Oshkosh Corp (OSK) Announces Strong Q4 and Full-Year 2023 Results with Record Backlog

Quarterly Revenue: $2.47 billion, up 12% from Q4 2022.

Backlog: Record $16.8 billion, providing significant future visibility.

Diluted EPS: Q4 at $2.28, Full-Year at $9.08, with adjusted EPS of $2.56 for Q4 and $9.98 for 2023.

Dividend: Quarterly cash dividend increased by 12% to $0.46 per share.

2024 Guidance: Diluted EPS expected to be in the range of $9.45, with adjusted EPS around $10.25.

Acquisitions: Inclusion of AeroTech and Hinowa sales contributing to revenue growth.

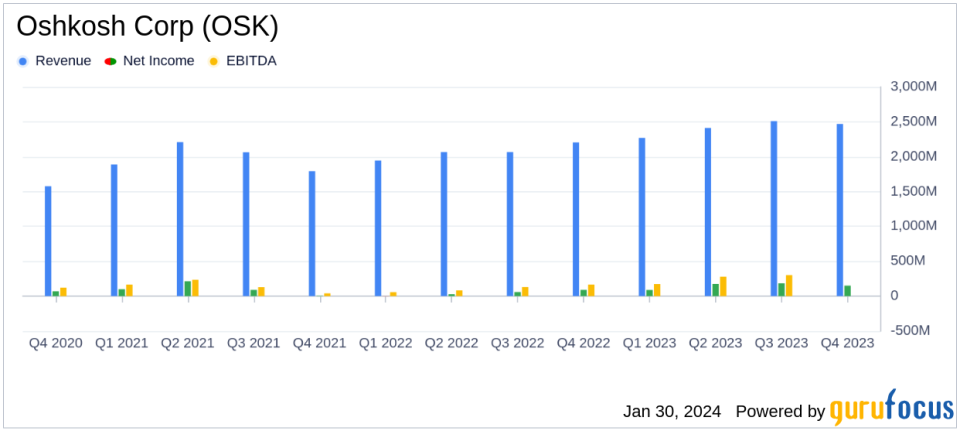

Oshkosh Corp (NYSE:OSK), a leading innovator of mission-critical vehicles and equipment, released its 8-K filing on January 30, 2024, revealing a robust performance for the fourth quarter and the full year of 2023. The company, known for its diverse portfolio including access equipment, specialty vehicles, and military trucks, reported a significant increase in sales and earnings per share (EPS), alongside a record backlog that promises sustained growth.

Financial Highlights and Segment Performance

Oshkosh's fourth-quarter sales rose to $2.47 billion, a 12 percent increase, largely due to acquisitions contributing $192 million in sales and improved pricing strategies. The company's operating income surged by 46.5 percent to $215.4 million, or 8.7 percent of sales, compared to the previous year. This increase was attributed to improved price/cost dynamics, favorable mix, and favorable cumulative catch-up adjustments in the Defense segment.

President and CEO John Pfeifer highlighted the strong quarter, noting the company's revenue and earnings growth leading to an adjusted EPS of $2.56. He also emphasized the solid order levels across the business, particularly in the Access segment, which led to a record backlog of $16.8 billion. Pfeifer expressed confidence in the future, especially with the upcoming production of the USPS Next Generation Delivery Vehicle starting in April.

The Access segment saw a 7.1 percent increase in sales, while the Defense segment's sales rose by 7.2 percent, primarily due to cumulative catch-up adjustments on contract awards. The Vocational segment experienced a notable 26.1 percent increase in sales, thanks to the AeroTech acquisition and higher pricing.

Challenges and Outlook

Despite the strong performance, Oshkosh faces challenges, including the loss of the JLTV recompete, which shifts focus to the USPS contract for electrification of postal vehicles. The company also anticipates wrapping up domestic JLTV production in early 2025 but sees continued opportunities in international markets.

Looking ahead, Oshkosh expects 2024 diluted EPS to be in the range of $9.45 and adjusted EPS around $10.25, based on projected net sales of approximately $10.4 billion. The company's confidence is bolstered by solid demand, a record backlog, improved supply chains, and a positive outlook, leading to a 12 percent increase in the quarterly cash dividend.

Financial Statements and Metrics

For the full year 2023, Oshkosh reported net sales of $9.66 billion and net income of $598.0 million, or $9.08 per diluted share, compared to $8.28 billion in net sales and a net income of $173.9 million, or $2.63 per diluted share, in the previous year. The adjusted net income for 2023 was $657.2 million, or $9.98 per diluted share.

The balance sheet reflects a strong financial position, with total assets amounting to $9.13 billion and total liabilities and shareholders' equity matching this figure. The company made significant investments in property, plant, and equipment, and successfully integrated acquisitions, as evidenced by the increase in goodwill and purchased intangible assets.

Oshkosh's cash flow statements show a net cash provided by operating activities of $599.6 million for the year, despite a decrease in cash and cash equivalents due to significant investments in property, plant, and equipment, and the acquisition of businesses.

Value investors may find Oshkosh's strong financial performance, strategic investments, and positive outlook appealing, as the company continues to lead in its market segments and prepares for new opportunities in the electrification of vehicles.

For a more detailed analysis and insights into Oshkosh Corp's financials and future prospects, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Oshkosh Corp for further details.

This article first appeared on GuruFocus.