O'Reilly (ORLY) to Report Q2 Earnings: What's in the Cards?

O’Reilly Automotive ORLY is slated to release second-quarter 2023 results on Jul 26 after the closing bell. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings per share and revenues is pegged at $10.02 and $3.99 billion, respectively.

For the second quarter, the consensus estimates for O’Reilly’s earnings per share have moved up by 2 cents in the past seven days. Its bottom-line estimates imply 14.12% growth from the year-ago reported numbers.

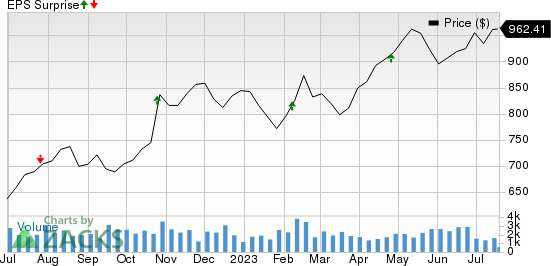

The Zacks Consensus Estimate for ORLY's quarterly revenues suggests a year-over-year increase of 8.69%. Over the trailing four quarters, the company surpassed earnings estimates on three occasions and missed the same once, the average surprise being 4.56%. This is depicted in the graph below:

O'Reilly Automotive, Inc. Price and EPS Surprise

O'Reilly Automotive, Inc. price-eps-surprise | O'Reilly Automotive, Inc. Quote

Q1 Highlights

In the first quarter of 2023, ORLY’s adjusted earnings per share of $8.28 beat the consensus metric of $8 and rose 15.5% year over year. Higher year-over-year comp growth resulted in the outperformance. The company reported net sales of $3,707.8 million, topping the Zacks Consensus Estimate of $3,564 million. The top line also rose 12% year over year.

Things to Note

O’Reilly’s revenue growth is impressive. The specialty retailer of automotive aftermarket parts has been generating record revenues for 30 consecutive years on the back of growth in the auto parts market and expansion of the store base.

A customer-centric business model and growing demand for technologically advanced auto parts are likely to drive the company’s upcoming results. The consensus mark of ORLY’s comps growth in the quarter to be reported is pegged at 5.47%, higher than the year-ago period’s growth of 4.3%.

The increased complexity of auto parts and repairs is driving more people toward independent repair shops. Thus, as cars are getting more technologically advanced, high-quality auto parts are much in demand, which is likely to bolster the company’s upcoming sales and earnings results.

O’Reilly’s wide-ranging product portfolio caters to DIY and DIFM customers, which is driving comparable store sales growth. The auto parts retailer is also undertaking several initiatives, like curbside pickup for Buy Online and Pick Up In-Store orders, et al. Robust e-commerce activities are likely to have boosted the company’s top-line performance in the quarter under review.

Earnings Whispers

Our proven model predicts an earnings beat for the automotive parts retailer for the quarter to be reported, as it has the right combination of the two key ingredients. A positive Earnings ESP combined with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat.

Earnings ESP: ORLY has an Earnings ESP of +2.10%. This is because the Most Accurate Estimate is pegged 21 cents higher than the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: It currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Other Stocks With the Favorable Combination

Let’s take a look at some other players from the auto space that, according to our model, have the right combination of elements to post an earnings beat for the quarter to be reported:

Ford Motor Company F will release second-quarter 2023 results on Jul 27. The company has an Earnings ESP of +3.73% and carries a Zacks Rank #1.

The Zacks Consensus Estimate for Ford’s to-be-reported quarter’s earnings and revenues is pegged at 48 cents per share and $39.45 billion, respectively. F surpassed earnings estimates in two of the trailing four quarters and missed twice, the average surprise being 24.35%.

Oshkosh Corporation OSK will release second-quarter 2023 results on Jul 27. The company has an Earnings ESP of +21.36% and carries a Zacks Rank #2.

The Zacks Consensus Estimate for Oshkosh’s to-be-reported quarter’s earnings and revenues is pegged at $1.62 per share and $2.24 billion, respectively. OSK surpassed earnings estimates once in the trailing four quarters and missed three times, the average negative surprise being 4.37%.

Lear Corporation LEA will release second-quarter 2023 results on Aug 1. The company has an Earnings ESP of +3.16% and has a Zacks Rank #2.

The Zacks Consensus Estimate for Lear’s to-be-reported quarter’s earnings and revenues is pegged at $3.05 per share and $5.72 billion, respectively. LEA surpassed earnings estimates in all the trailing four quarters, the average surprise being 15.53%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

O'Reilly Automotive, Inc. (ORLY) : Free Stock Analysis Report

Lear Corporation (LEA) : Free Stock Analysis Report

Oshkosh Corporation (OSK) : Free Stock Analysis Report