Ormat Technologies Inc (ORA) Reports Strong Earnings Growth and Progress Towards 2026 Goals

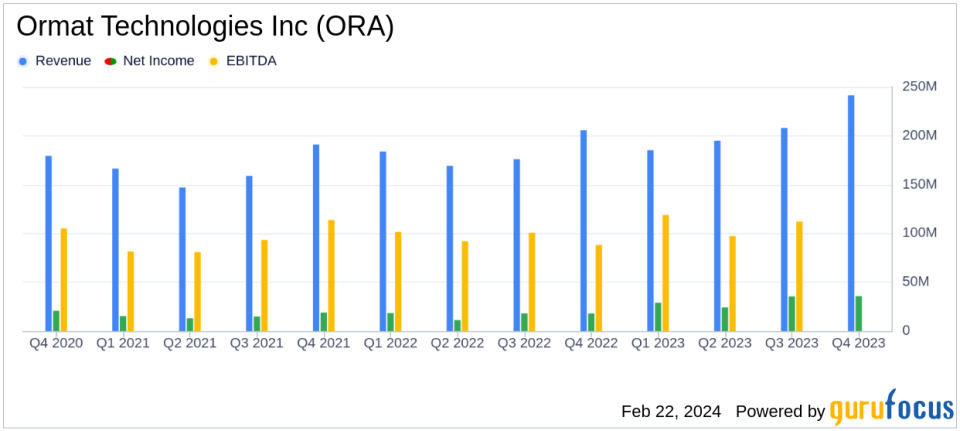

Revenue Growth: ORA's Q4 2023 revenues increased by 17.4% to $241.3 million, with a full-year rise of 13.0% to $829.4 million.

Net Income Surge: Net income attributable to ORA's stockholders jumped by 98.0% in Q4 and 88.9% annually.

Earnings Per Share (EPS): Diluted EPS for the year rose sharply by 77.8% to $2.08, reflecting robust operational performance.

Adjusted EBITDA: Adjusted EBITDA for the year increased by 10.6% to $481.7 million, indicating strong earnings before interest, taxes, depreciation, and amortization.

Dividend Policy: ORA declared a quarterly dividend of $0.12 per share, consistent with its commitment to shareholder returns.

Capacity Expansion: ORA is on track to meet its 2026 capacity goals of 2.1 to 2.3 GW, with 239MW added since the beginning of 2023.

On February 21, 2024, Ormat Technologies Inc (NYSE:ORA) released its 8-K filing, detailing a year of substantial financial growth and operational achievements. ORA, a leader in the geothermal energy power business and energy storage solutions, reported a significant increase in annual diluted EPS by 77.8% and a 25.0% increase in annual adjusted diluted EPS compared to the previous year. The company's progress is a testament to its strategic initiatives and operational excellence across its three business segments: Electricity, Product, and Energy Storage.

Financial Performance Highlights

ORA's financial results for the fourth quarter and full year ended December 31, 2023, show a company in strong fiscal health. The Electricity segment achieved record quarterly revenues of $183.9 million, contributing to the overall revenue growth. The Product segment experienced a remarkable 56.7% growth, while the Energy Storage & Management Services faced a slight decline. Despite these variances, the total revenues for the year reached $829.4 million, a 13.0% increase from the previous year.

The company's gross margin for the year stood at 31.8%, with the Electricity segment at 36.6%, the Product segment at 13.4%, and the Energy Storage & Management Services at 6.4%. Operating income for the year improved by 9.0% to $166.6 million, and net income attributable to ORA's stockholders saw a substantial increase of 88.9% to $124.4 million. Diluted EPS for the year was $2.08, up from $1.17 in the previous year.

Strategic Growth and Future Outlook

ORA's CEO, Doron Blachar, highlighted the company's successful operation of new projects and the commercial operation of its diverse portfolio as key drivers of the strong financial results. The company's growth trajectory is supported by the escalating demand for sustainable electricity, with 239MW of new capacity added through development and acquisition.

"Looking forward, we are on track with our capacity expansions in both the Electricity and the Storage segments, with the potential to reach capacity of between 2.1 GW to 2.3 GW by the end of 2026. We anticipate an increase of 7% and 10% in total revenues and Adjusted EBITDA, respectively, for 2024," said Doron Blachar, CEO of Ormat.

ORA's commitment to strategic execution and investment in high-quality assets positions the company for continued growth and contributions to reducing greenhouse gas emissions. The company's dedication to delivering value to shareholders and advancing sustainable communities is evident in its forward-looking statements and actions.

Dividend and Shareholder Returns

In line with its dividend policy, ORA's Board of Directors declared a quarterly dividend of $0.12 per share, payable on March 20, 2024, to stockholders of record as of March 6, 2024. The company expects to maintain this dividend payout in the upcoming quarters, reinforcing its commitment to providing consistent returns to its shareholders.

Conference Call and Investor Relations

ORA will host a conference call to discuss these financial results and provide further insights into the company's performance and strategy. The call is scheduled for February 22, 2024, at 10:00 a.m. ET, with details provided for both domestic and international participants.

As a vertically integrated company, ORA's expertise spans over five decades, with a generating portfolio of 1,385 MW and a presence in multiple countries. The company's strategic focus on energy storage, solar PV, and energy storage plus Solar PV, alongside its core geothermal and REG operations, positions it as a leader in the renewable energy sector.

For a detailed understanding of ORA's financials, investors and stakeholders are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Ormat Technologies Inc for further details.

This article first appeared on GuruFocus.