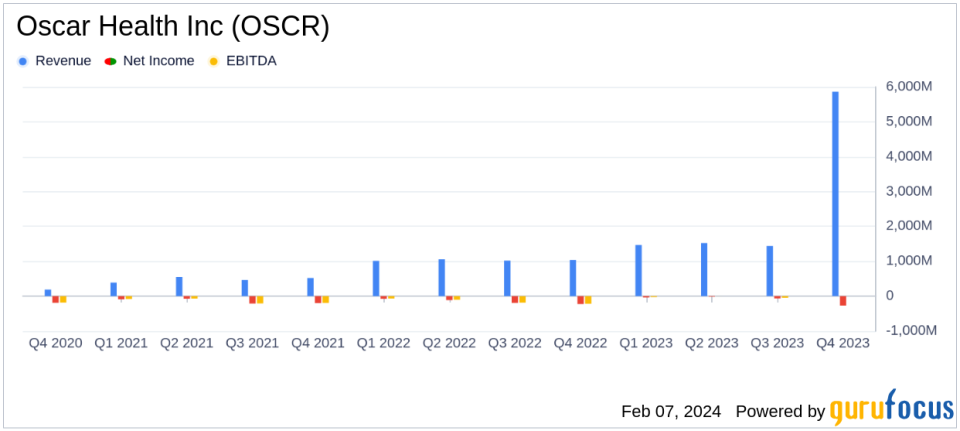

Oscar Health Inc (OSCR) Posts Significant Year-Over-Year Loss Reduction in 2023 Earnings Report

Net Loss Improvement: Oscar Health Inc (NYSE:OSCR) reduced its net loss by $339 million year-over-year.

Revenue Growth: Premiums earned increased by 47% year-over-year to $5.7 billion.

Medical Loss Ratio: Improved by 370 basis points year-over-year to 81.6%.

Administrative Efficiency: InsuranceCo Administrative Expense Ratio improved by 270 basis points year-over-year.

Adjusted EBITDA: Loss decreased by $417 million year-over-year, signaling a move towards profitability.

2024 Outlook: Oscar Health anticipates Total Revenue of $8.3 to $8.4 billion and Adjusted EBITDA of $125 to $175 million.

Oscar Health Inc (NYSE:OSCR), a pioneering health insurance company, released its 8-K filing on February 7, 2024, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its innovative approach to healthcare, offers a range of insurance plans for individuals, families, and small groups, as well as Medicare Advantage plans for seniors. Oscar Health also provides virtual care and other health-related services, aiming to make healthcare accessible and affordable.

In 2023, Oscar Health reported a decrease in Direct and Assumed Policy Premiums by 3% year-over-year to $6.6 billion, attributed mainly to lower membership, which was partially offset by rate increases. Despite this, the company saw a significant increase in Premiums Earned, up 47% to $5.7 billion, primarily due to the impact of deposit accounting for quota share reinsurance agreements and lower risk transfer per member as a percent of premiums.

Financial Highlights and Performance Analysis

Oscar Health's InsuranceCo Combined Ratio improved notably to 99.5%, a 640 basis point enhancement compared to the previous year. This improvement was driven by an improved Medical Loss Ratio, which saw a 370 basis point reduction to 81.6%, and a more efficient InsuranceCo Administrative Expense Ratio, which improved by 270 basis points to 17.9%. These improvements reflect the company's disciplined pricing strategy and cost of care initiatives, as well as lower distribution expenses and higher net premiums.

The Adjusted Administrative Expense Ratio also saw a 350 basis point improvement to 21.0%, contributing to a reduced Adjusted EBITDA loss of $45 million, a $417 million improvement year-over-year. The Net Loss for the year improved significantly by $339 million to $271 million.

For 2024, Oscar Health is introducing guidance on new metrics, including Total Revenue and SG&A Expense Ratio. The company anticipates Total Revenue between $8.3 billion and $8.4 billion, a Medical Loss Ratio between 80.2% and 81.2%, an SG&A Expense Ratio between 20.5% and 21.0%, and Total Company Adjusted EBITDA between $125 million and $175 million.

"Oscar reported strong 2023 results with most core metrics exceeding our expectations for the full year. We delivered on our commitment for Insurance Company Adjusted EBITDA profitability and have a clear line of sight into consolidated Adjusted EBITDA profitability in 2024," said Mark Bertolini, CEO of Oscar.

The company's focus on long-term sustainable margin expansion is evident in its improved financial metrics and the introduction of a positive Adjusted EBITDA outlook for 2024. These results demonstrate Oscar Health's commitment to enhancing its operational efficiency and financial stability, positioning it well for future growth within the healthcare plans industry.

Investors and stakeholders can expect Oscar Health to continue refining its strategies to maintain this positive trajectory, with an emphasis on member engagement, cost management, and leveraging technology to improve healthcare delivery.

For a more detailed analysis and to stay updated on Oscar Health Inc's financial journey, visit GuruFocus.com for comprehensive reports and investment insights.

Explore the complete 8-K earnings release (here) from Oscar Health Inc for further details.

This article first appeared on GuruFocus.