Is Orgenesis (ORGS) Too Good to Be True? A Comprehensive Analysis of a Potential Value Trap

Value-focused investors are consistently on the lookout for stocks priced below their intrinsic value. One stock that has recently caught attention is Orgenesis Inc (NASDAQ:ORGS). Currently trading at 0.47, the stock recorded a single-day gain of 14.61% and a 3-month decrease of 60.35%. The stock's fair valuation, as indicated by its GF Value, is $3.83.

Understanding GF Value

The GF Value represents the current intrinsic value of a stock derived from our exclusive method. The GF Value Line on our summary page gives an overview of the fair value that the stock should be traded at. It is calculated based on three factors:

1. Historical multiples (PE Ratio, PS Ratio, PB Ratio and Price-to-Free-Cash-Flow) that the stock has traded at.

2. GuruFocus adjustment factor based on the company's past returns and growth.

3. Future estimates of the business performance.

We believe the GF Value Line is the fair value that the stock should be traded at. The stock price will most likely fluctuate around the GF Value Line. If the stock price is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. On the other hand, if it is significantly below the GF Value Line, its future return will likely be higher.

However, investors need to consider a more in-depth analysis before making an investment decision. Despite its seemingly attractive valuation, certain risk factors associated with Orgenesis should not be ignored. These risks are primarily reflected through its low Altman Z-score of -2.97, and a Beneish M-Score of -1.29 that exceeds -1.78, the threshold for potential earnings manipulation. These indicators suggest that Orgenesis, despite its apparent undervaluation, might be a potential value trap. This complexity underlines the importance of thorough due diligence in investment decision-making.

Understanding Key Financial Indicators

Before delving into the details, let's understand what the Altman Z-score entails. Invented by New York University Professor Edward I. Altman in 1968, the Z-Score is a financial model that predicts the probability of a company entering bankruptcy within a two-year time frame. The Altman Z-Score combines five different financial ratios, each weighted to create a final score. A score below 1.8 suggests a high likelihood of financial distress, while a score above 3 indicates a low risk.

Developed by Professor Messod Beneish, the Beneish M-Score is based on eight financial variables that reflect different aspects of a company's financial performance and position. These are Days Sales Outstanding (DSO), Gross Margin (GM), Total Long-term Assets Less Property, Plant and Equipment over Total Assets (TATA), change in Revenue (?REV), change in Depreciation and Amortization (?DA), change in Selling, General and Admin expenses (?SGA), change in Debt-to-Asset Ratio (?LVG), and Net Income Less Non-Operating Income and Cash Flow from Operations over Total Assets (?NOATA).

Company Overview

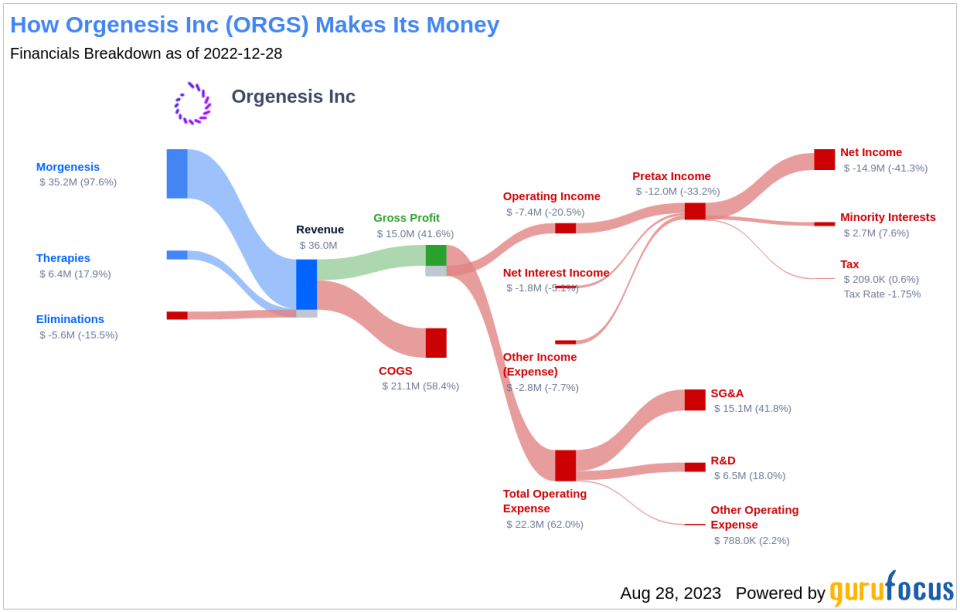

Orgenesis Inc is a biotech company working to unlock the potential of cell and gene therapies. It is focused on autologous therapies, with processes and systems that are developed for each therapy using a closed and automated processing system approach that is validated for compliant production near the patient for treatment of the patient at the point of care (POCare). The Company's business includes two reporting segments: Morgenesis and Therapies.

This article first appeared on GuruFocus.