDAQ:VIRC) shareholders have had their patience rewarded with a 66% share price jump in the last month. The last month tops off a massive increase of 149% in the last year.

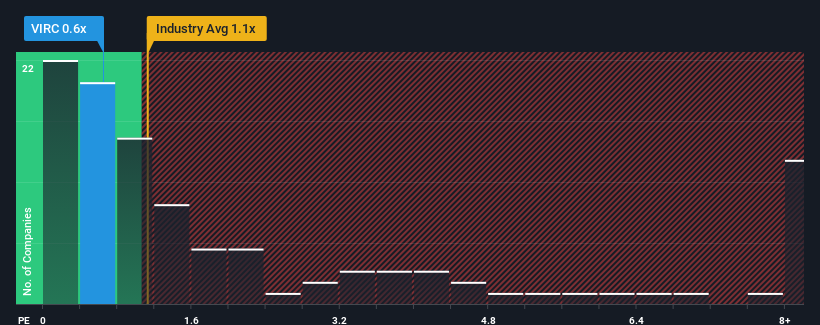

Even after such a large jump in price, it's still not a stretch to say that Virco Mfg's price-to-sales (or "P/S") ratio of 0.6x right now seems quite "middle-of-the-road" compared to the Commercial Services industry in the United States, where the median P/S ratio is around 1.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Virco Mfg

What Does Virco Mfg's Recent Performance Look Like?

Virco Mfg certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Virco Mfg.

How Is Virco Mfg's Revenue Growth Trending?

In order to justify its P/S ratio, Virco Mfg would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. The latest three year period has also seen an excellent 63% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 6.9% over the next year. With the industry predicted to deliver 10% growth, the company is positioned for a weaker revenue result.

With this information, we find it interesting that Virco Mfg is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Virco Mfg's P/S?

Virco Mfg's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

When you consider that Virco Mfg's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Virco Mfg that you need to be mindful of.

If these risks are making you reconsider your opinion on Virco Mfg, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.