Option Bulls, Analysts Eye Clorox Stock

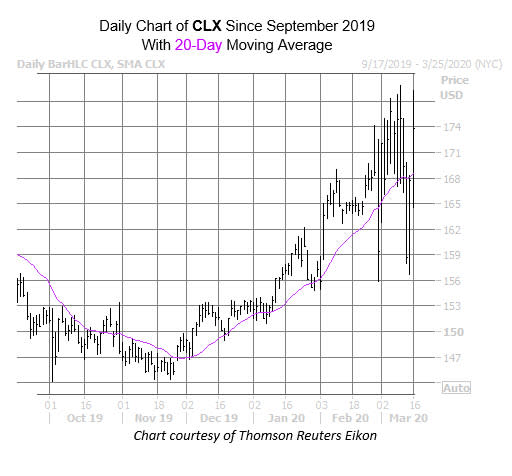

With the massive demand for hand sanitizer, trash bags and other cleaning products wiping the headlines, its no surprise that Clorox Co (NYSE:CLX) is one of the few stocks bucking the broadmarket trend today. The equity is up 2.9% at $172.44, set to close back atop its 20-day moving average after a brief dip below here late last week, and is clinging to a rare year-to-date gain of 6.6%.

Analysts are starting to come around to the outperforming Pine-Sol parent. UBS Group just lifted its price target to $152 from $135 and J.P. Morgan Securities upgraded the equity to "overweight" from "underweight" and hiked its price target to $185 from $153, with one researcher at the brokerage firm calling Clorox "one of the few stocks that can positively surprise guidance."

Coming into today, just one member of the brokerage bunch considered CLX a "strong buy," compared to the 10 calling it a "hold" or worse. Plus, the consensus 12-month target price of $159.23 sits at a 7.5% discount to current levels, leaving the door wide open for even more bull notes.

Clorox stock's options pits are bustling with activity, too. So far, 6,726 calls and 2,528 puts have crossed the tape, 1.2 times what is typically seen at this point. By far the most popular contract is the March 180 call, followed by the 175 call in the same monthly series.