Orbimed Advisors LLC Bolsters Portfolio with Alpine Immune Sciences Inc Stake

Introduction to the Transaction

Orbimed Advisors LLC, a prominent investment firm, has recently expanded its portfolio by adding shares of Alpine Immune Sciences Inc (NASDAQ:ALPN). On November 9, 2023, the firm acquired 145,251 additional shares of the biopharmaceutical company, bringing its total holdings to 4,226,843 shares. This transaction reflects a 0.03% impact on Orbimed's portfolio, with the shares purchased at an average price of $12.06. The firm now holds a 0.92% position in its portfolio and a 7.30% stake in Alpine Immune Sciences Inc.

Profile of Orbimed Advisors LLC

Founded in 1989, Orbimed Advisors LLC has established itself as a significant player in healthcare sector investments. With a diverse portfolio strategy that spans from venture capital start-ups to large multinational companies, Orbimed has grown its assets under management to approximately $15 billion. The firm's investment philosophy is deeply rooted in the healthcare sector, with a focus on long-term growth and innovation. Orbimed's top holdings include Intuitive Surgical Inc (NASDAQ:ISRG), Sinovac Biotech Ltd (NASDAQ:SVA), and Boston Scientific Corp (NYSE:BSX), among others, with an equity portfolio valued at $5.51 billion.

Alpine Immune Sciences Inc Company Overview

Alpine Immune Sciences Inc, based in the USA, is a clinical-stage biopharmaceutical company that specializes in developing protein-based immunotherapies for autoimmune and inflammatory diseases. Since its IPO on June 17, 2015, Alpine has been committed to advancing its pipeline candidates, including ALPN-303 and ALPN-101, which target key cytokines and costimulatory molecules involved in immune responses. With a market capitalization of $688.188 million, Alpine operates primarily within the biotechnology industry segment of collaboration revenue.

Analysis of the Trade Impact

The recent acquisition by Orbimed Advisors LLC has a modest impact on its portfolio, yet it signifies the firm's confidence in Alpine Immune Sciences Inc's potential. The trade has increased Orbimed's position in Alpine by 3.56%, indicating a strategic move to capitalize on the biopharmaceutical company's growth prospects. The trade's position and share change underscore Orbimed's investment strategy and its bullish outlook on Alpine's future.

Market Performance of Alpine Immune Sciences Inc

Alpine Immune Sciences Inc's stock is currently trading at $11.865, slightly below the trade price of $12.06. The stock is considered modestly overvalued with a GF Value of $10.03 and a price to GF Value ratio of 1.18. Despite a year-to-date increase of 59.69%, the stock has experienced a decline of 1.62% since the transaction and a significant drop of 82.29% since its IPO.

Financial Health and Growth Prospects

Alpine Immune Sciences Inc's financial health is reflected in its balance sheet rank of 7/10 and a cash to debt ratio of 19.61. The company's profitability rank stands at 3/10, while its growth rank is impressive at 8/10. Alpine's revenue growth over the past three years has been robust at 111.50%, indicating strong growth prospects for the company.

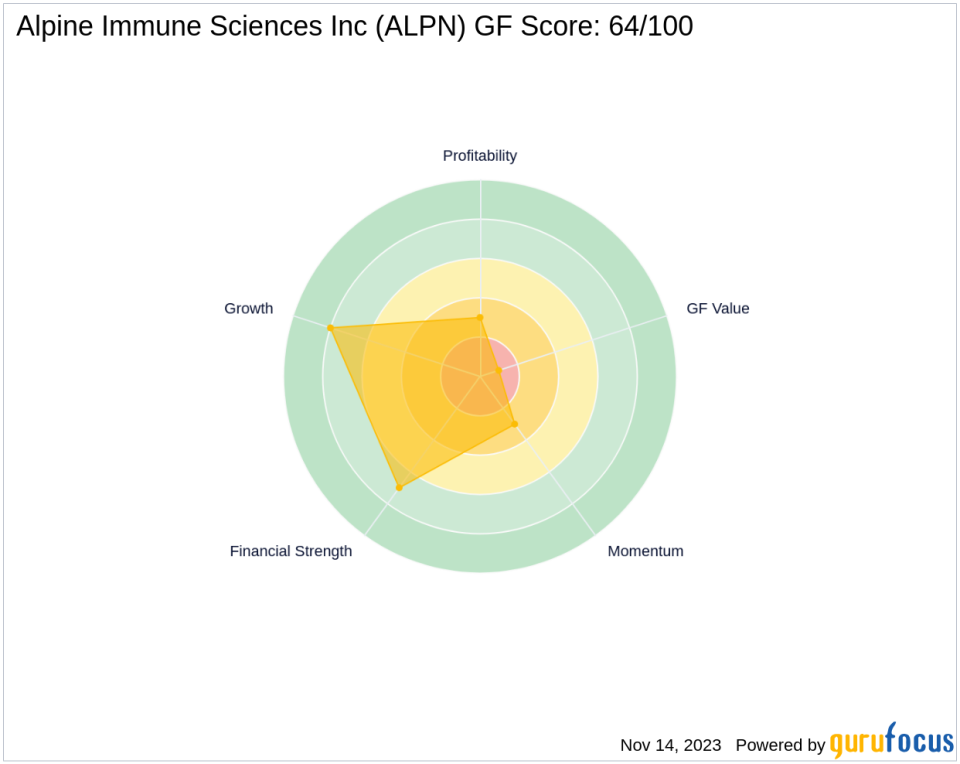

Stock Valuation and Performance Indicators

Despite being deemed modestly overvalued, Alpine Immune Sciences Inc's stock valuation is supported by a GF Score of 64/100, suggesting potential for future performance. The company's performance since its IPO and year-to-date growth, along with post-transaction adjustments, provide a comprehensive view of its market standing and investment appeal.

Conclusion

Orbimed Advisors LLC's recent addition of Alpine Immune Sciences Inc to its portfolio is a strategic move that aligns with the firm's healthcare-focused investment philosophy. Alpine's promising pipeline and growth trajectory make it an attractive asset within Orbimed's diverse portfolio. As Alpine continues to advance its immunotherapies, the investment firm's stake could yield significant returns, reflecting the potential of both the company and Orbimed's investment acumen.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.