Orion (ORN) Wins $100M Contract From GBSL, Aids Marine Unit

Orion Group Holdings, Inc. ORN received a more than $100 million contract from Grand Bahama Shipyard Limited (GBSL) for the turnkey design-build of the Grand Bahama Shipyard Dry Dock Replacement Project.

ORN’s Marine and Engineering business will support GBSL in marine works and infrastructure construction, dredging, creating new mooring facilities and enhancing shore stability. It will also modify and extend service piers to install two cutting-edge floating dry docks, among the largest in the western hemisphere.

The contract will begin immediately and be completed in late 2025.

Post-completion, the Grand Bahama Shipyard will have the first floating dry docks in the Atlantic region, capable of lifting the largest cruise ships in the world. Installing two advanced floating dry docks, namely XL and Mega XL, promises substantial efficiency and cost savings for GBSL’s customers.

The company recently won new contracts worth $121 million in its Concrete and Marine segments. This comprises a contract worth $50.8 million in the Concrete segment and $68.5 million in the Marine segment.

Orion derives revenues from marine construction, dredging, turnkey concrete services and other specialty services contracts. These projects are typically of short duration and usually span less than a year.

The company’s focus on de-risking the business to clear the path for long-term growth and profitability is commendable. The company remains optimistic about continued improvement in the future. The Concrete segment, more driven by the private sector and the Marine unit, backed by the public sector, can balance each other during challenging times and different business cycles.

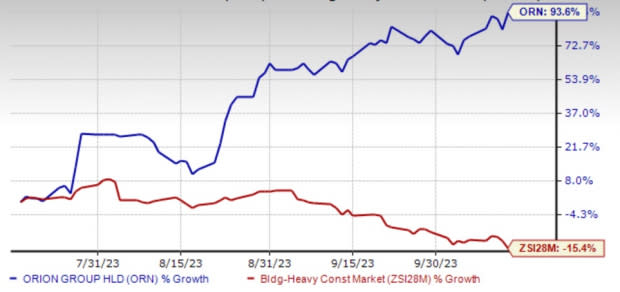

Image Source: Zacks Investment Research

Shares of this Zacks Rank #3 (Hold) company have surged 5.94% on Oct 13 and 93.6% in the past three months versus the Building Products - Heavy Construction industry’s 15.4% decline.

Stocks to Consider

Some better-ranked stocks in the Zacks Construction sector are:

EMCOR Group, Inc. EME currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

EME delivered a trailing four-quarter earnings surprise of 17.2%, on average. The Zacks Consensus Estimate for EME’s 2023 sales and earnings per share (EPS) indicates growth of 11.3% and 35.4%, respectively, from the previous year’s reported levels.

Dycom Industries, Inc. DY, based in Palm Beach Gardens, FL, is a specialty contracting service provider in the United States. The company has been benefiting from the higher demand for network bandwidth and mobile broadband, extended geographic reach and proficient program management and network planning services. Yet, persistent challenges associated with the automotive and equipment supply chains are causes of concern.

Dycom, a Zacks Rank #2 stock, surpassed earnings estimates in all the trailing four quarters, with the average surprise being 147.4%. Earnings per share for fiscal 2024 are expected to grow by 43.9%.

Fluor Corporation FLR currently flaunts a Zacks Rank #1. FLR delivered a trailing four-quarter negative earnings surprise of 5.3%, on average.

The Zacks Consensus Estimate for FLR’s 2023 sales and EPS indicates growth of 12.6% and 159.8%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fluor Corporation (FLR) : Free Stock Analysis Report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

Dycom Industries, Inc. (DY) : Free Stock Analysis Report

Orion Group Holdings, Inc. (ORN) : Free Stock Analysis Report