Oracle (ORCL) Makes its Autonomous Database Generally Available

Oracle ORCL announced the general availability of its Globally Distributed Autonomous Database, which utilizes advanced sharding technology to help organizations easily distribute and manage their data across multiple locations worldwide.

This new database offers the benefits of Oracle Autonomous Database while giving customers control over data distribution and placement policies, enhancing scalability and availability.

With the Globally Distributed Autonomous Database, organizations can automatically distribute and store data across various physical locations without impacting the application’s functionality.

This database simplifies the development and management of distributed databases for critical applications by supporting diverse data types, workloads and programming styles at scale. It enables existing SQL applications to seamlessly utilize distributed databases without requiring extensive rewriting or modification.

Managing distributed databases across multiple servers and locations can be complex and challenging. However, the Globally Distributed Autonomous Database addresses this issue by leveraging artificial intelligence (AI) and machine learning to automate data distribution, shard management, provisioning, tuning, scaling, patching and security tasks. This automation reduces manual efforts, minimizes errors and allows administrators to manage the distributed database as a single logical entity.

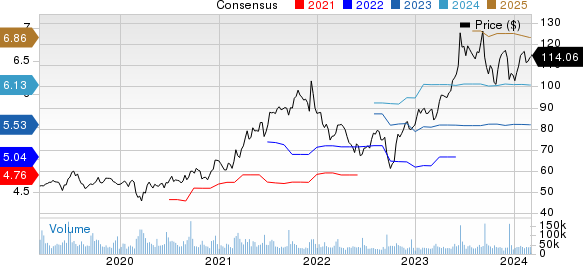

Oracle Corporation Price and Consensus

Oracle Corporation price-consensus-chart | Oracle Corporation Quote

ORCL Faces Competition in the Cloud Infrastructure Market

According to a report by Statista, in fourth-quarter 2023, the global cloud infrastructure service spending grew $12 billion from the year-ago quarter’s level to $73.7 billion. In 2023, spending increased 19%, while the fourth quarter witnessed growth of 20% year over year. In the fourth quarter, spending rose $5.6 billion from the previous quarter’s level, marking the largest sequential increase ever recorded.

Shares of this Zacks Rank #4 (Sell) company have gained 8.2% year to date compared with the Zacks Computer and Technology sector’s growth of 11.5% due to tough competition from giants like Amazon AMZN, Microsoft MSFT and Alphabet’s GOOGL Google.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the fourth quarter of 2023, Amazon's market share in the global cloud infrastructure space decreased to 31% from 33% reported in the year-ago quarter. Microsoft witnessed an increase of 24% in its market share during the same time frame. Combined with Google's 11% market share, these three companies now dominate two-thirds of the expanding cloud market.

Amazon Web Services is renowned for its highly secure, extensive and reliable cloud infrastructure, offering more than 200 fully-featured services from data centers located worldwide.

Microsoft provides organizations with an integrated and open cloud platform spanning six key areas like security, infrastructure, digital and app innovation, data and AI, business applications, and modern work.

The Google Cloud Platform offers a suite of modular cloud infrastructure services, including computing, data storage, data analytics and machine learning, combined with a range of management tools.

Oracle Cloud stands out in the cloud infrastructure industry for its focus on delivering seamlessly integrated solutions that work in tandem with the company's software and databases.

ORCL recently announced that its Cloud Scale Charging and Billing solution has been chosen by SmarTone to enhance the latter’s current consumer and business services, offering advanced features like automated billing, real-time monitoring and personalized invoicing. This solution is aligned with TM Forum and 3GPP standards and adopts an API-first strategy to effortlessly integrate with various existing systems, including CRM, payment gateways and self-service platforms. This advancement in the cloud infrastructure market is expected to boost the company’s cloud services and license revenues in the current financial year.

The Zacks Consensus Estimate for ORCL’s fiscal 2024 cloud services and license revenues is pegged at $44.68 billion, indicating year-over-year growth of 26.5%. The Zacks Consensus Estimate for 2024 earnings is pegged at $5.53 per share, indicating year-over-year growth of 8.01%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report