Orange (ORAN) Expands Presence in Digital Healthcare Space

Orange S.A.’s ORAN subsidiary — Enovacom — has made significant strides in the healthcare sector by acquiring NEHS Digital and Xperis, which are subsidiaries of the MNH group. NEHS Digital specializes in healthcare solutions, particularly in medical imaging, while Xperis excels in healthcare data interoperability.

The acquisition will likely help Enovacom to expand its footprint in medical imaging, telemedicine, medical interpretation services organization, care production and coordination, and information systems' security and interoperability. This acquisition also complements Enovacom's existing solutions, such as Enovacom Nomadeec, and emphasizes its strong position in the telemedicine sector.

The acquisition supports Orange Business’ "Lead the Future" strategic plan, which involves capitalizing on Enovacom's core business excellence, accelerating its position in the digital healthcare sphere and supporting healthcare professionals in maximizing the potential of healthcare data.

Orange Price and Consensus

Orange price-consensus-chart | Orange Quote

These strategic acquisitions mark Enovacom's second successful venture in two years. In May 2022, Enovacom announced the acquisition of a leader in emergency and day-to-day telemedicine — Exelus. The current acquisition of NEHS Digital and Xperis complements Exelus and will help Enovacom strengthen its strategy of developing solutions for healthcare professionals.

Per a report from Grand View Research, the global digital health market size is projected to grow at a CAGR of 18.6% from 2023 to 2030. The industry is likely to benefit from the advancement in healthcare IT infrastructure and ongoing digitalization. This bodes well for players like Enovacom.

Orange Business Services is a global digital services provider that offers a range of services, including networking, cloud, cybersecurity and unified communications to businesses of all sizes. The company is a subsidiary of Orange S.A., one of the world’s leading telecommunications carriers with a presence in 26 countries.

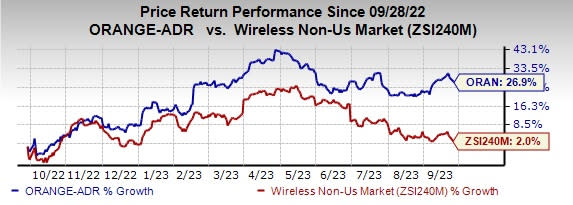

At present, ORAN carries a Zacks Rank #3 (Hold). Shares of the company have gained 26.9% compared with the sub-industry’s growth of 2% in the past year.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the broader technology space are Asure Software ASUR, Aspen Technology AZPN and Badger Meter BMI. Asure Software and Aspen Technology presently sport a Zacks Rank #1 (Strong Buy), whereas Badger Meter currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Asure Software’s 2023 earnings per share (EPS) has increased 35% in the past 60 days to 54 cents.

Asure Software’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 676.4%. Shares of ASUR have surged 59.1% in the past year.

The Zacks Consensus Estimate for Aspen Technology’s fiscal 2024 EPS has increased 6.8% in the past 60 days to $6.58.

Aspen Technology’s long-term earnings growth rate is 17.1%. Shares of AZPN have declined 17.1% in the past year.

The Zacks Consensus Estimate for Badger Meter’s 2023 EPS has increased 1.4% in the past 60 days to $2.86.

Badger Meter’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 6.7%. Shares of BMI have surged 58.8% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Aspen Technology, Inc. (AZPN) : Free Stock Analysis Report

Orange (ORAN) : Free Stock Analysis Report