Organon & Co (OGN) Reports Steady Growth Amidst Market Challenges

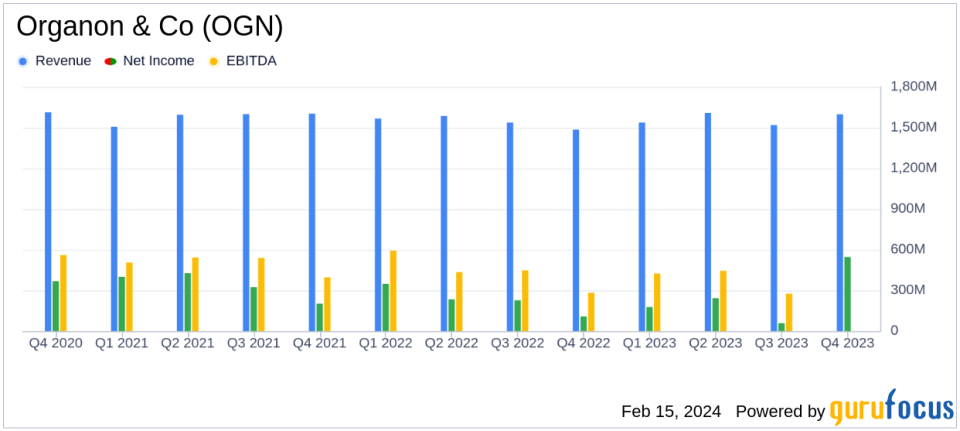

Revenue: Full year revenue increased by 1% as-reported and 3% ex-FX compared to the previous year.

Net Income: Fourth quarter net income soared to $546 million, a significant increase from $108 million in the prior year.

Adjusted EBITDA: Adjusted EBITDA margin improved to 28.1% in Q4 2023 from 25.6% in Q4 2022.

Biosimilars: Biosimilars revenue grew by 23% as-reported and 24% ex-FX for the full year 2023.

Dividend: A quarterly dividend of $0.28 per share has been declared, payable on March 14, 2024.

Guidance: Organon anticipates low-single-digit revenue growth and a stable to improving Adjusted EBITDA margin for 2024.

On February 15, 2024, Organon & Co (NYSE:OGN) released its 8-K filing, detailing its financial results for the fourth quarter and the full year ended December 31, 2023. The company, a global pharmaceutical player focused on women's health, biosimilars, and established brands, reported an 8% increase in Q4 revenue year-over-year, both as-reported and ex-FX, reaching $1,598 million.

Organon & Co (NYSE:OGN) is a science-based global pharmaceutical company that develops and delivers health solutions through a portfolio of prescription therapies within women's health, biosimilars, and established brands. The company's operations include the following product portfolio: Women's Health, Biosimilars, and Established medicines. Geographically, it derives a majority of its revenue from Europe and Canada.

Financial Performance and Challenges

Women's Health revenue increased by 7% as-reported and 8% ex-FX, driven by strong growth in fertility products, particularly Follistim AQ. However, challenges included a decline in Nexplanon and NuvaRing due to competitive pressures. Biosimilars revenue surged by 49% as-reported and 48% ex-FX, with significant contributions from Ontruzant and Renflexis. Established Brands saw a 3% increase in revenue, overcoming challenges in China and supply interruptions.

The importance of these performance metrics lies in their reflection of Organon's ability to grow its core businesses despite market challenges. The growth in Women's Health and Biosimilars is particularly significant as it underscores the company's strategic focus and potential for future expansion in these areas.

Financial Achievements and Importance

Organon's financial achievements, including the growth in revenue and net income, are critical for the company's ability to invest in innovation and future growth opportunities, especially in women's health and biosimilars. The improved Adjusted EBITDA margin indicates effective cost management and operational efficiency, which are vital for sustaining profitability in the competitive pharmaceutical industry.

Key Financial Details

For the fourth quarter of 2023, Organon reported a gross margin of 57.3% as-reported and 60.3% on an adjusted basis. Adjusted EBITDA margin improved to 28.1%, reflecting lower operating expenses and foreign exchange losses. Net income for the quarter was $546 million, translating to $2.13 per diluted share, a substantial increase from the previous year's $108 million, or $0.42 per diluted share. The reported GAAP net income includes a net $476 million tax benefit from the termination of a Swiss tax arrangement.

For the full year 2023, Organon's gross margin was 59.8% as-reported and 62.7% on an adjusted basis. Adjusted EBITDA margin for the year was 31.0%. Net income for 2023 reached $1.0 billion, or $3.99 per diluted share, up from $917 million, or $3.59 per diluted share in 2022.

Organon's Board of Directors declared a quarterly dividend of $0.28 per share, demonstrating confidence in the company's financial health and commitment to shareholder returns. As of December 31, 2023, the company had $693 million in cash and cash equivalents and $8.8 billion in debt.

Looking Ahead

Organon's guidance for 2024 includes expectations for low-single-digit revenue growth and a stable to improving Adjusted EBITDA margin, achieved partly through operating expense management. The company's focus on women's health and biosimilars, coupled with its global footprint and commercial capabilities, positions it well for continued growth and innovation.

For more detailed financial information and to view the full earnings report, visit Organon's Investor Relations website.

Explore the complete 8-K earnings release (here) from Organon & Co for further details.

This article first appeared on GuruFocus.