Orthofix (OFIX) Q4 Earnings Beat Estimates, Gross Margin Up

Orthofix Medical OFIX reported fourth-quarter 2023 loss per share of 59 cents compared with the pro forma loss of 73 cents per share in the prior-year period. However, the figure beat the Zacks Consensus Estimate by 1.7%.

Per the company earnings release, the comparisons with the year-ago period are carried out on a pro forma basis, which includes the combined results of Orthofix and SeaSpine in 2022.

Total Revenues

Revenues in the fourth quarter totaled $200.4 million, up 63.9% year over year on a reported basis and 7.5% on a pro forma basis. The metric beat the Zacks Consensus Estimate by 2%.

Full-Year Results

Orthofix Medical recorded total revenues of $746.6 million in 2023, an increase of 62% on a reported basis and 6% on a pro forma basis. In 2023, the loss per share was $4.12 compared with a pro forma loss of $2.39 in 2022.

Segmental Details

Across product categories, Bone Growth Therapies’ (BGT) revenues totaled $58.8 million, up 15.3% year over year on a reported basis and pro forma basis. The rise was driven by revenues from the company’s most recent bone growth therapy solution for fracture care, which grew nearly 23.6% on a sequential basis.

Revenues from Spinal Implants, Biologics, and Enabling Technologies (comprising of spinal fixation and motion preservation) were $111 million, up 4% year over year on a pro forma basis.

In the reported quarter, the Global Spine business's revenues increased 7.7% year over year to $169.8 million on a pro forma basis.

The Global Orthopedics business's revenues increased 6.8% year over year on a reported and pro forma basis to $30.6 million.

Margins

In the reported quarter, gross profit improved 7% year over year to $136.6 million on a pro forma basis. The adjusted gross margin improved 330 basis points to 72.2% on a pro forma basis.

Sales and marketing expenses increased 64.8% year over year to $97.7 million, whereas general and administrative expenses rose 35.6% year over year to $34.5 million. Research and development expenses increased 44% year over year to $18.9 million.

The operating loss for the quarter was $18.3 million compared with $11 million in the prior-year period.

Operational Update

The company ended the fourth quarter of 2023 with cash and cash equivalents of $37.8 million compared with $33.7 million in the third quarter.

Cumulative net cash used in operating activities at the end of 2023 was $45.8 million compared with the prior-year period’s pro forma cash outflow of $49.7 million.

Accordingly, the cumulative free cash flow reported by the company at the end of 2023 was negative $107.8 million, narrower than the free cash outflow of $110.6 million at the end of the year-ago period. The company’s free cash reserves were consumed by strategic investments in inventory, milestone payments related to partnerships, leasehold improvement costs and merger and integration costs, among others.

2024 Guidance

Orthofix has issued full-year 2024 guidance.

The company expects its net sales between $785 and $795 million, which represents implied growth of 5% to 7% year over year on a constant currency basis. The Zacks Consensus Estimate currently stands at $791.9 million.

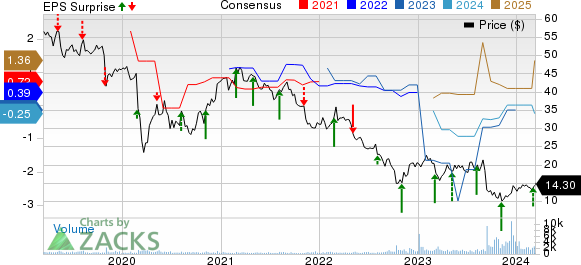

ORTHOFIX MEDICAL INC. Price, Consensus and EPS Surprise

ORTHOFIX MEDICAL INC. price-consensus-eps-surprise-chart | ORTHOFIX MEDICAL INC. Quote

Zacks Rank & Stocks to Consider

OFIX carries a Zacks Rank #3 (Hold) at present.

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Cardinal Health, Inc. CAH and Cencora, Inc. COR.

DaVita, sporting a Zacks Rank #1 (Strong Buy), has an estimated long-term growth rate of 12.1%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 35.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 58.3% compared with the industry’s 18.9% rise in the past year.

Cardinal Health, flaunting a Zacks Rank of 1 at present, has an estimated long-term growth rate of 14.2%. CAH’s earnings surpassed estimates in each of the trailing four quarters, with the average being 15.6%.

Cardinal Health has gained 51.9% compared with the industry’s 3.2% rise in the past year.

Cencora, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 9.8%. COR’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 6.7%.

Cencora’s shares have rallied 51.5% compared with the industry’s 3.6% rise in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

ORTHOFIX MEDICAL INC. (OFIX) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report