Oshkosh (OSK) Q3 Earnings Top Estimates, Guidance Raised

Oshkosh Corporation OSK reported third-quarter 2023 adjusted earnings of $3.04 per share, beating the Zacks Consensus Estimate of $2.19. The outperformance can be attributed mainly to double-digit operating margins in the Access segment. The bottom line also rose from $1 per share recorded in the year-ago period. In the quarter under review, consolidated net sales climbed 21% year over year to $2,510 million. The top line surpassed the Zacks Consensus Estimate of $2,462 million.

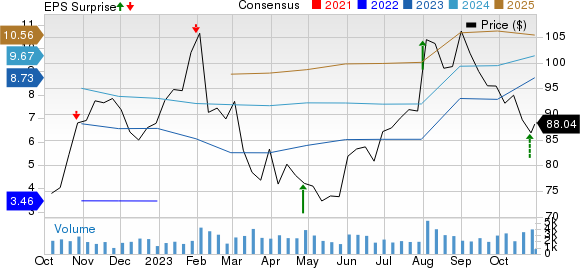

Oshkosh Corporation Price, Consensus and EPS Surprise

Oshkosh Corporation price-consensus-eps-surprise-chart | Oshkosh Corporation Quote

Segmental Details

Access: The segment’s net sales rose 27% year over year to $1,318.2 million due to enhanced sales volume, pricing strength and $19.0 million in sales related to the Hinowa acquisition. The metric also surpassed our estimate of $1,273.4 million.

Operating income rose 93.5% to $229.9 million (accounting for 17.4% of sales), owing to higher sales volume, pricing and an improved product mix. The metric also came ahead of our estimate of $128.2 million.

Defense: The segment’s net revenues tailed off 3.6% year over year to $500.1 million due to lower Joint Light Tactical Vehicle program volume. The metric also missed our estimate of $520.2 million.

Operating income skyrocketed 635.5% from the prior-year figure to $22.8 million (4.6% of sales), owing to lower unfavorable cumulative catch-up adjustments on contract margins and a gain on the sale of a business. The metric surpassed our estimate of $10 million.

Vocational: The segment’s net sales rose 35.4% year over year to $692.6 million due to the inclusion of sales related to the AeroTech acquisition, improved sales volume and higher pricing. The metric also surpassed our estimate of $658.3 million.

Operating income increased 63.6% to $52.5 million (accounting for 7.6% of sales) due to higher pricing and an improved product mix. The metric missed our estimate of $75 million.

Financials

Oshkosh had cash and cash equivalents of $106.1 million as of Sep 30, 2023 compared with $805.9 million as of Dec 31, 2022. The company recorded a long-term debt of $597.5 million, up from $595 million on Dec 31, 2022.

Oshkosh declared a quarterly cash dividend of 41 cents per share. The dividend will be paid out on Nov 27, 2023, to shareholders of record as of Nov 13, 2023.

Updated 2023 Guidance

The company estimates full-year 2023 sales to be around $9.65 billion, up from the previous estimate of $9.5 billion. It expects earnings of $8.75 per share, up from the prior estimate of $7.65 per share. It anticipates adjusted earnings of $9.50 per share, up from the previous estimate of $8 per share.

Zacks Rank & Key Picks

OSK currently carries a Zacks Rank #2 (Buy).

Some other top-ranked players in the auto space are Toyota Motor TM, Honda Motor Co., Ltd. HMC and Volvo VLVLY, each sporting Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for TM’s 2023 sales and earnings implies year-over-year growth of 10.6% and 27.6%, respectively. The EPS estimates for 2023 and 2024 have increased by 4 cents and 21 cents, respectively, in the past seven days.

The Zacks Consensus Estimate for HMC’s 2023 sales and earnings suggests year-over-year improvements of 7.7% and 29.4%, respectively. The EPS estimate for 2023 has moved up by a cent in the past 30 days. The EPS estimate for 2024 increased by a cent in the past seven days.

The Zacks Consensus Estimate for VLVLY’s 2023 sales and earnings indicates year-over-year increases of 5.4% and 68.8%, respectively. The EPS estimate for 2023 increased by a cent in the past seven days. The EPS estimate for 2024 has increased by 23 cents in the past seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

Honda Motor Co., Ltd. (HMC) : Free Stock Analysis Report

Oshkosh Corporation (OSK) : Free Stock Analysis Report

AB Volvo (VLVLY) : Free Stock Analysis Report