How Oracle Stock Could Partially Recoup Recent Losses

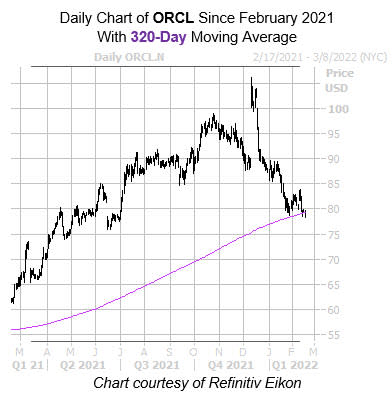

Oracle Corporation (NYSE:ORCL) is down 1.6% at $78.46 this afternoon. The equity has been testing a floor at the $78 level over the last couple of weeks, after pulling back from a Dec. 10, all-time high of $106.25. The cloud name still sports a 26.2% year-over-year lead, though, and is now flashing a historically bullish signal that may help it recoup some of its recent losses.

More specifically, Oracle stock's latest pullback has placed it within one standard deviation of its 320-day moving average, which has helped ORCL surge higher in the past. According to a study conducted by Schaeffer's Senior Quantitative Analyst Rocky White, the stock has seen six similar signals over the last three years. One month after each signal, the security was higher, averaging a 6.6% return in that period. From its current perch, a move of the same magnitude would put ORCL above the $83 mark.

There is plenty of room for optimism among the brokerage bunch. Of the 17 analysts in coverage, 12 call Oracle stock a tepid "hold," while the remaining five doled out "strong buy" ratings.

It is also worth noting the equity's Schaeffer's Volatility Scorecard (SVS) stands at a relatively high 81 out of 100. This means ORCL has exceeded option traders' volatility expectations during the past year.