OrbiMed Advisors LLC Reduces Stake in NeuroPace Inc

OrbiMed Advisors LLC, a renowned investment firm, recently executed a significant transaction involving NeuroPace Inc. This article provides an in-depth analysis of the transaction, the profiles of both the guru and the traded company, and the potential implications of the transaction on the market.

Details of the Transaction

The transaction took place on October 3, 2023, with OrbiMed Advisors LLC reducing its stake in NeuroPace Inc. The firm sold 8,314 shares at a trading price of $9.07 per share, leaving it with a total of 4,003,967 shares in the company. This transaction had a negligible impact on the firm's portfolio, with the position in NeuroPace Inc now accounting for 0.66% of its total holdings. The firm now holds 15.48% of NeuroPace Inc's total shares.

Profile of the Guru: OrbiMed Advisors LLC

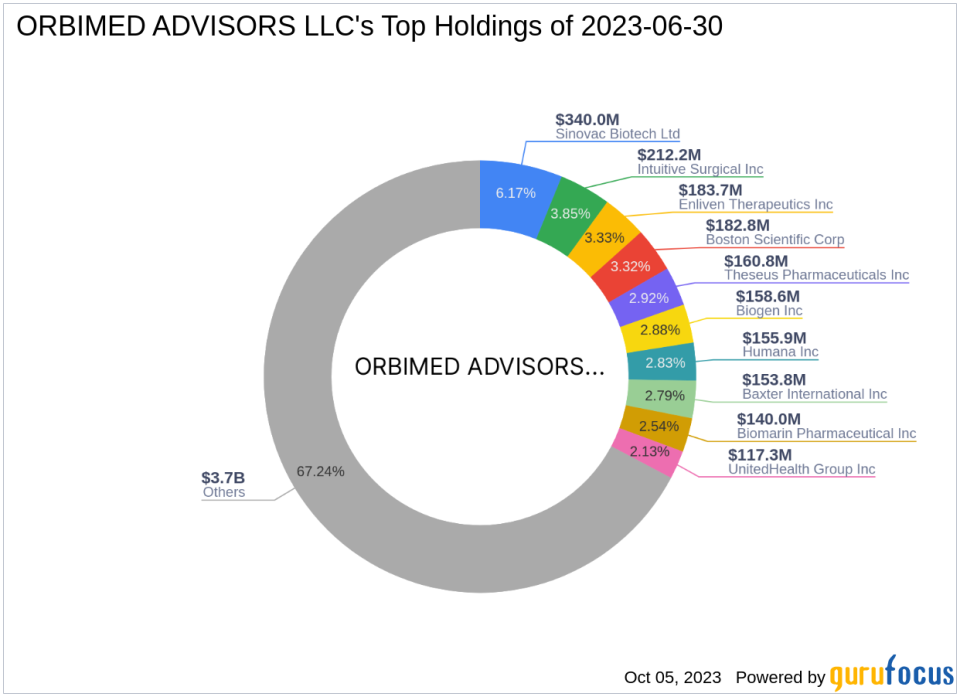

OrbiMed Advisors LLC is a globally recognized investment firm, founded in 1989. The firm invests across a broad spectrum of healthcare companies, ranging from venture capital start-ups to large multinational corporations. With approximately $15 billion in total assets under management, OrbiMed Advisors LLC has a diverse portfolio, including top holdings in Intuitive Surgical Inc(NASDAQ:ISRG), Sinovac Biotech Ltd(NASDAQ:SVA), Boston Scientific Corp(NYSE:BSX), Theseus Pharmaceuticals Inc(NASDAQ:THRX), and Enliven Therapeutics Inc(NASDAQ:ELVN).

Profile of the Traded Company: NeuroPace Inc

NeuroPace Inc is a commercial-stage medical device company based in the USA. The company, which had its IPO on April 22, 2021, is focused on transforming the lives of people suffering from epilepsy by reducing or eliminating the occurrence of debilitating seizures. The company's market capitalization stands at $202.222 million, with a current stock price of $7.82. However, the company's GF Value and GF Valuation are currently not available due to insufficient data.

