Organic Growth Aids Webster Financial (WBS), Higher Debt Ails

Webster Financial Corporation’s WBS top-line growth has been aided by a rise in NII and non-interest income over the years. Strategic acquisitions have fortified the company’s balance sheet. However, an unsound liquidity position makes capital distributions seem unsustainable.

Webster Financial has an impressive revenue growth story. NII and non-interest income have been rising over the years. Also, its merger deal with Sterling Bancorp has expanded selected commercial lending portfolios, HSA Bank and digital banking offerings. This has helped in diversification and the unlocking of new revenue-growth opportunities.

Management expects NII (non-fully tax-equivalent or non-FTE) in the range of $580-$590 million (excluding accretion) in fourth-quarter 2023. Also, non-interest income is projected to be around $90 million.

WBS exhibits a healthy balance sheet position. Deposits and loans recorded a three-year (2019-2022) compounded annual growth rate of 32.3% and 35.4%, respectively, with the rising trend continuing in the first nine months of 2023. Going forward, we believe that growth in deposit and loan balances will keep supporting its financials.

Additionally, in January 2023, the company acquired StoneCastle Insured Sweep, LLC, which helped it to diversify its funding capabilities and add another technology-enabled platform to its system. Such strategic acquisitions have fortified the company’s balance sheet. Management anticipates loan growth to be between 1% and 2% in fourth-quarter 2023 on a sequential basis.

Webster Financial efforts to drive cost savings have been beneficial as the metric declined in the first nine months of 2023. For fourth-quarter 2023, management suggests adjusted expenses of around $305 million, with an efficiency ratio of 42%.

However, volatile cash levels, along with high debt, make us believe that Webster Financial may not be able to meet its debt obligations if the economic situation worsens. Moreover, the times interest earned ratio of 5 declined sequentially in the third quarter of 2023.

The sustainability of WBS’ capital-distribution activities keeps us apprehensive. The latest dividend hike of 21% was announced back in April 2019. Although it repurchased around 1.2 million shares in third-quarter 2023, it did not repurchase any shares in the first half of 2023. Given the low liquidity levels, the capital distribution activities do not seem sustainable in the long run.

The loan portfolio of Webster Financial mostly comprises commercial loans (including commercial non-mortgage and commercial real estate loans). Such loans make up 59.6% of total loans and leases as of Sep 30, 2023. The current rapidly changing macroeconomic backdrop is likely to put some strain on commercial lending, thus hurting the company’s financials if the economic situation worsens.

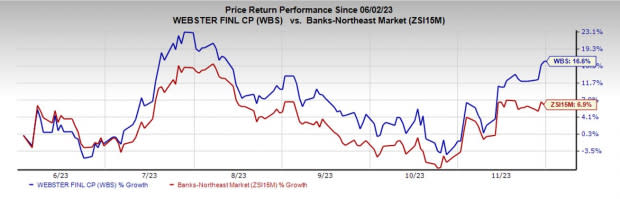

WBS shares have gained 16.6% over the past six months compared with the industry’s 6.9% growth.

Image Source: Zacks Investment Research

WBS presently carries a Zacks Rank #3 (Hold).

Finance Stocks Worth Considering

A couple of better-ranked stocks from the finance space are Merchants Bancorp MBIN and Arrow Financial Corporation AROW. Each stock currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for MBIN’s 2023 earnings has moved 10.9% north over the past 60 days. The company’s share price has increased 36.7% over the past six months.

The Zacks Consensus Estimate for AROW’s fiscal 2023 earnings has been revised 13% upward over the past 60 days. The stock has gained 26.8% over the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Webster Financial Corporation (WBS) : Free Stock Analysis Report

Arrow Financial Corporation (AROW) : Free Stock Analysis Report

Merchants Bancorp (MBIN) : Free Stock Analysis Report