New Oriental Education & Technology Group (EDU): A Closer Look at Its Modest Overvaluation

New Oriental Education & Technology Group Inc (NYSE:EDU) has recently seen a daily gain of 4.38%, and a 3-month gain of 35.35%. Despite these positive figures and an Earnings Per Share (EPS) of 1.1, the question arises - is the stock modestly overvalued? This article aims to answer this question by providing a comprehensive valuation analysis of the company.

Company Overview

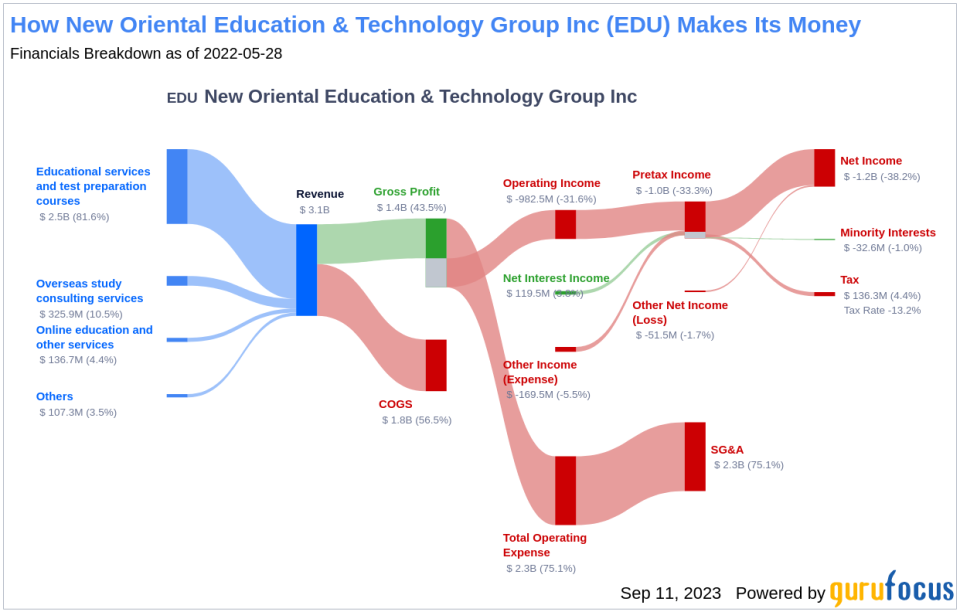

New Oriental Education & Technology Group Inc is a leading private education provider in China. The company has shifted its focus to nonacademic tutoring and intelligent learning systems following a regulatory crackdown in 2021. It also owns a significant stake in East Buy, a market leader in live-streaming e-commerce. Despite a current stock price of $56.90, the company's fair value, according to the GF Value, is estimated to be $49.40.

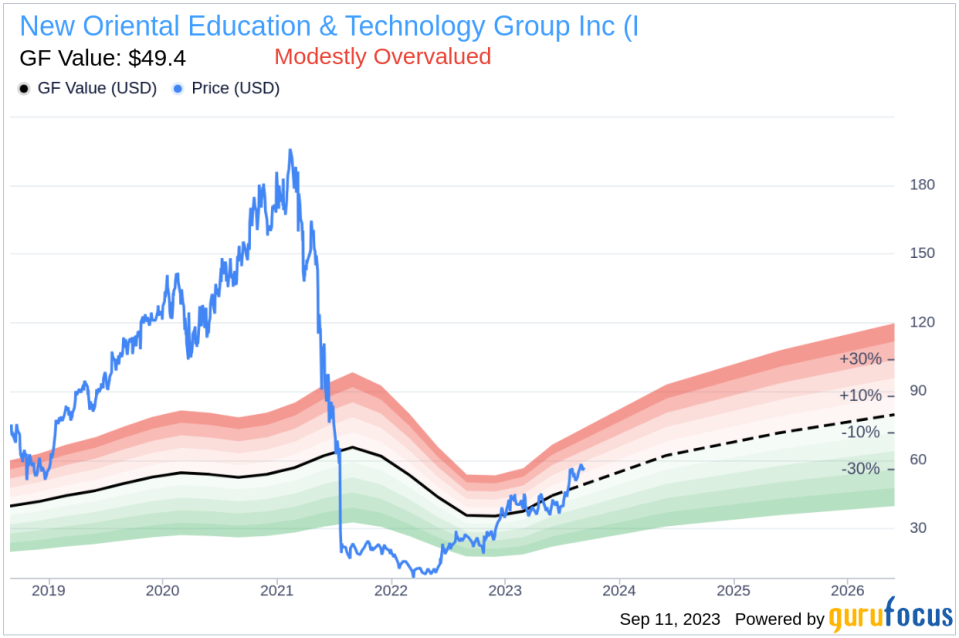

Understanding GF Value

The GF Value is a proprietary measure that estimates the fair value of a stock based on historical trading multiples, an adjustment factor based on past performance and growth, and future business performance estimates. If the stock price is significantly above the GF Value Line, it is considered overvalued and its future return is likely to be poor. Conversely, if the stock price is significantly below the GF Value Line, it is undervalued and its future return will likely be higher.