Analysis of the Transaction

The transaction's impact on OrbiMed Advisors LLC's portfolio was minimal, with the position in NeuroPace Inc now accounting for 0.66% of its total holdings. However, the transaction may have a more significant impact on NeuroPace Inc, with the firm now holding 15.48% of the company's total shares. This reduction in shares aligns with OrbiMed Advisors LLC's investment philosophy, which involves investing across a broad spectrum of healthcare companies.

Market Performance of the Traded Stock

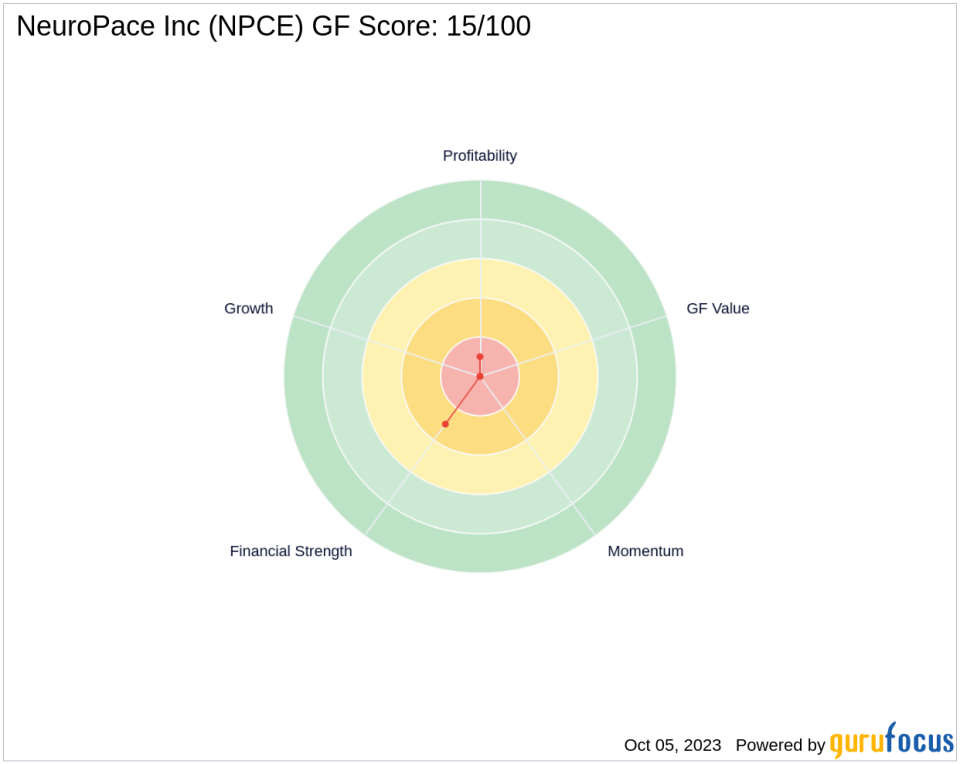

Since its IPO, NeuroPace Inc's stock has experienced a significant decrease in value, with a price change ratio of -66.37%. However, the stock has shown a remarkable year-to-date performance, with a price change ratio of 443.06%. The company's GF Score stands at 15/100, indicating a poor future performance potential.

Financial Health and Performance of the Traded Company

NeuroPace Inc's financial health and performance metrics reveal a mixed picture. The company's balance sheet rank is 3/10, indicating a relatively weak financial position. Its profitability rank is 1/10, suggesting low profitability. The company's growth rank is 0/10, indicating no growth. The company's Piotroski F-Score is 2, suggesting poor business operations. The company's Altman Z-Score is -4.55, indicating potential financial distress. However, the company's cash to debt ratio is 0.90, which is relatively healthy.

Conclusion

In conclusion, OrbiMed Advisors LLC's recent transaction involving NeuroPace Inc aligns with its investment philosophy. While the transaction had a minimal impact on the firm's portfolio, it may have a more significant impact on NeuroPace Inc. Despite the company's weak financial health and performance metrics, its cash to debt ratio suggests a relatively healthy financial position. However, investors should exercise caution due to the company's poor GF Score and potential financial distress.

This article first appeared on GuruFocus.