Option Care Health Inc Reports Robust Revenue and Net Income Growth in Q4 and Full Year 2023

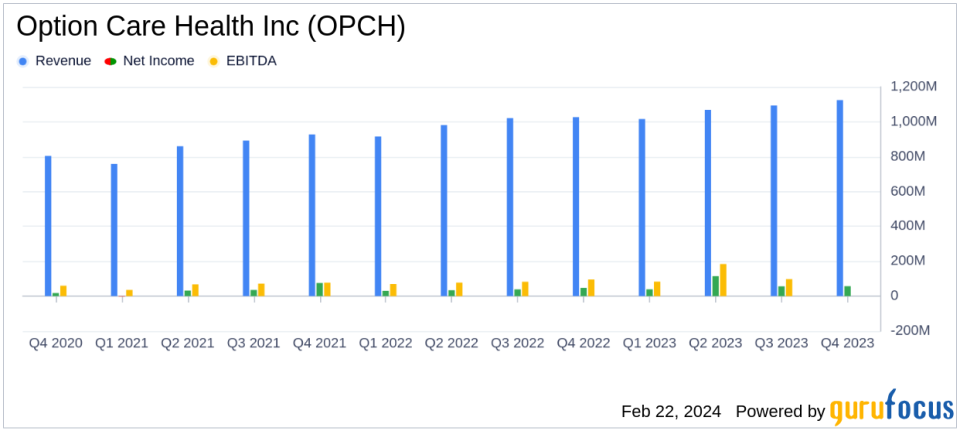

Net Revenue: $1.12 billion in Q4, a 9.5% increase year-over-year; $4.30 billion for full year, up 9.1%.

Gross Profit: Rose to $247.1 million in Q4, marking a 6.9% increase; $981.2 million for full year, a 13.2% rise.

Net Income: Improved to $57.2 million in Q4; $267.1 million for full year, significantly up from $150.6 million in 2022.

Adjusted EBITDA: Increased by 18.4% to $111.6 million in Q4; 24% increase to $425.2 million for full year.

Cash Flow: Operations generated $51.0 million in Q4; $371.3 million for full year, a 38.8% increase.

Share Repurchase: Completed $250 million in share repurchases with an additional $250 million authorized.

On February 22, 2024, Option Care Health Inc (NASDAQ:OPCH), the nations largest independent provider of home and alternate site infusion services, released its 8-K filing, detailing financial results for the fourth quarter and the full year ended December 31, 2023. The company reported a significant increase in net revenue, gross profit, and net income, highlighting its continued growth and strong market position.

Financial Performance and Industry Relevance

Option Care Health's financial achievements are particularly noteworthy in the context of the Healthcare Providers & Services industry. The company's ability to increase net revenue and gross profit amidst challenging healthcare market conditions underscores its operational efficiency and the increasing demand for its home and alternate-site infusion services. The rise in net income and adjusted EBITDA reflects the company's successful strategy and execution, which are critical for maintaining competitiveness and shareholder value.

OPCH's performance is a testament to its commitment to clinical excellence and patient care, as emphasized by CEO John C. Rademacher. He stated,

The Option Care Health team delivered strong financial results in the fourth quarter and full year of 2023 and continued to execute on our commitment to clinical excellence by providing extraordinary patient care through our resilient national platform."

This focus on patient-centered care is crucial for long-term success in the healthcare sector.

Financial Statements Overview

An examination of the income statement reveals that the net revenue increase is a direct result of the company's expanded service offerings and market penetration. The balance sheet shows a healthy cash and cash equivalents position of $343.8 million, which provides the company with the liquidity to pursue growth opportunities and shareholder returns, as evidenced by the share repurchase program.

The cash flow statement indicates a strong cash flow from operations, which is essential for funding operations and investing in future growth. The company's financial stability is further evidenced by a solid equity position, which has increased from the previous year, providing a robust foundation for future initiatives.

Looking Ahead

For the full year 2024, Option Care Health anticipates net revenue between $4.6 billion and $4.8 billion, adjusted EBITDA of $425 million to $450 million, and operating cash flow of at least $300 million. These projections reflect the company's confidence in its business model and growth trajectory.

In conclusion, Option Care Health's financial results for the fourth quarter and full year 2023 demonstrate a strong performance with significant increases in revenue, net income, and cash flow. The company's strategic focus on patient care and clinical excellence, coupled with its financial discipline, positions it well for continued success in the evolving healthcare landscape.

Investors and stakeholders are encouraged to join the conference call hosted by Option Care Health to discuss these financial results, which will provide further insights into the company's operations and future prospects.

Explore the complete 8-K earnings release (here) from Option Care Health Inc for further details.

This article first appeared on GuruFocus.