For New Oriental Education & Technology Group (NYSE:EDU), with a current price of $56.9 per share and a market cap of $9.70 billion, the stock appears to be modestly overvalued according to the GF Value. As a result, the long-term return of its stock is likely to be lower than its business growth.

For potentially higher future returns at reduced risk, check out these high-quality companies.

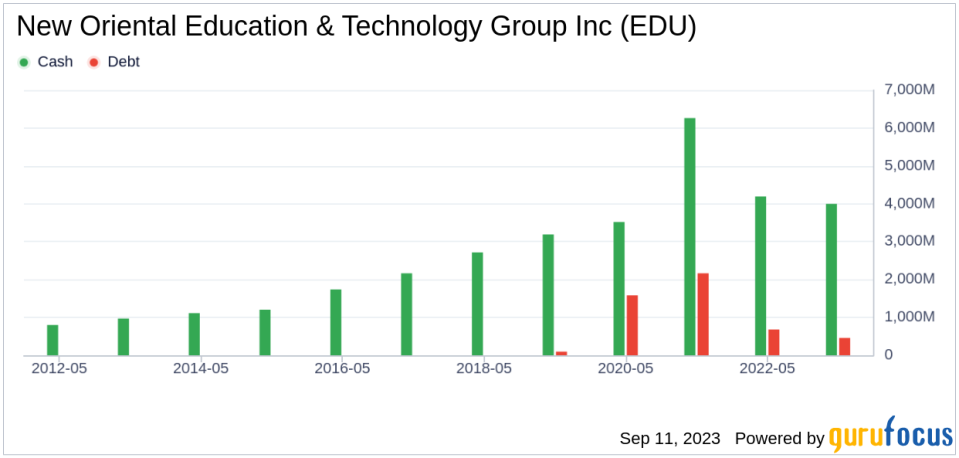

Financial Strength

Investing in companies with low financial strength can result in permanent capital loss. Therefore, it is crucial to review a company's financial strength before deciding to buy shares. New Oriental Education & Technology Group has a cash-to-debt ratio of 8.72, ranking better than 73.62% of 254 companies in the Education industry. Based on this, GuruFocus ranks the company's financial strength as 7 out of 10, suggesting a fair balance sheet.

Profitability and Growth

Investing in profitable companies carries less risk. New Oriental Education & Technology Group has been profitable 9 years over the past 10 years. However, its operating margin of 6.34% is worse than 52.24% of 245 companies in the Education industry, suggesting fair profitability.

As for growth, the company's 3-year average annual revenue growth of -9% ranks worse than 79.91% of 234 companies in the Education industry. Its 3-year average EBITDA growth rate is -35.7%, which ranks worse than 93.48% of 184 companies in the Education industry.

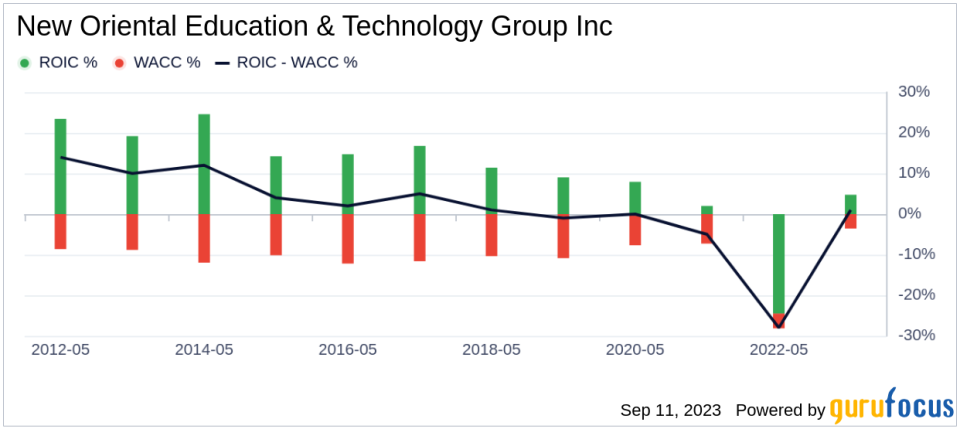

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) can also evaluate its profitability. If the ROIC exceeds the WACC, the company is likely creating value for its shareholders. For New Oriental Education & Technology Group, the ROIC is 5.2 while its WACC is 4.73.

Conclusion

In conclusion, the stock of New Oriental Education & Technology Group appears to be modestly overvalued. The company's financial condition is fair, and its profitability is fair. However, its growth ranks worse than 93.48% of 184 companies in the Education industry. For more details about New Oriental Education & Technology Group stock, check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, visit the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.