OptiNose Inc (OPTN) Reports Decline in 2023 Revenue Amidst Preparations for Potential XHANCE ...

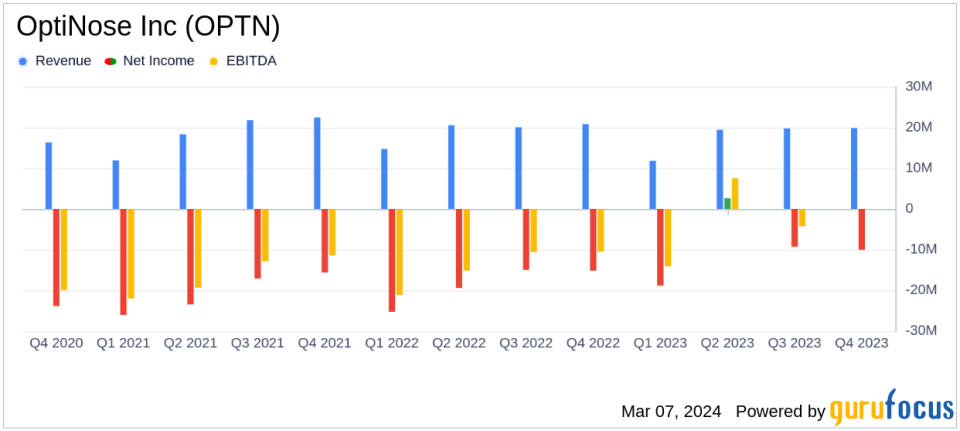

Net Revenue: Full year 2023 net revenue from XHANCE sales reported at $71.0 million, a 7% decrease from 2022.

Operating Expenses: Total SG&A and R&D expenses decreased by 31% to $85.1 million in 2023.

Net Loss: Net loss for 2023 stood at $35.5 million, or $0.32 per share, improving from a net loss of $74.8 million in 2022.

Balance Sheet: Cash and cash equivalents at year-end 2023 were $73.7 million.

Corporate Guidance: Q1 2024 XHANCE net revenues expected to be approximately $13.0 million with an average net revenue per prescription of $220 for the full year.

On March 7, 2024, OptiNose Inc (NASDAQ:OPTN), a specialty pharmaceutical company, released its 8-K filing, detailing its financial results for the fourth quarter and full year of 2023. The company, known for its product XHANCE (fluticasone propionate) nasal spray, is at the forefront of developing treatments for patients with ear, nose, and throat (ENT) and allergy issues. XHANCE utilizes the proprietary Exhalation Delivery System (EDS) to deliver medication effectively to the nasal passages.

Despite a decrease in net revenue and shipments, OptiNose Inc (NASDAQ:OPTN) has made significant strides in preparing for the potential launch of XHANCE for the treatment of chronic sinusitis, pending FDA approval with a target action date of March 16, 2024. Chronic sinusitis is diagnosed 10 times more frequently than the current nasal polyps indication for XHANCE, representing a substantial market opportunity.

Financial Performance and Challenges

OptiNose Inc (NASDAQ:OPTN) reported a decrease in net revenue for both the fourth quarter and the full year of 2023, with fourth-quarter revenue down 5% to $19.9 million and full-year revenue down 7% to $71.0 million compared to the previous year. This decline was primarily attributed to a decrease in shipments. However, the company's operational efficiency improvements are evident in the reduced total SG&A and R&D expenses, which decreased by $37.8 million, or 31%, to $85.1 million for the full year.

The company's net loss improved, with a net loss of $10.0 million, or $0.09 per share, for the fourth quarter, and a net loss of $35.5 million, or $0.32 per share, for the full year. This represents a significant improvement from the previous year's net loss of $74.8 million. The balance sheet reflects a solid cash position with $73.7 million in cash and cash equivalents as of December 31, 2023.

Looking Ahead: 2024 Corporate Guidance

Looking forward, OptiNose Inc (NASDAQ:OPTN) has provided guidance for the first quarter of 2024, expecting XHANCE net revenues to be approximately $13.0 million. For the full year, the company anticipates an average net revenue per prescription of $220. These projections are crucial as they reflect the company's expectations for product performance and market penetration in the coming year.

OptiNose Inc (NASDAQ:OPTN) is poised for a potential significant expansion in its product offering, pending FDA approval for XHANCE to treat chronic sinusitis. This opportunity is underscored by the lack of FDA-approved medications for this condition, which affects a large patient population. The company's preparations for a 2024 launch, if approved, demonstrate a proactive approach to capitalizing on this market potential.

Value investors may find the company's cost reduction efforts and the potential for revenue growth through new indications for XHANCE to be of particular interest. As OptiNose Inc (NASDAQ:OPTN) navigates the challenges of a competitive pharmaceutical market, its strategic focus and operational efficiencies may position it favorably for future growth.

For further details on OptiNose Inc (NASDAQ:OPTN)'s financial performance and strategic initiatives, interested parties are encouraged to join the company's conference call and presentation today at 8:00 a.m. Eastern Time, accessible via webcast on the Investors section of OptiNoses website or by telephone registration.

Explore the complete 8-K earnings release (here) from OptiNose Inc for further details.

This article first appeared on GuruFocus.